The top 5 AI spenders have all reported their Q3 and given insights into their current AI investments.

The AI revolution has only been visible for less than five quarters. On August 22nd, 2023, Nvidia announced that its revenue grew 88% in a quarter to $13.5B, and the rest is history—as they say, very recent history.

Although the revolution started a little earlier in the supply chain, the impact on the tech economy has been massive and if we listen to the tech bros (and Lisa) at the top of the AI companies, this is only the beginning.

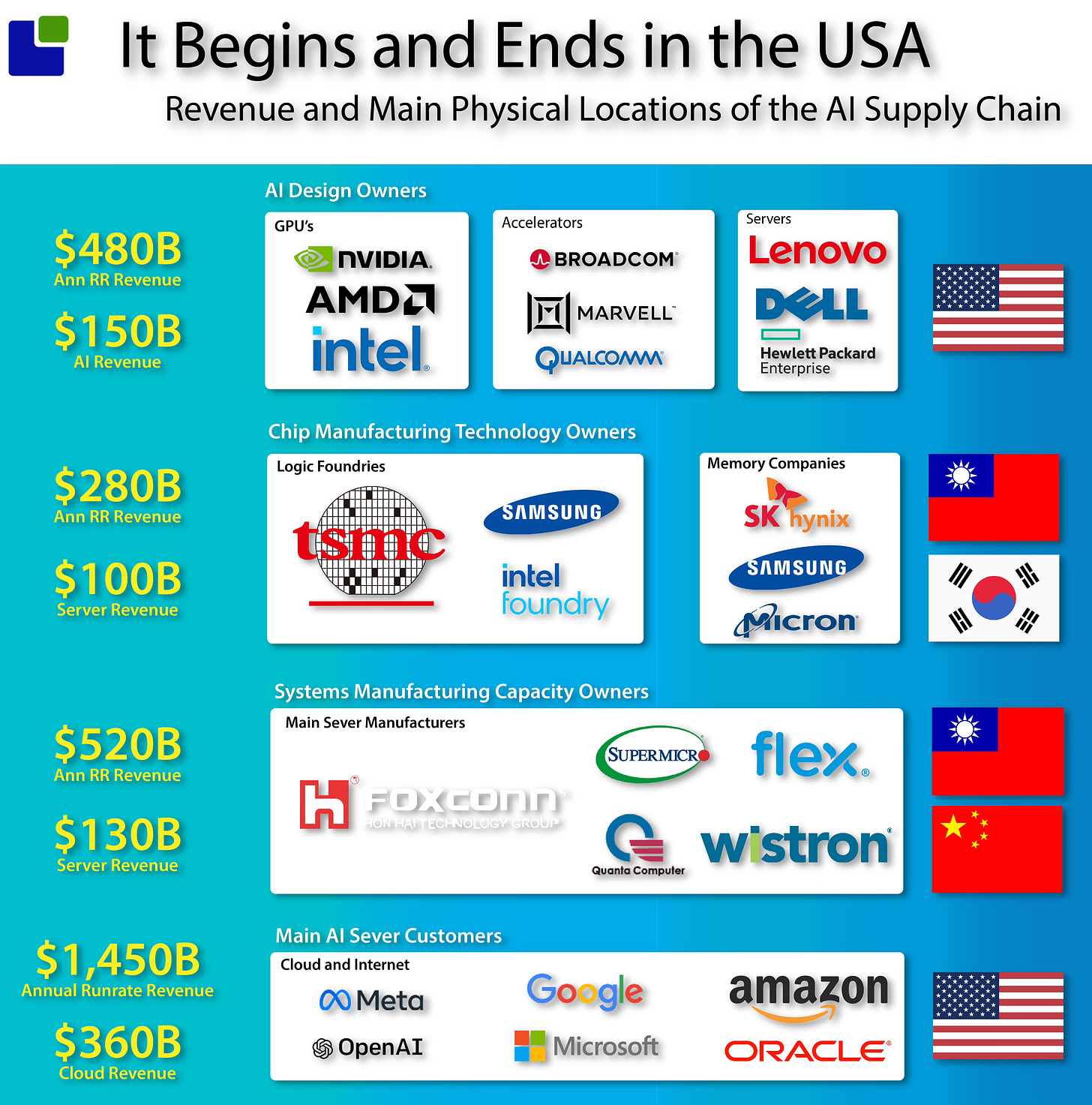

While this is important for investors to understand, it is now crucial after the US Presidential Election. Most AI servers have been migrating to the US and allowed entry and permanent residence in the warm, cosy data centres of the cloud and internet giants. However, their predominantly Asian heritage can become an issue when the new administration takes office. The servers were born in Taiwan & Korea and assembled in China by Taiwanese companies before entering the caravan to the US.

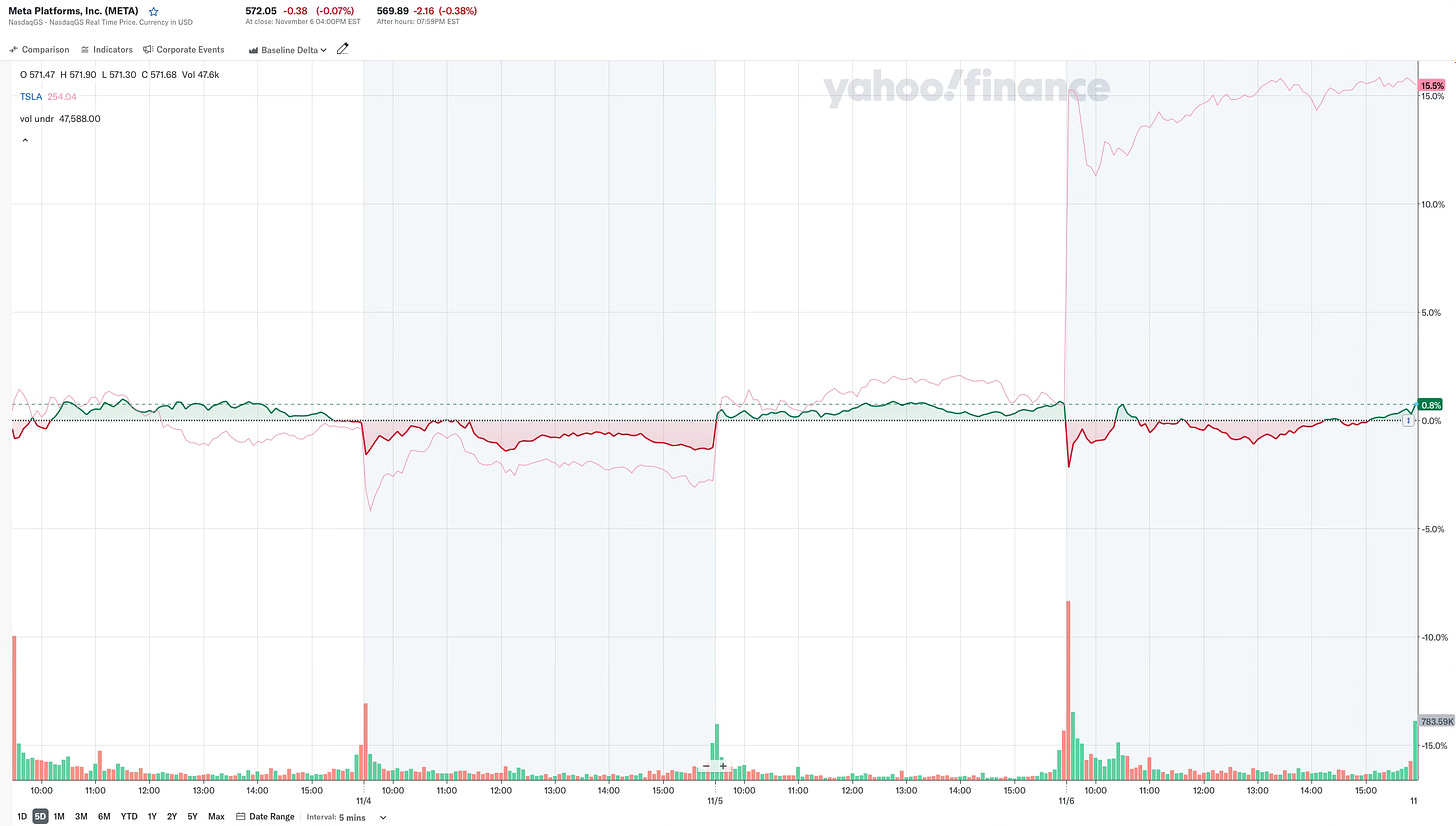

The Asian reliance on the server supply chain, with very little manufactured in the US. Thus, it is an obvious candidate for tariffs. Tariffs could also become increasingly transactional, with Elon Musk’s Tesla getting a better shake than Zuck’s Meta. The markets seem to think that Tesla could benefit from Elon’s relationship or seat in the new administration.

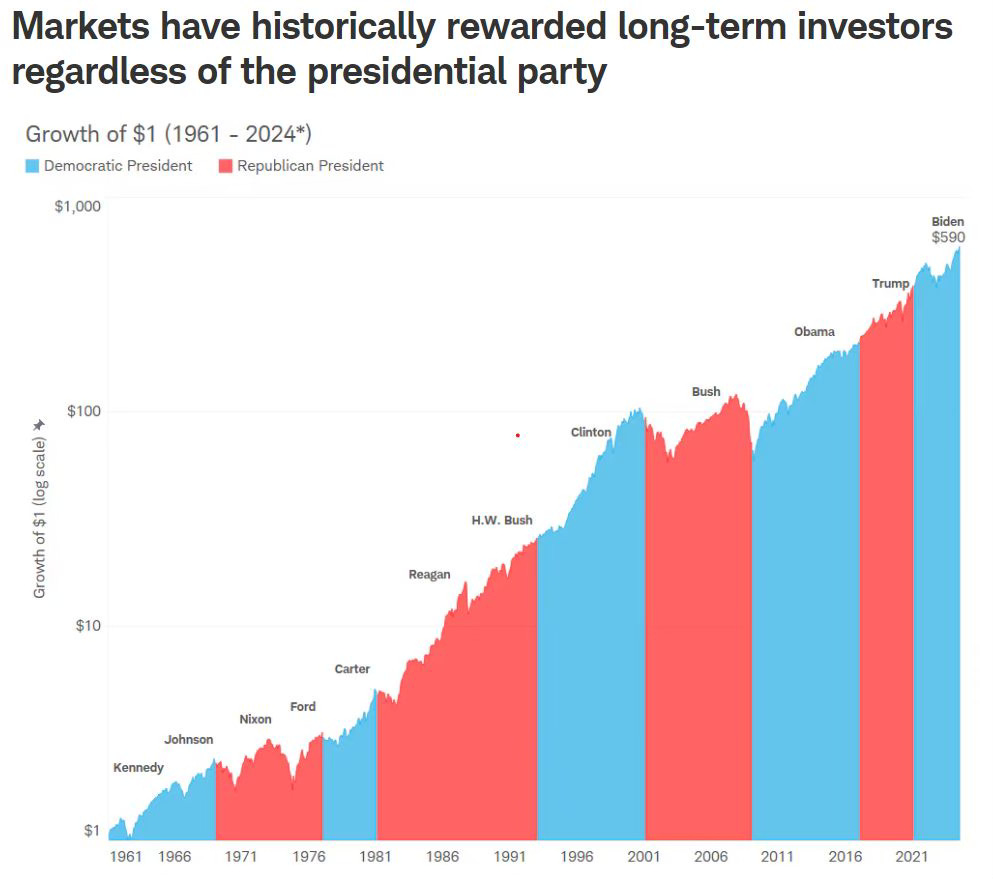

The US presidency has much power and influence. Voters expect a single person to be responsible for gas prices and stock market gains and that the election of that person is vital for those gains.

History shows that, in all likelihood, that from a long term stock market perspective, there is little difference in who the residing president was or the ruling party ( Election Insights):

This is true at the highest level, but there are likely to be winners and losers (enemies) due to the new administration. What is certain is that everything is less certain.

The large server farm owners could also benefit as a result of deregulation that will be on the table.

Due to the new administration, I expect the large AI server companies to take action depending on the new policies. While this has not impacted the Q3-24 numbers, I expect to be busy for the next four years.

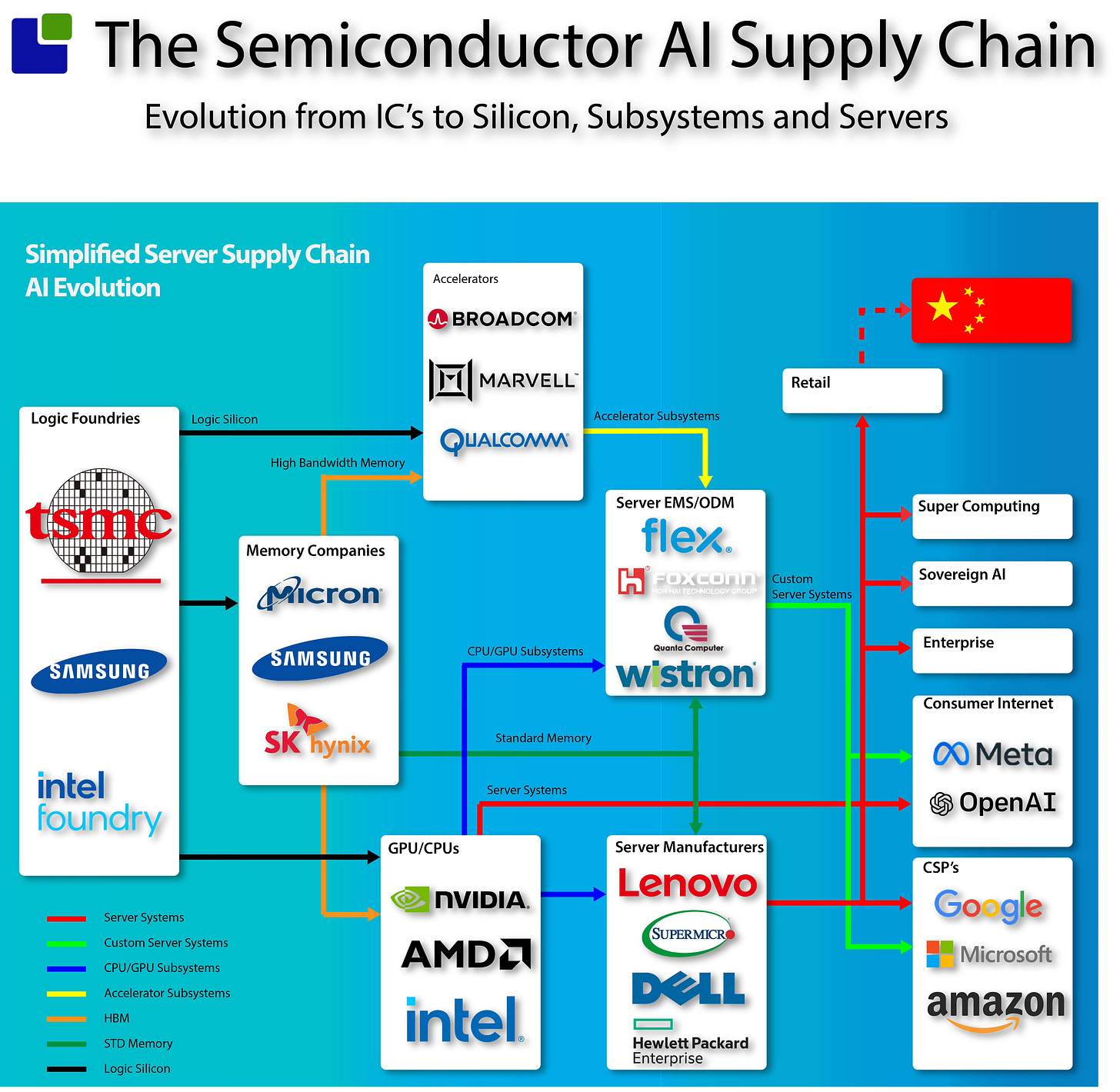

Let’s investigate the AI revolution seen from the semiconductor side.

The Supply side of the AI revolution

Even though the AI revolution is very US-centric from an ownership perspective, the complex supply chain cannot be moved easily. While the Chips Act has made progress in reshoring some of the high-end chip manufacturing, there is increasing uncertainty about the new administration’s interest in continuing to invest in local fab capacity. This could also become transactional, which could benefit Intel, while TSMC, as a foreign company, could end up as the loser from the Chips Act perspective.

While it is unlikely that Chinese companies can be impacted more than they already are in AI, there are higher risks for US companies. The supply chain is running at total capacity to support the hunger for Nvidia servers, and the AI leader is pushing its suppliers to the limit. Recently, Nvidia has been trying to influence SK Hynix to deliver the next generation of high-bandwidth memory for Rubin earlier than planned.

The Chinese authorities are likely to take retaliatory action against any additional tariffs, and the AI supply chain will be on the target list. It doesn’t take much tariff action to upset the supply chain.

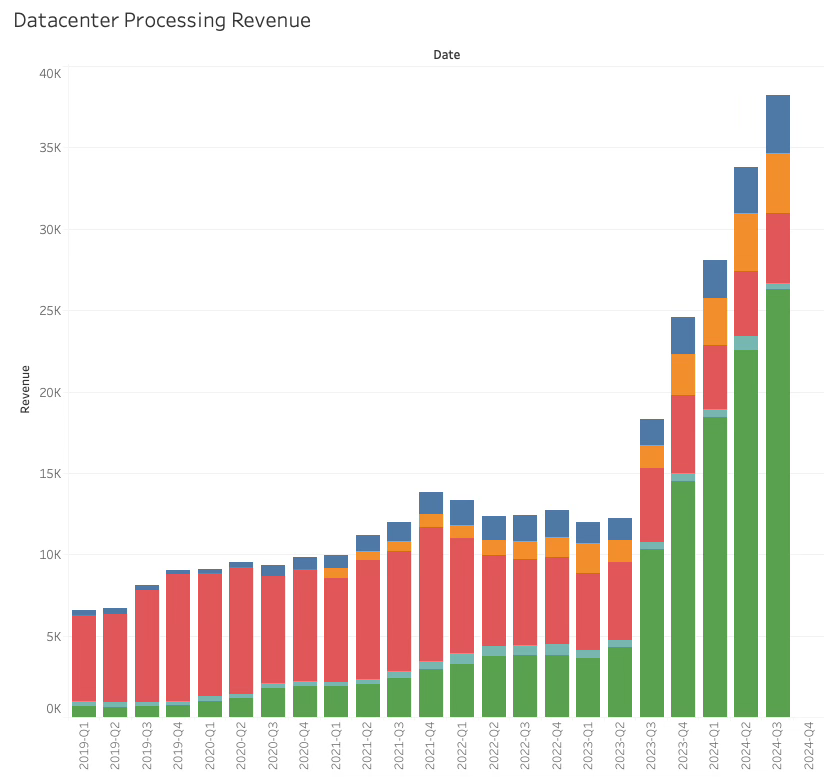

The supply side of processing increased by 13% in revenue QoQ, adding an extra $4.4B in Q3-24.

While still heavily dominated by Nvidia, AMD and Broadcom are making tangible gains, and Intel has stopped the bleeding and settled in the 4B$/qtr range.

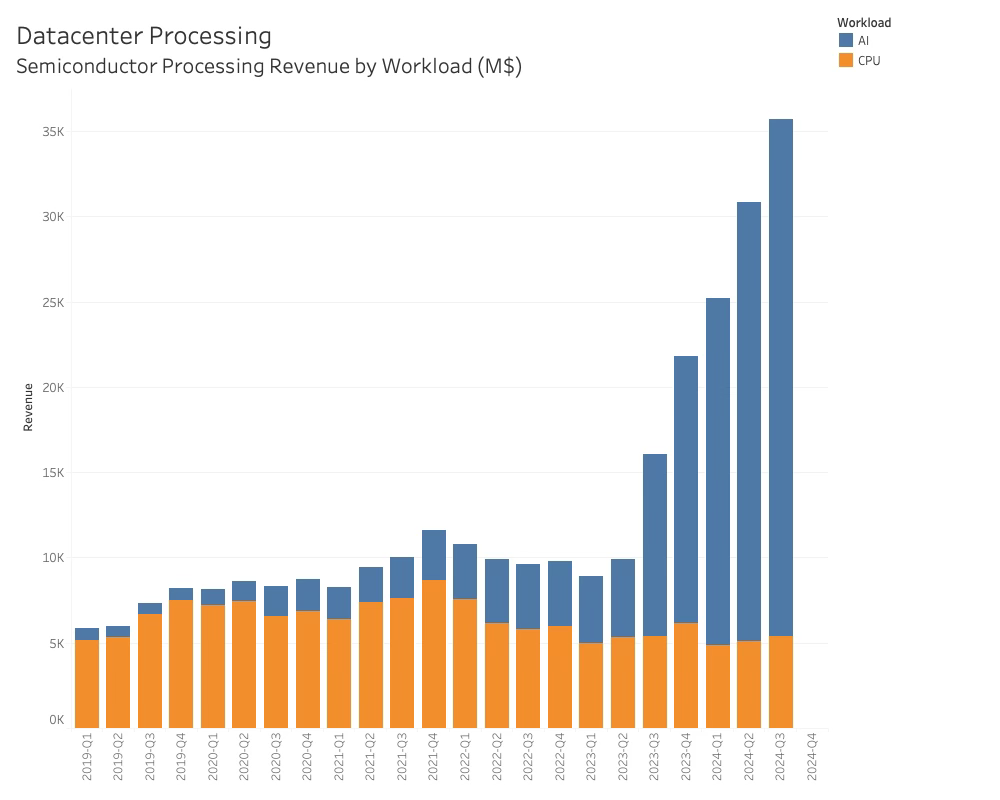

Not surprisingly, the processing revenue (excluding networks) is driven by the AI side of the equation.

The AI share of data centre processing increased by 1.5% to 84.9%. It is hard to understand that only 5 quarters ago, AI accounted for less than half the revenue.

The Nvidia demand remains strong, and the company expects the H100 demand to strengthen during the next two quarters while Blackwell makes its debut in Q4 of 2024.

AMD started the year with an expected annual AI revenue of $2B, which was revised to $4.5B last quarter and exceeded $5B this quarter. AMD has certainly gained traction, although it cannot command the same margin as Nvidia.

AI companies generally describe the demand for AI-related hardware and services as very strong. They expect this demand to grow rapidly in the coming quarters and years. While still early, enterprise adoption of AI is increasing, creating additional demand

The supply side is most definitely limited, and as all the semiconductor product owners are US-based corporations, and almost all of the manufacturing is in Asia, it will be interesting to see how the new administration navigates this, given the statements made during the election period.

The demand side of the AI revolution

Knowing that the supply side is limited, the demand side of the equation becomes a matter of what we can get rather than what we want.

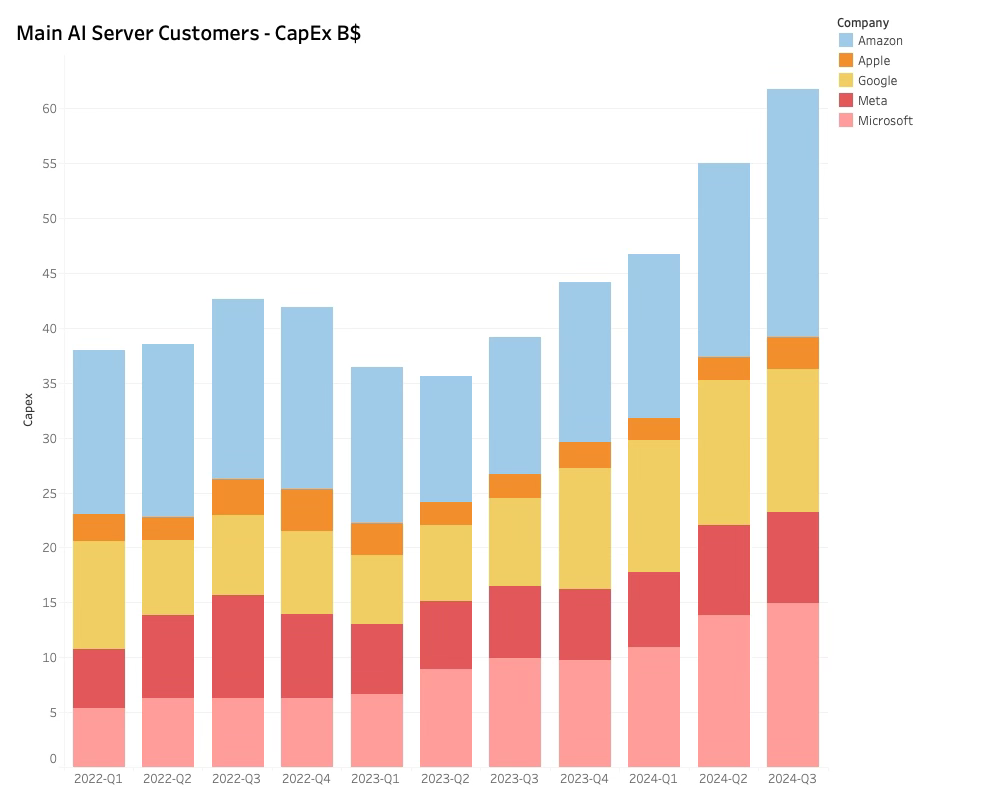

Only some large AI server consumers have reported, but the significant ones have shown their hand, and the AI race is still on, as can be seen with the Q3 Capex:

Keep reading with a 7-day free trial

Subscribe to Semiconductor Business Intelligence to keep reading this post and get 7 days of free access to the full post archives.