Did The Dutch Draw a Line — Or a Bottleneck?

Nexperia Shortage drives fear in the automotive industry.

As we now live in a hyperinformation era where half the news is pumped out by AI, trying to accommodate the biases of its masters, means that conclusions are drawn with limited use of research and logic.

Speed is more important than accuracy; clicks are more important than the truth.

While I need clicks as much as the AI puppet masters do, I have not found LLMs very reliable in my research so far. While that can change, I do my research the old-fashioned way for now.

The latest craze dominating the news is the legal action by Dutch authorities targeting the Chinese owner of the Dutch semiconductor entity Nexperia, Wintech.

Nexperia traces its roots to the “Standard Products” business of NXP Semiconductors (formerly Philips Semiconductors). In 2017, the unit spun off and quickly established itself as a global manufacturer of discretes, MOSFETs, & logic devices. The company served the broad automotive, industrial, consumer and communications markets.

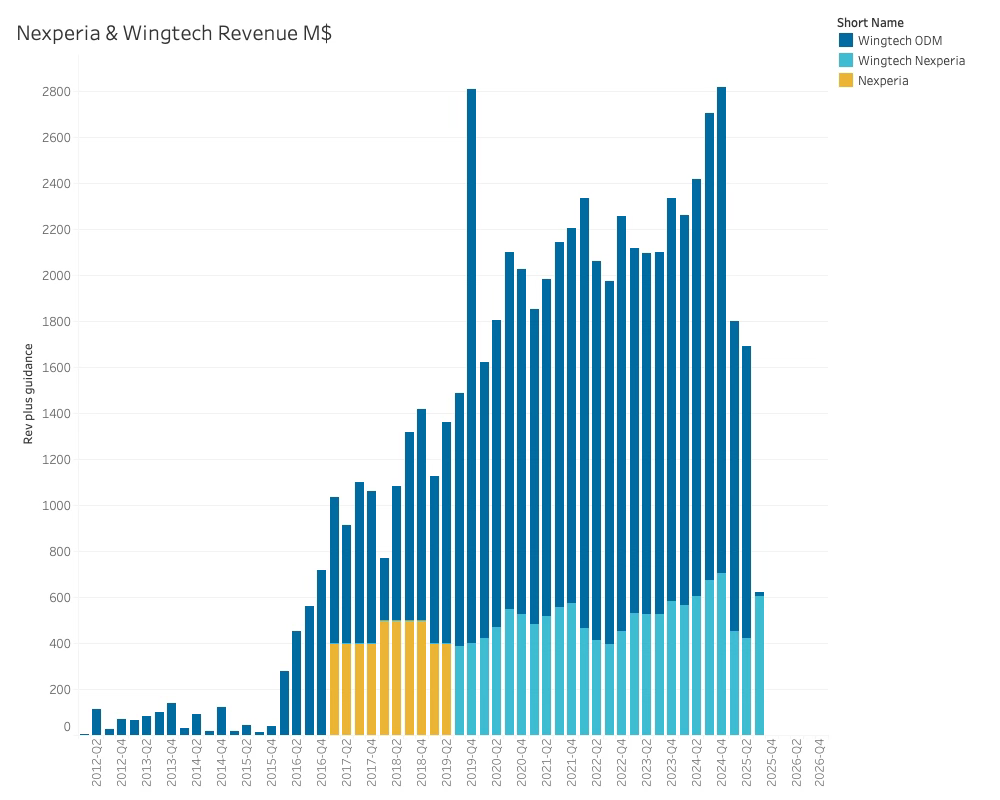

In 2019, Wingtech Technology of China announced a controlling stake in Nexperia. The acquisition reshaped Wingtech and Nexperia into a vertically integrated unit, combining Wingtech's ODM business with Nexperia's semiconductor business.

The move unlocked new growth opportunities—greater access to Asian supply chains, expanded capacity, and stronger automotive qualification credentials—but it also exposed Nexperia (and by extension Wingtech) to mounting geopolitical risk.

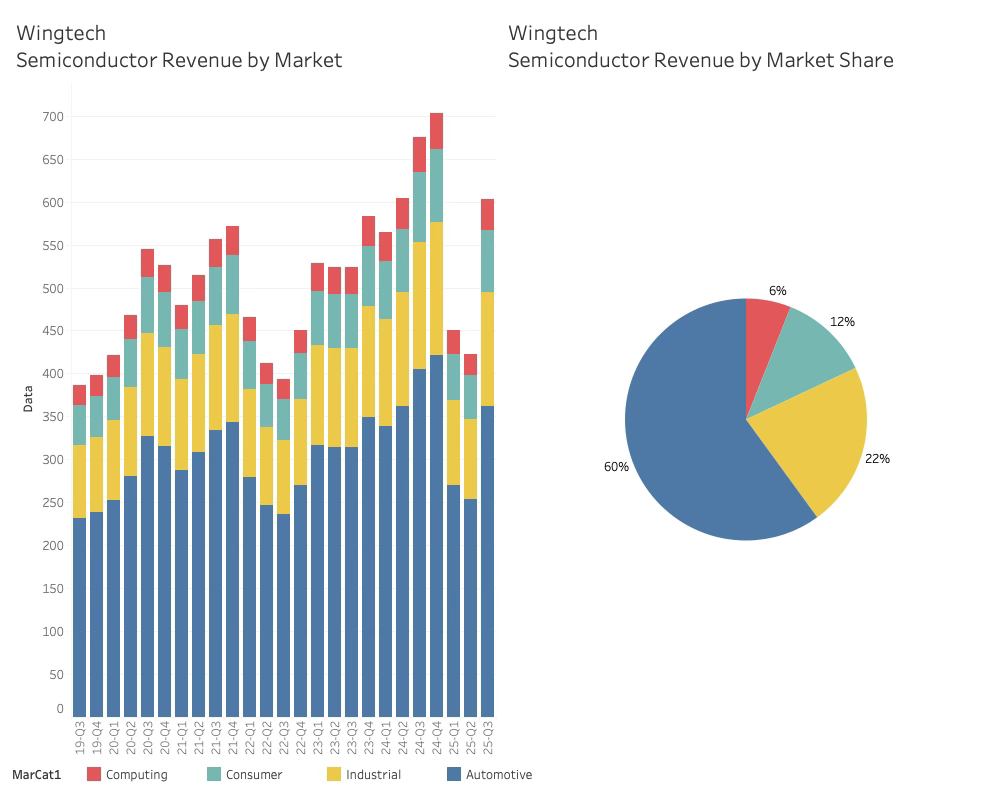

As can be seen, the integration benefited Wingtech's ODM side much more than it benefited Nexperia's Semiconductor business.

From being 40% of the merged company, the semiconductor share had declined to 25% at the end of 2024.

This could be the reason Wingtech has faced increased regulatory scrutiny in the UK, US and the Netherlands, apart from the stated national-security and supply-chain risk grounds.

In December 2024, the United States Department of Commerce added Wingtech to its Entity List, significantly restricting the firm’s ability to access U.S. technology without licenses.

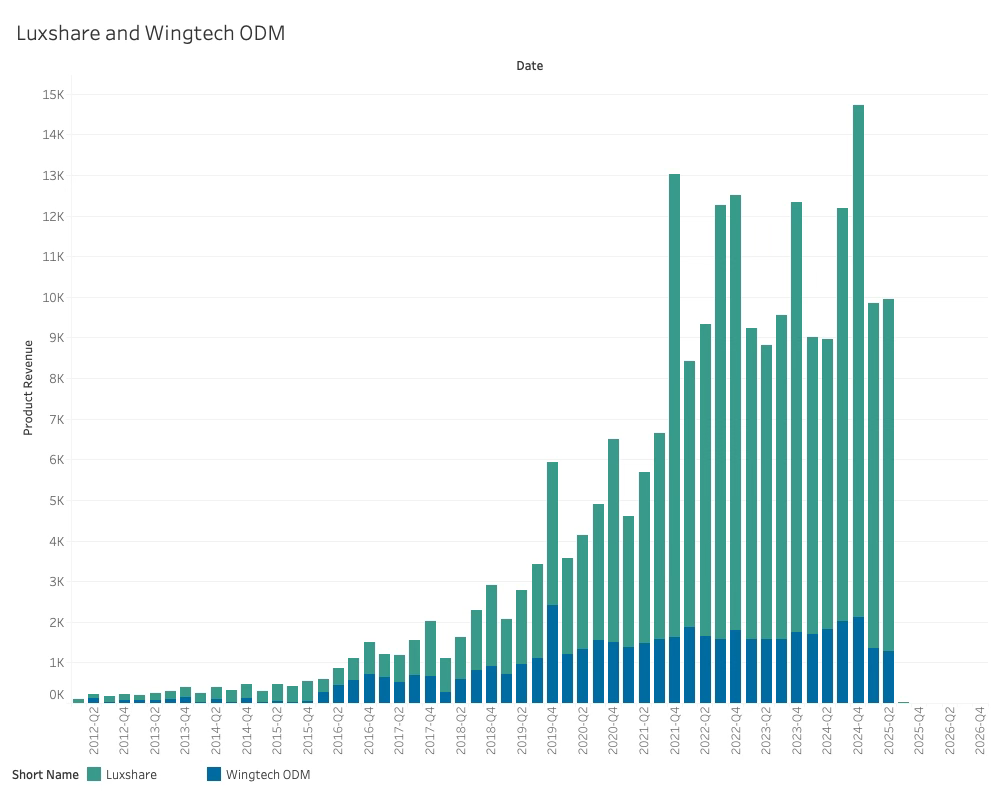

In response, Wingtech announced a major restructuring of its business. It sold off roughly US$635 million of assembly/ODM assets — including stakes in five subsidiaries — to fellow Chinese Apple supplier Luxshare Precision Industry. The company stated this move was driven by “changes in the geopolitical environment and business development needs.”

The combined businesses of Luxshare and Wingtech ODM are shown below.

It is still too early to fully evaluate the impact of the Wingtech ODM business on Luxshare Precision's much larger business, as the Chinese ODM’s operations are highly seasonal due to the mobile phone manufacturing cycle.

While this was happening below the surface, the Ministry of Economic Affairs of the Netherlands invoked a rarely-used Goods Availability Act to temporarily take control of Nexperia, citing “serious administrative shortcomings” and a threat to the availability of crucial technology on Dutch and European soil. The ministry emphasised that this intervention aims to protect Dutch and European economic security by safeguarding the supply of semiconductors used in the automotive and consumer markets. Reuters

Wingtech strongly criticised the move, calling it “an excessive intervention based on geopolitical bias rather than a fact-based risk assessment.” The company warned that the restrictions imposed by the Dutch order — which temporarily limit Wingtech’s control of Nexperia — may impose “downward pressure on revenue, profit and cash-flow.”

Nexperia itself noted that it will continue day-to-day operations and is engaging with authorities, but stressed that governance changes were made under duress.

The main aim of this post is not to dissect the legal and political sides of the story, but to focus on the possible impact on the supply chain. In particular, the threat to the automotive supply chain has been stoked by the AI-infused press blender.

I know it is unfair to introduce facts to a developing story that is spinning out of control, but I deal in facts foremost.

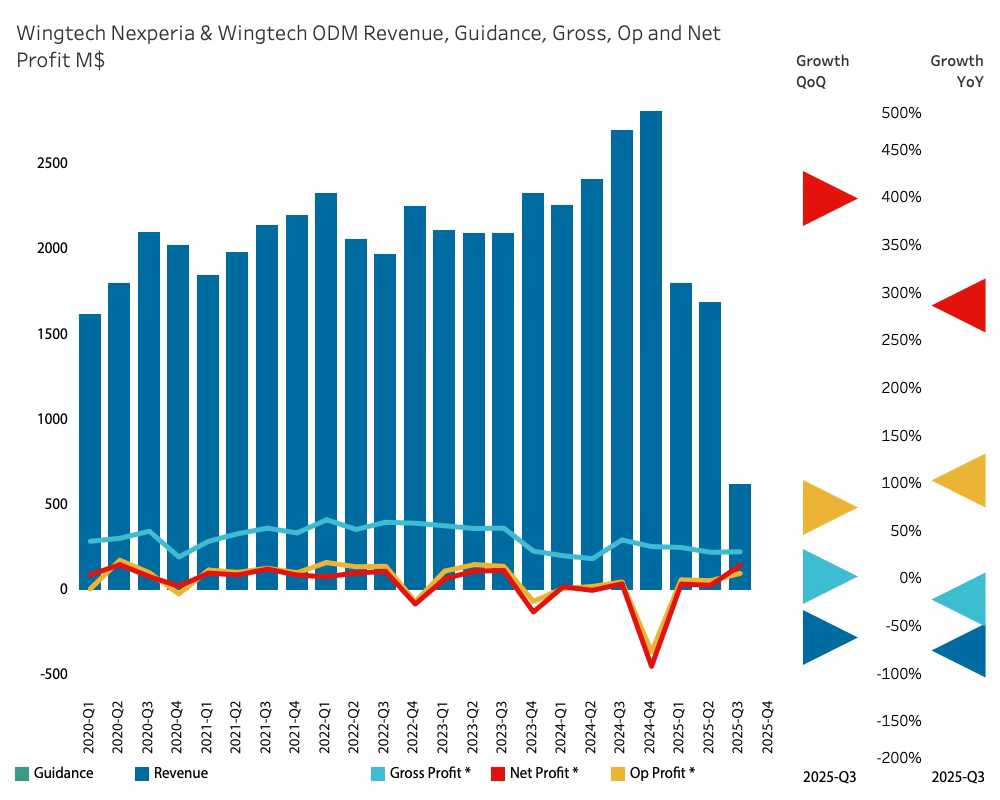

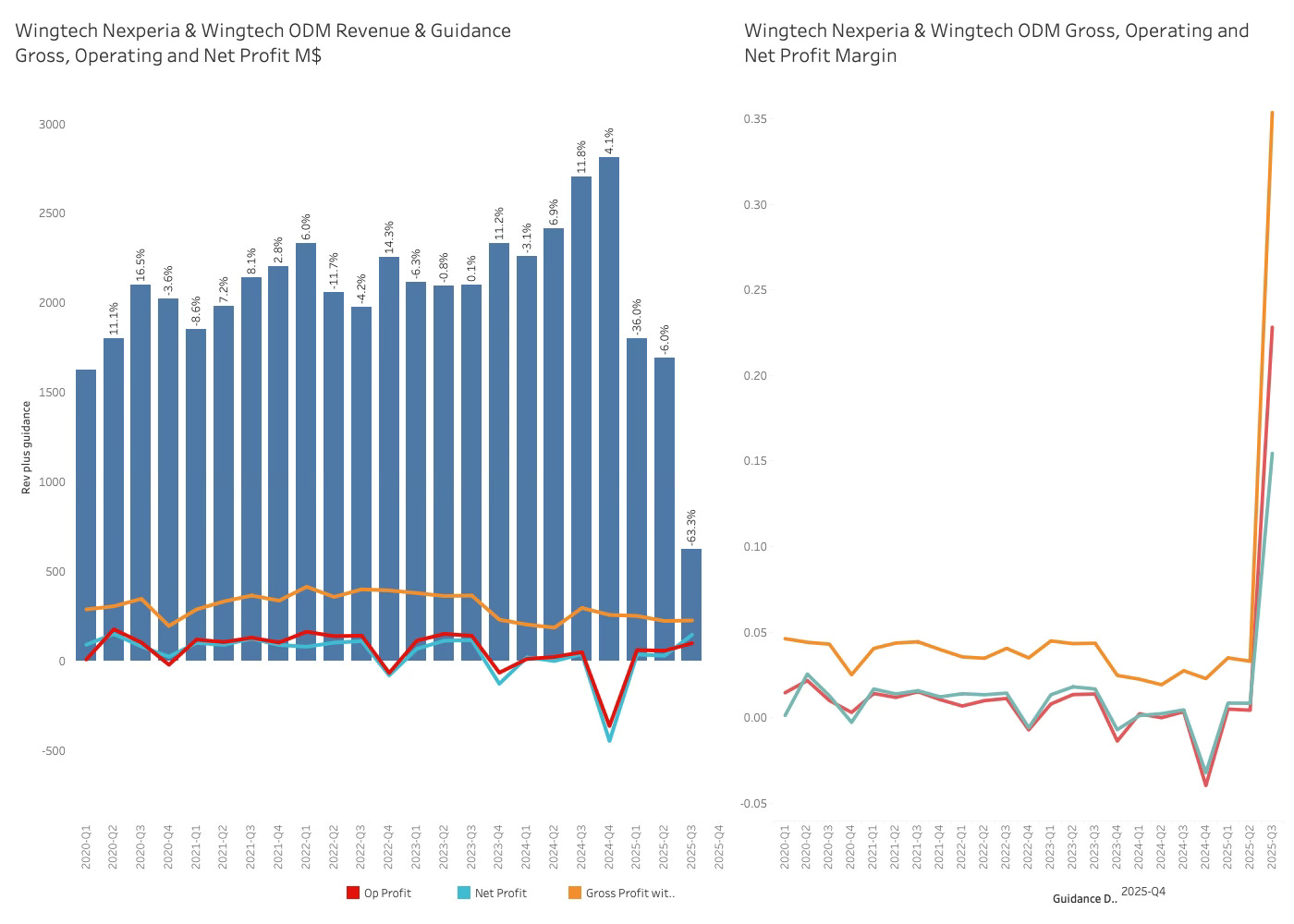

Before diving into an analysis of the impact a paralysis of Wingtech has on the automotive industry, it’s worth having a peek into the recently released financial results of Wingtech:

A pretty brutal 63% revenue decline suggests the doomsday writers could have a point, and it could spell trouble for the automotive markets.

Remembering this is a snapshot from before the legal actions, the flatish gross profit and improving net and operating profits tell the story of the divestiture of the ODM business to Luxshare and not yet trouble for the semiconductor unit. That will not be reflected before next quarter’s results.

What is more interesting about the result is that it is now almost exclusively a semiconductor result, as the ODM business accounts for less than $20M of Wingtech's revenue.

This reveals that semiconductor gross margins are 35% and healthier than those of the ODM business. While this could be inflated as a result of the divestiture, they are still in line with a “Standard products division”, as NXP called it. At the point of spinoff, the Nexperia gross margins were in the mid-thirties, so it has not changed dramatically over time.

As Wingtech's R&D budget has averaged $85M, or 4.2% of revenue, nothing suggests that it has developed the Nexperia standard products into more advanced products commanding higher prices.

So we are talking about a mature business that has not materially changed over time.

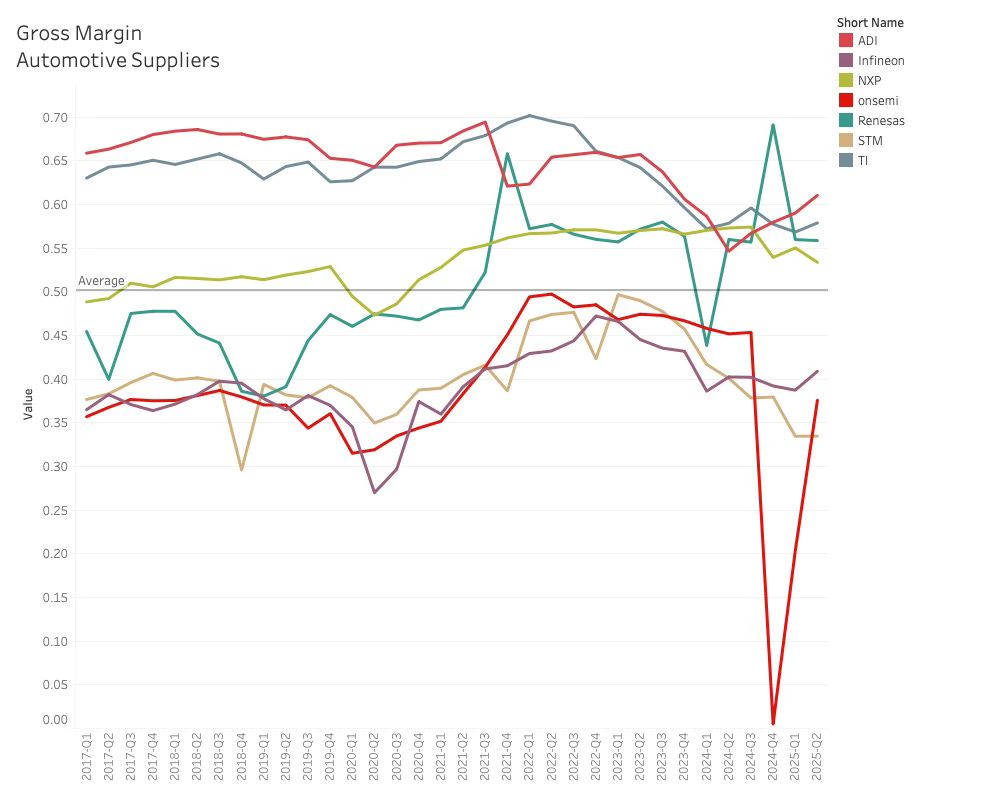

Comparing Nexperia's Gross margins with those of other Automotive suppliers shows that the company’s overall business is below theirs.

The average for the other suppliers over time is a tad over 50% gross margin.

While it is plausible that Wingtech has improved margins on its semiconductor products by bundling them with ODM services, there is no evidence that Nexperia has left its place at the bottom of the barrel to find a healthier niche.

This is important for further analysis, as there is no sign that higher-end components are impacted, while some lower-cost legacy products could be in jeopardy.

While the Dutch government is accusing the Chinese company of “stealing” Dutch IP, there is no indication that Wingtech are currently moving production. The assets outside China are still 85% which is almost entirely Semiconductor assets.

Contrary to the generally accepted narrative, Nexperia is not entirely selling its products to the automotive market, as about 40% of its revenue comes from other markets.

For Q3-25, the share of revenue derived from China was close to 50% and had the highest regional growth. This does not come as a significant surprise and could be the reason that Wingtech is allegedly trying to move manufacturing from Europe to China.

The impact on the Automotive supply chain.

To get an idea of the impact that a limited supply from Nexperia has on the Automotive industry, it is necessary to analyse the industry in more depth.