Is Nvidia hitting the Ceiling?

The underwhelming response to the Q4-24 result.

It is incredible how fast Wall Street can get accustomed to anything. Nvidia added another 5B in revenue, and the markets said, “Nah”.

But “Suddenly, nothing happened” is not an excuse for not analysing the world's most important semiconductor company. I have learned that something is always going on, as will be demonstrated.

The first thing to notice is that the guidance was relatively weak compared to the last few quarters. As demand is still reported stronger than ever, this must represent a weakness in the supply chain or at least a heightened awareness from Nvidia that something can go wrong with the Blackwell introduction. This could also be a significant upside if the supply and manufacturing operations succeed in pumping out Blackwells to the AI-starved data centres.

Nvidia’s profit margins tell the story of the products introduced over the last few years. The A100 brought Nvidia to the 65% gross margin range before the downcycle, and the H100 could pull the GM to a shade below 80% gross margin. What can also be seen is that there is a slight dip in the profit margins. The guidance shaves another 125 basispoints of the gross margins.

The explanation could not be Blackwell, as this is not generating revenue, or at least not meaningful revenue. Gross margins are only calculated based on the products sold, not those manufactured. The dip is around 400 percentage points, so something is going on. This will be uncovered later.

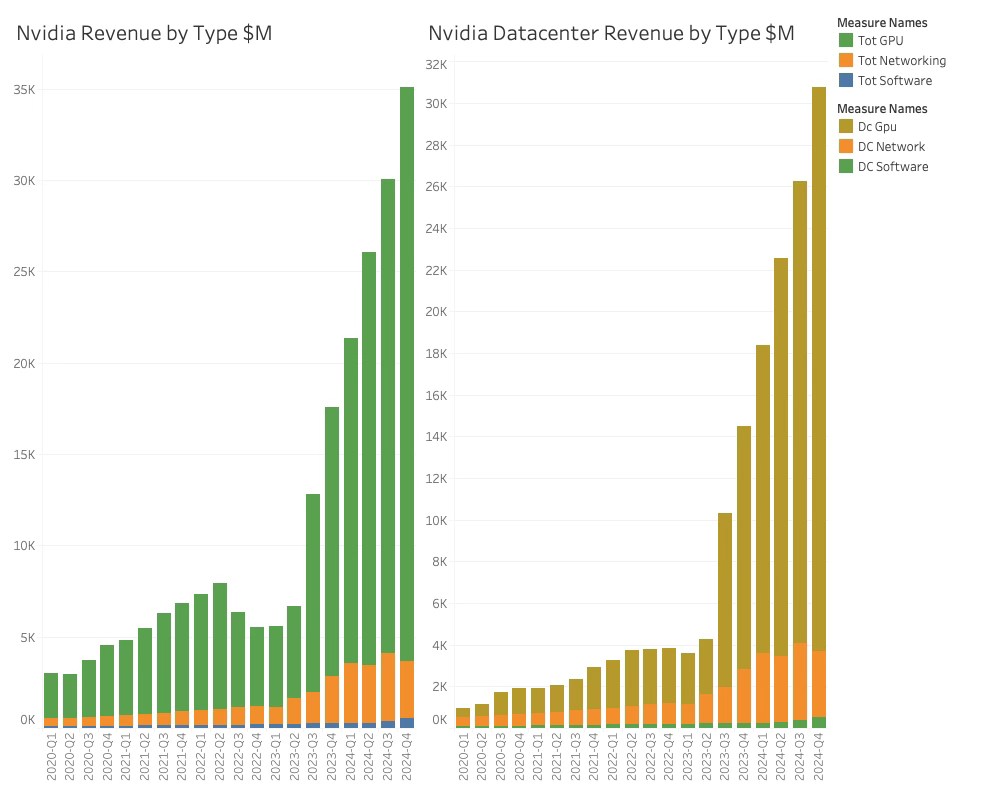

The transformation of Nvidia into a datacenter AI company continues at a rapid pace as can be seen from the segment and divisional perspective:

Dividing the business up is a usefull way of managing different product areas, but only if they are of comparable size. As can be seen, the Segment and divisional splits made sense a couple of years ago but will likely soon be changed. The graphics segment and the non-datacenter divisions are still struggling to get back to their Q2-22 record levels while the data centre business is off to the races. It is now more than 84% of the business. What is important to understand about the data centre revenue is that it is not semiconductor component revenue anymore; it is systems revenue.

The Datacenter revenue components.

While WSTS and others still count Nvidia revenue as Semiconductor revenue, the reality is that Nvidia is now a server company with some additional Integrated Device revenue.

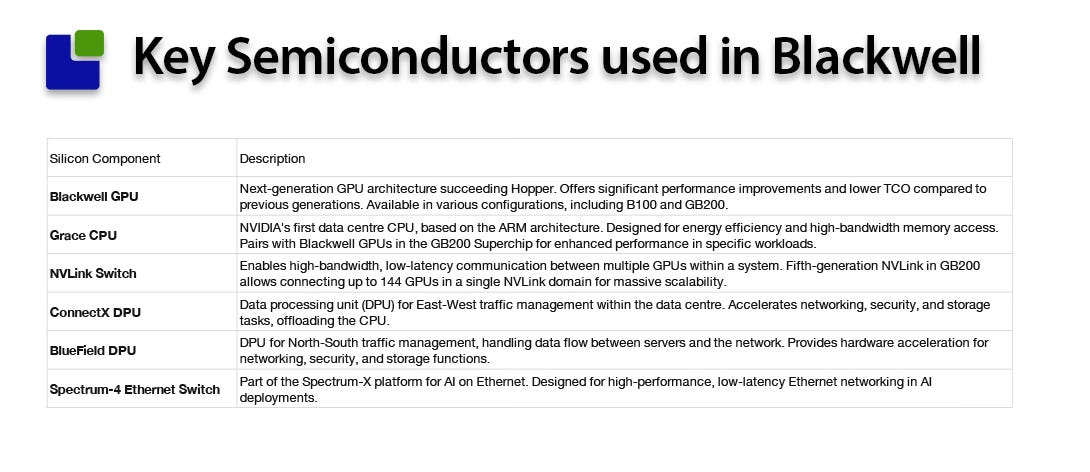

Blackwell has several boards that can be deployed in different versions according to performance needs and the data centre environment. The key Nvidia components on the Blackwell board are the following:

From an accounting perspective, the networking components used in Blackwell and Hopper are not part of the networking revenue that Nvidia reports; they are internal costs.

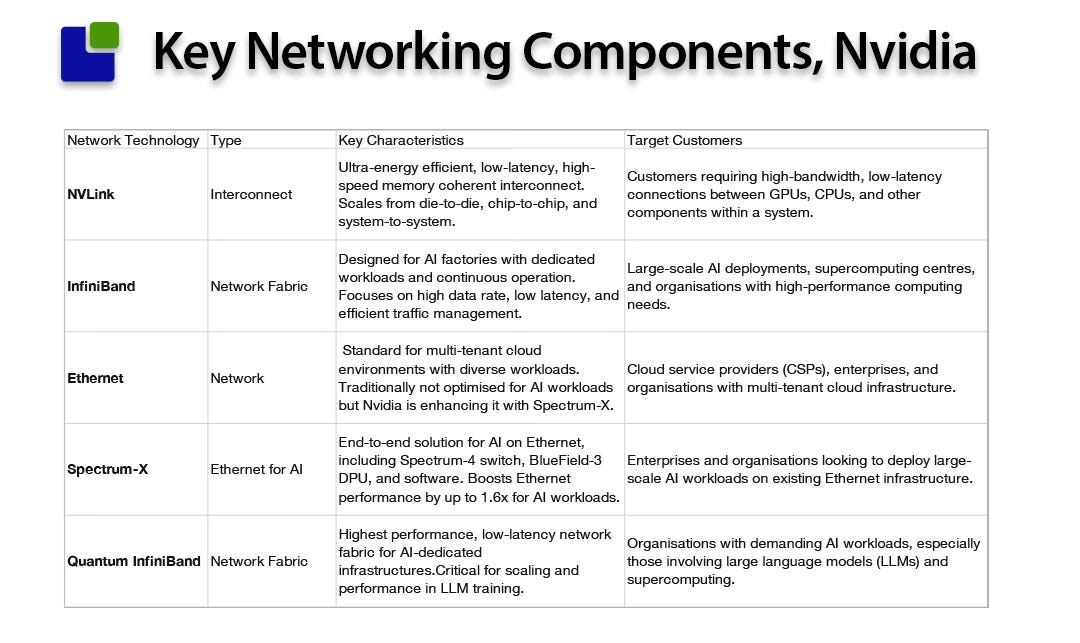

The key networking components that are sold to external customers can be seen in the table below.

There is a complete overlap of networking customers and the most significant server customers.

The revenue for Nvidia and the data centre are split into the main product types, as seen in the chart below.

While networking revenue has flattened, Nvidia maintains that the business is still growing but lumpy. The next few quarters will reveal if this is indeed the case.

From a systems perspective, the H100 dominates the data centre business with nearly 75% of the overall revenue. The Ampere A100 systems have served their objective as the stepping stone into AI dominance and are near the end of life.

Interestingly, the downgraded H20 system that passes the embargo rules for China is doing incredibly well. With 50% growth, quarter over quarter, this is Nvidia’s most successful product. The H100 business “only” grew 25% QoQ.