Intel got Everything Except what it Really Wanted.

..and what the media really wanted to talk about.

Just as I was planning to begin a new analysis, another Intel shell was fired and hit the financial markets. Life is happening while you are busy planning it.

While I have a hard time imagining a semiconductor industry without Intel, the media has diced and killed the former giant many more times than the democrats can say Epstein. I have also been very critical of many of the half-baked actions and strategies of the shifting CEOs, but I have also given credit when credit is due.

Especially the two Semiconductor Coinvestment Programs with Apollo and Brookfield were masterpieces of financing deals given Intel’s situation.

As an analyst at heart, I have no ingrained positions and will try to forget what I wrote last time, as new information and data have arrived, calling for a new analysis.

What I can guarantee is that, no matter what I write about Intel, I will receive a lot of praise and a lot of incoming criticism. Intel always divides the waters.

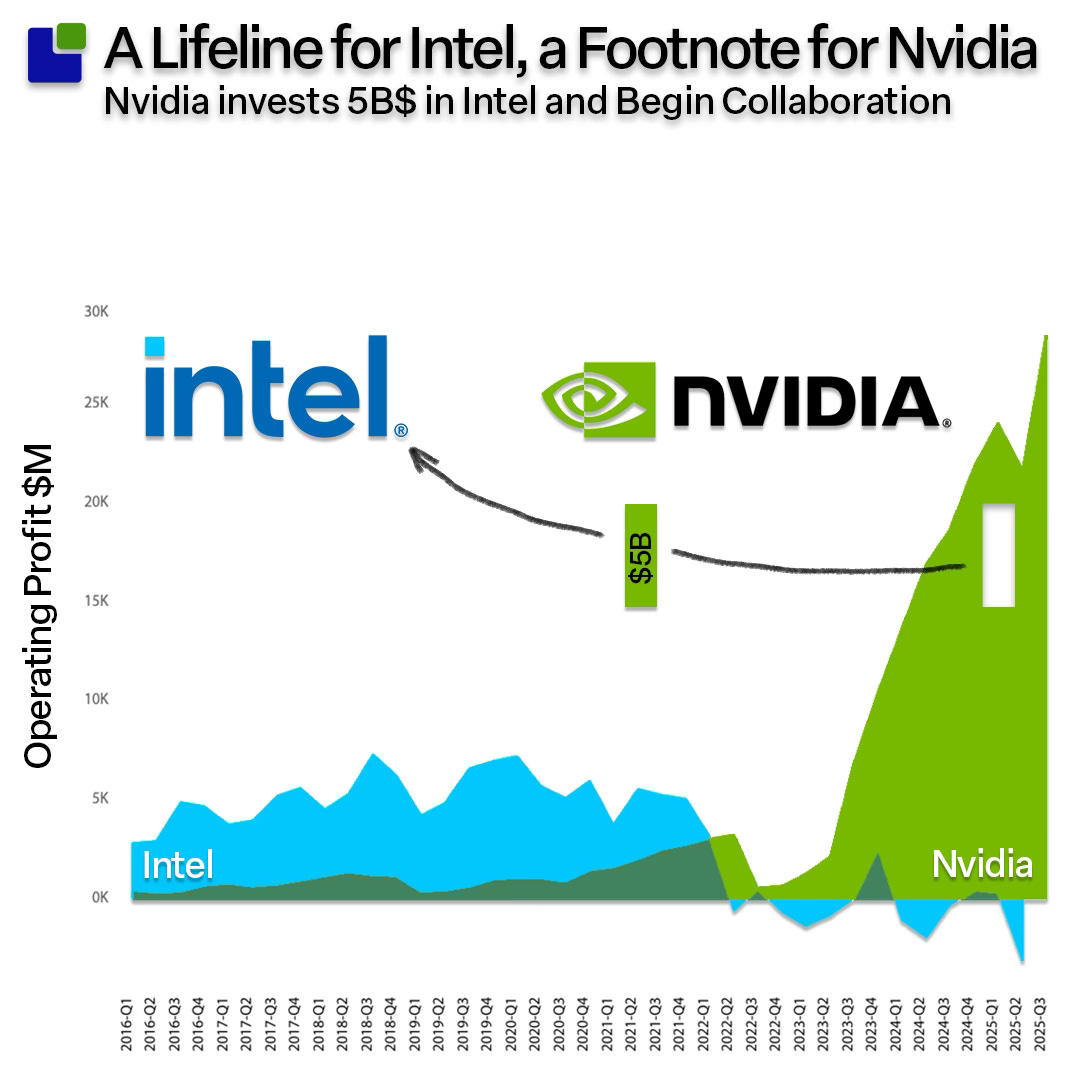

I am sure most experts were not surprised by the Nvidia-Intel deal (experts are never surprised), but I was flabbergasted. On the surface, it made little sense to me that Nvidia should invest in a leaky supertanker that they had already overtaken many quarters ago.

My first suspicion was that the Trump administration was behind it to secure its recent stake in Intel, but Jensen debunked this. He used the term: “The Trump administration had no involvement in this agreement, but would have been very supportive of it.”

He also mentioned he had talked to Secretary Lutnik just after the deal was published, so he is clearly still close to the administration. While deception is considered an art form by the Taiwanese, I have no reason to believe Jensen is not being truthful.

Then again, the administration has told Jensen, “Nice GPU shop you have there, shame if something happened to it”.

Also, the Nvidia deal has been underway for some time, so it is possible that the administration became aware of it beforehand. I will leave my conspiracy theories to my spare time, and leave you with this: I am sure it was a key priority for both companies. As always, you should feel free to disagree.

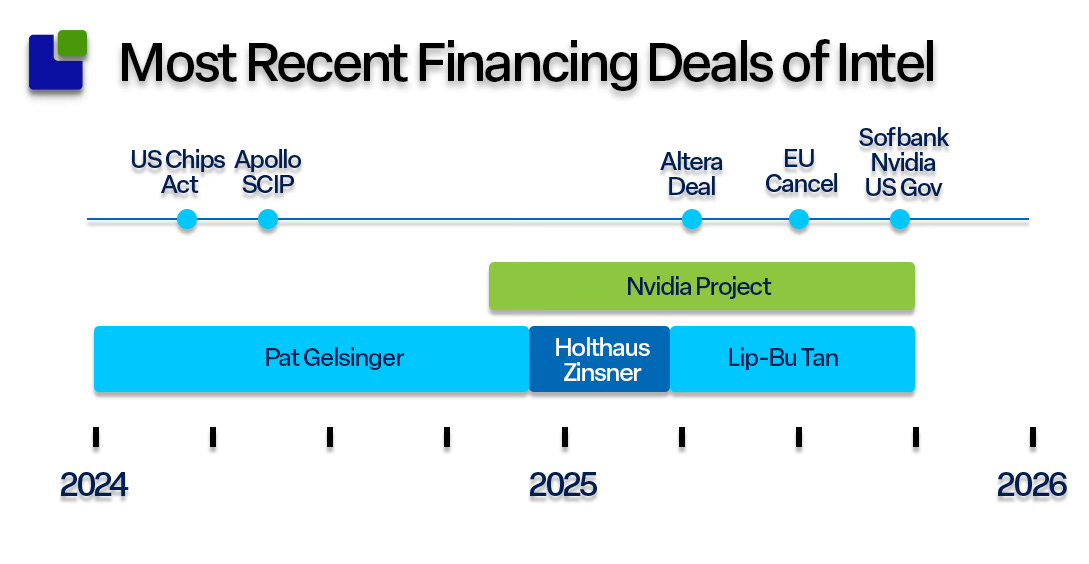

In light of the several leadership changes in Intel, it is worth having a look at the timeline of key investment events before diving into the details of the deal:

While Li-Bu Tan cannot take credit for initiating the collaboration between the two architecture teams at Intel and Nvidia, he certainly got it over the finish line.

You should not be the CEO of Intel if you can not handle criticism, and Lip-Bu Tan has already had his fair share, from being accused of being a Chinese Collaborator to virtually securing Intel’s survival by converting Chips Act Money to Government equity.

All I can say is that I view Lip Bu Tan very differently this week than I did last after he has finalised four deals of utmost importance to Intel’s future.

New Green Deal

The short press release stated that this was a collaboration to jointly develop multiple generations of custom data centre and PC products that accelerate applications and workloads across hyperscale, enterprise, and consumer markets.

The webcast provided more information, especially from the surprisingly suited Jensen Huang. While my conspiratorial genes thought it was friendly advice from a former Ukrainian actor, I think a more plausible reason was that Jensen was at a trade show.

While I understood Intel’s interest in the deal, it became clear to me that the key reason for Nvidia’s interest was networking.

The collaboration on CPU design aimed to integrate the x86 architecture into Nvidia’s NVlink ecosystem and optimise it for this purpose.

Li-Bu Tan bowed to Jensen as he proclaimed that Nvidia is the clear leader in accelerated Computing while keeping the fig leaf of Intel dominance in the much smaller datacenter CPU market. Lip bu tan has finally found a way for the x86 franchise. A term that was revived last year.

Lip-Bu Tan also specifically mentioned NVLink and Unified Memory for the first time, indicating that Intel is adopting a follower attitude in this slightly skewed partnership.

Unified Memory” is a term Nvidia uses to describe a memory architecture where CPU and GPU memory pools are more tightly coupled & share virtual address space. It reduces overhead in moving data between the CPU and GPU.

Currently, the only CPU available to the disaggregated NVLink switches that makes all the GPUs act like a single large CPU is Nvidia’s own Arm-based Vera. The only way of accessing x86 CPUs is via PCI Express.

This is limited to an 8-port NVLink rather than a 32-port NVLink used for GPU interconnects.

While some analysts misunderstood the concept and thought Intel would replace Nvidia’s own CPUs on the GPU boards, Jensen had to clarify that, in his opinion, this would have no impact on ARM. Nvidia remains firmly committed to the ARM roadmap and will continue to develop next-gen Grace, Vera, and Thor for robotics, with an N1 integrated into DGX Spark.

Jensen is targeting the traditional CPU server market, which still dominates the clouds of CSPs and enterprises. He is going to outcompete the conventional x86 server market that Intel and AMD serve. This will be a severe blow to AMD, which appears to be the big loser at the moment.

The analysts and the markets misunderstood this and thought that ARM, rather than AMD, would be impacted.

The other part of the announcement was aimed at the PC market, more specifically at a new emerging AI laptop market. Fuse Custom x86 SOCs with GPU chiplets for a new PC experience.

The Laptop market, where RTX GPUs and CPUs can be tightly integrated for power, a smaller form factor, and cost, has largely been ignored by NVIDIA to date. The fusing of CPUs and GPUS would create a new class of Laptops never seen before.

Nvidia's market share in the PC market is solely in Gaming and Graphics, where discrete GPUs are used.

Nvidia will become a significant supplier of GPU chiplets to Intel’s co-packaged CPUs, while Intel will become a substantial supplier of x86 CPUs for Nvidia’s future assault on the traditional x86 cloud server infrastructure.

While the deal's headline was about Nvidia investing in Intel, this was far from Nvidia's top priority. The agreement only represents 17% of Nvidia’s Q3-25 operating profits, but for Intel, it was vital. In modern government language, Nvidia had leverage in the art of the deal.

After the call, I understood the reasoning behind Nvidia pursuing the deal, and this is mainly about networking, as I will elaborate on later in this post.

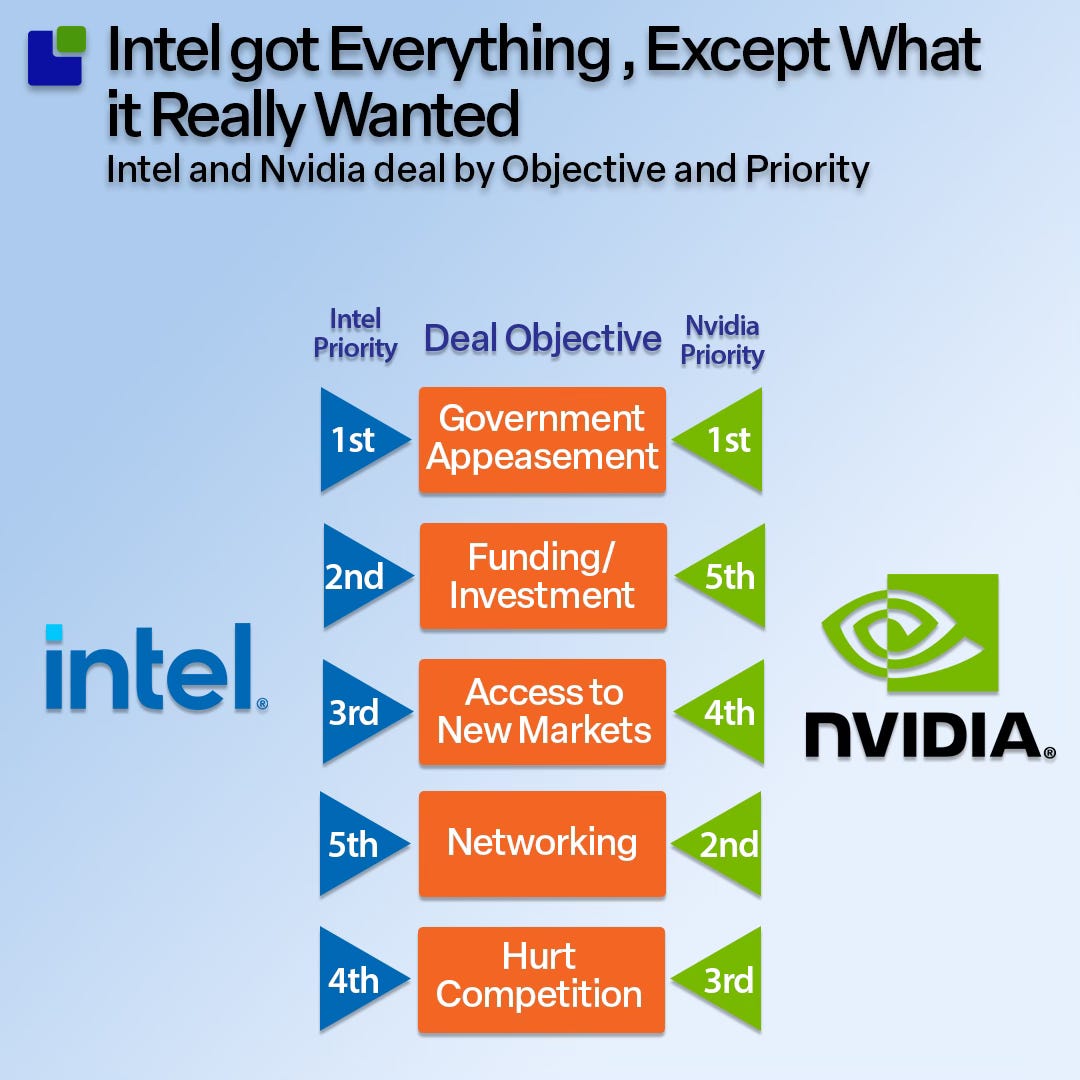

My analysis of the Strategic objectives is presented below for each of the two parties.

While Intel emerges as the initial winner, Lip-Bu Tan did not get what he wanted the most. He did not get the foundry customers as he desperately wanted.

After the analysts (replaced by TV celebrities on this call) had found out that Intel was not going to replace Grace and Vera on Nvidia’s board, they moved on to foundry questions, and Jensen used all his diplomacy, wit, and charm to say NO!

Nvidia Continues to evaluate Intel’s foundry capability, but this deal is squarely focused on the development of chips. Nvidia will, however, become a major customer of Intel chips.

Rechallenged on why he could not commit to Intel Foundry, Jensen said that both Intel and Nvidia were customers of TSMC for a reason. Calling the Taiwanese giant both extraordinary and magical.

Lip-Bu Tan would not even commit to the CPUs being manufactured on 14 nm, leaving the whole foundry setup very vulnerable.

There was a band-aid for Lip-Bu Tan as Jensen stated that Nvidia is going to become a large supplier of GPU chiplets into CPU SOCs, which could be a significant win for Intel's advanced packaging business. Jensen mentioned this specifically.

Nuf talk - show me the numbers.

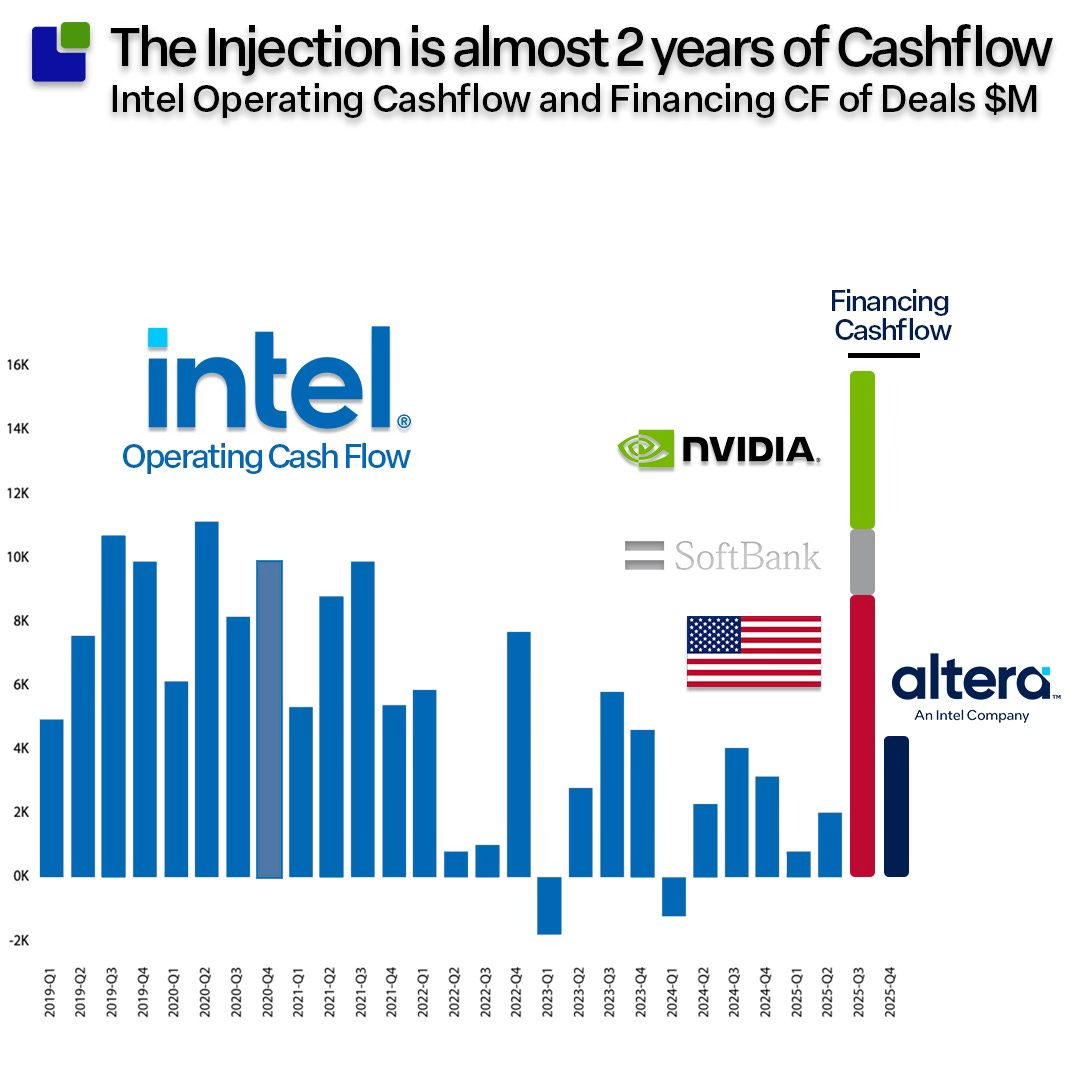

In the financial analysis of Intel's funding, I will include the three other deals that Lip-Bu Tan has concluded. While the disposal of the 51% stake of Altera was announced on April 25, it is now finalised and will hit the books in Q4.

The deals are going to do wonders for Intel's Cash Flow.

Apart from the additional operating cash flow Intel can generate, the four deals add over $20 billion in financing cash flow, which is nearly equal to the operating cash flow Intel has generated over the last eight quarters.

As Altera is now below 50% Intel ownership, Altera's revenue will no longer be reported in Intel’s revenue numbers, while 49% of the profits will still be reported under operating profits. As Altera is currently running at a loss, half of that loss will disappear with the Altera stake.

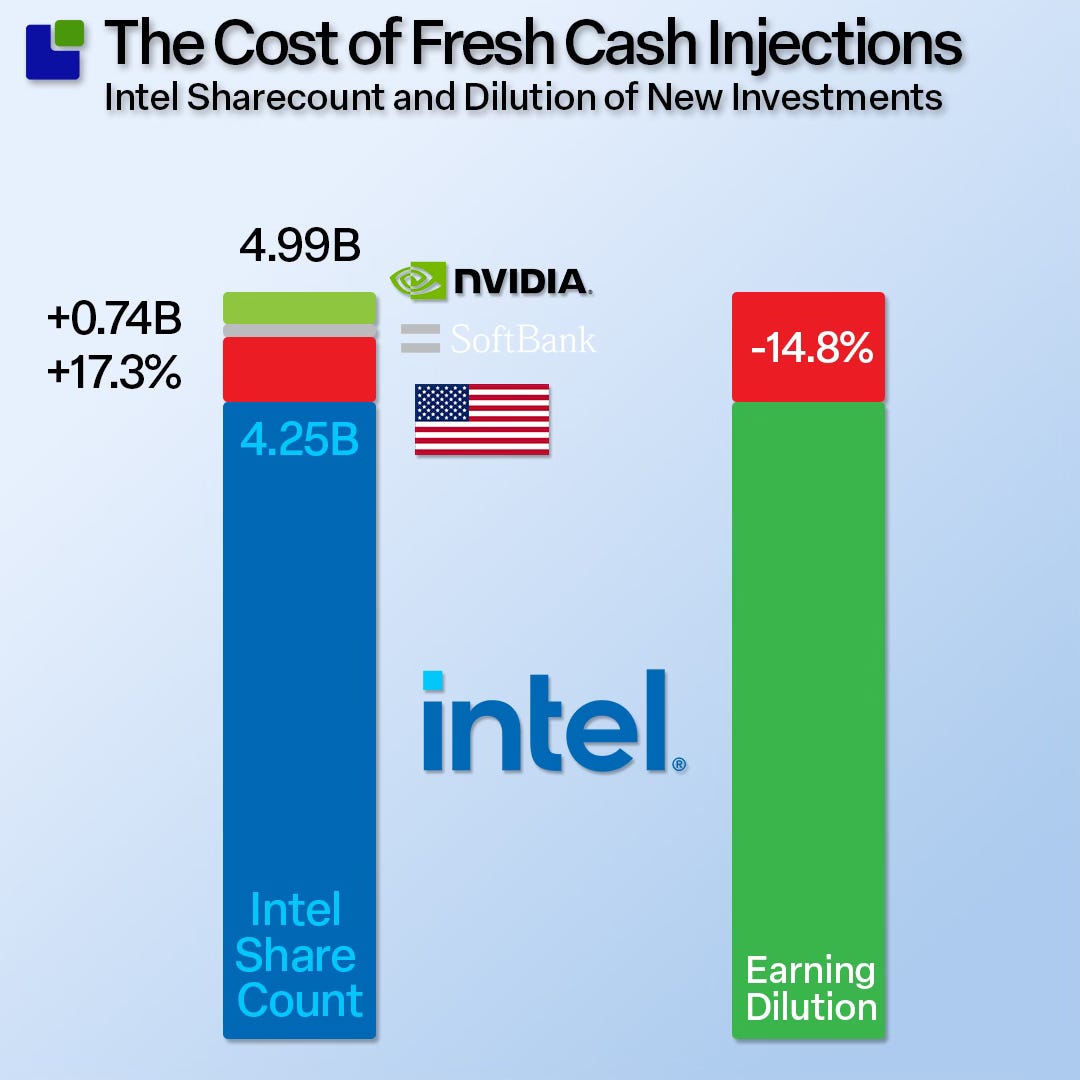

It is only governments and Dire Straits that can get money for nothing; the rest of us will have to sacrifice something, and for Intel, that is dilution of their net profit. More shares will have to share the profit (loss).

The three equity deals add 740M new shares and bring the sharecount to $5B. This results in a nearly 15% dilution of earnings. While this is the opposite of stock buybacks, it makes sense for Intel presently. The Investors Intel have left are looking for long-term survival rather than immediate returns.

While the US government financed the equity deal without spending any money, Intel is getting a real cash injection.