Leading or Bleeding Edge?

TSMCs Q3 result is terrible news for Intel and Samsung

The easiest way to become a millionaire is to start as a 50x billionaire and build a Semiconductor Foundry. Within a short while, you will be stripped of most of your cash while having a big, beautiful cheeselayer concrete box full of the most expensive toys anybody has ever imagined.

And then the fun begins. If you are lucky, you now have the most advanced semiconductor technology in the world and are waiting for customers to break into your sales offices. AI customers are screaming for capacity on 3nm processes, so why do we have to check if our phones are disconnected?

These questions could be asked in the corner offices of the two contenders to the foundry Game of Thrones occupied by TSMC. Both Samsung and Intel are jumping from disappointment to disappointment while trying to convince everybody that they should take a gamble.

If they are lucky enough to find customers, they will find out that their new fab and technology are years away from profitability, primarily due to TSMC’s business model.

The TSMC Q3-24 result deserves some analysis before we discuss its implications and the information shared at the investor call.

TSMC Q3-24 result

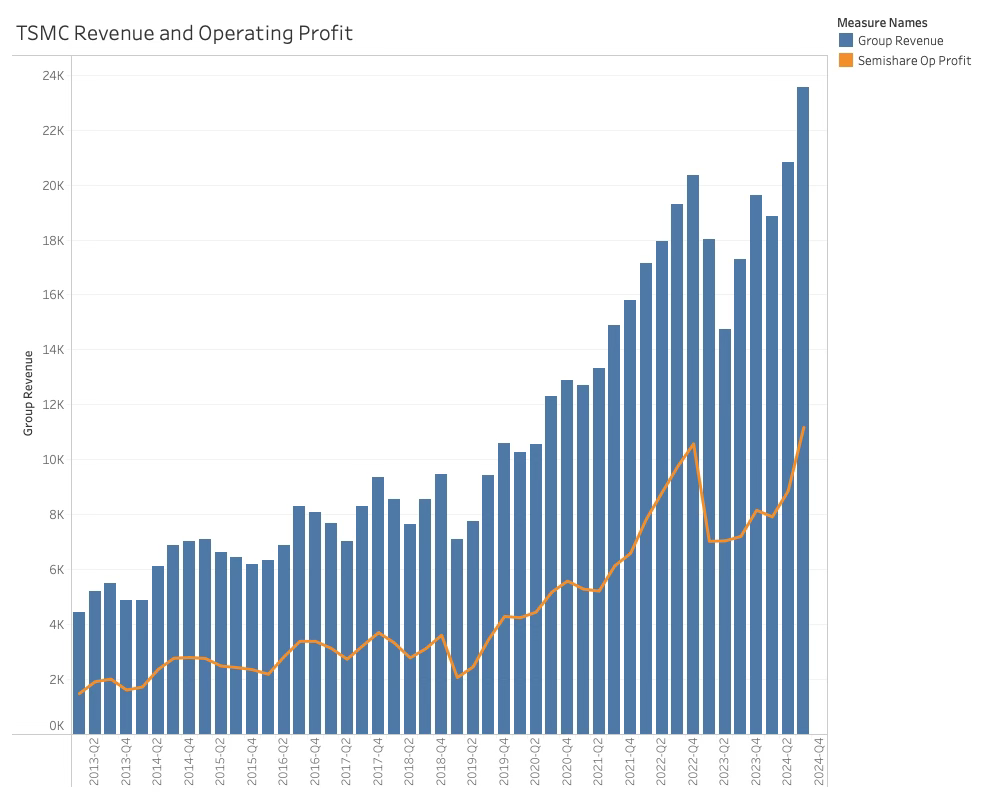

The revenue result was a solid 13% growth over the last quarter and up 36% YoY. The guidance for Q4 adds another 12% of growth if achieved.

The gross margin improved by 4.6% sequentially, reflecting a higher capacity utilisation rate. The guidance for Q4 was only slightly up, adding 20 basis points, bringing the Gross margin to 58% at the midpoint.

The moving parts in the Gross profit projection are a further increase in capacity utilisation. At the same time, there are headwinds from increasing electricity costs, dilution from 3nm ramp-up (this will be painful for Intel) and N5 to N3 tool conversion costs.

The GPM dilution from the 3nm ramp-up will decline over 2025, while the overseas operations will dilute the margin by 2-3%

As can be seen on the graph, operating profit has not been following revenue growth. From Q1-23, operating profit flattened while revenue grew.

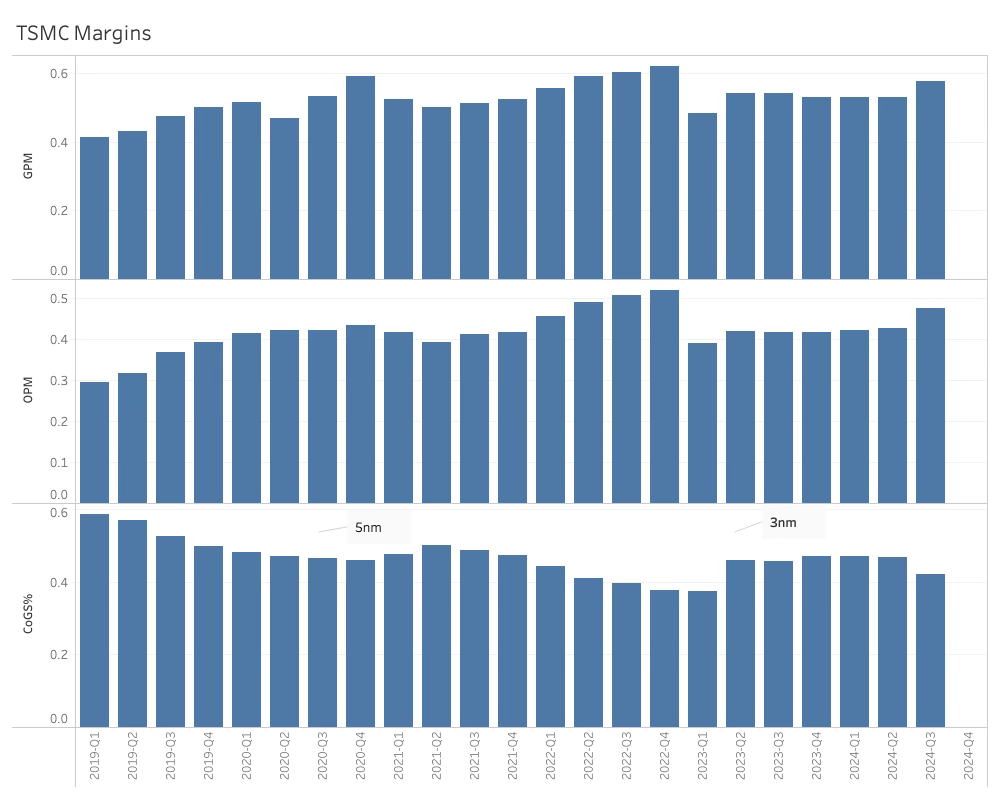

This is easier to see in a margin plot of gross, operating, and cost of goods sold.

There was a slight COGS margin increase when the 5nm process was introduced and a much more significant when 3nm started production. While it might not surprise Intel, it is another headwind for the former Chipzilla.

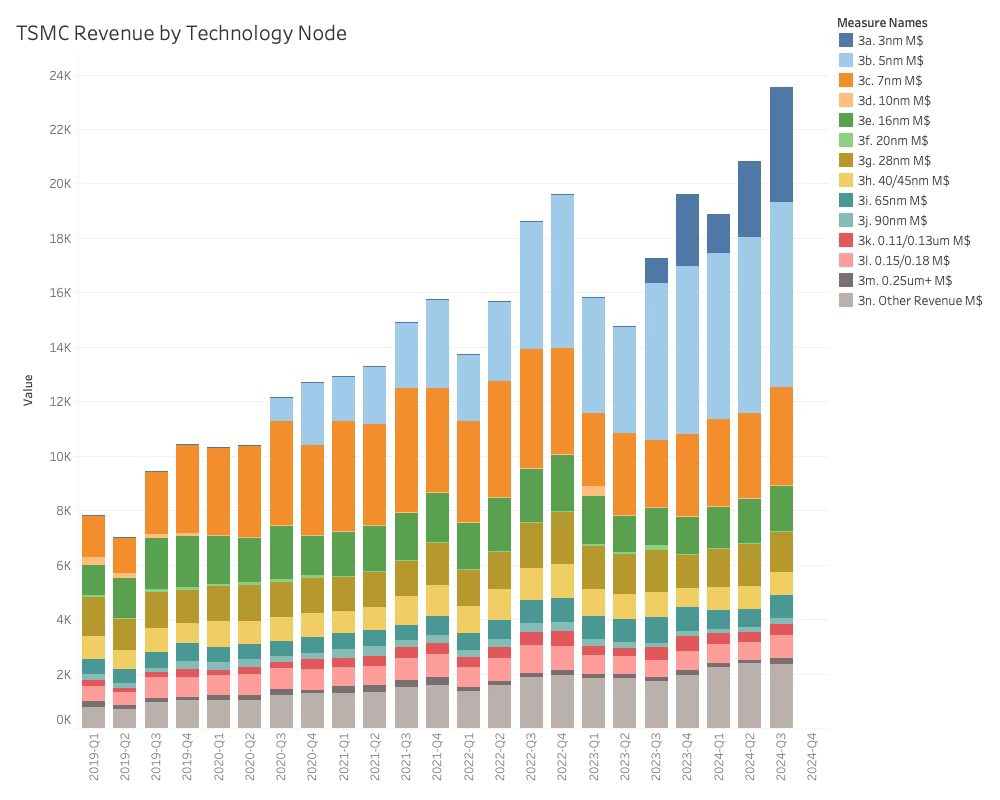

The revenue by technology shows that the timing corresponds to the introduction of new nodes and that the effect is becoming more severe.

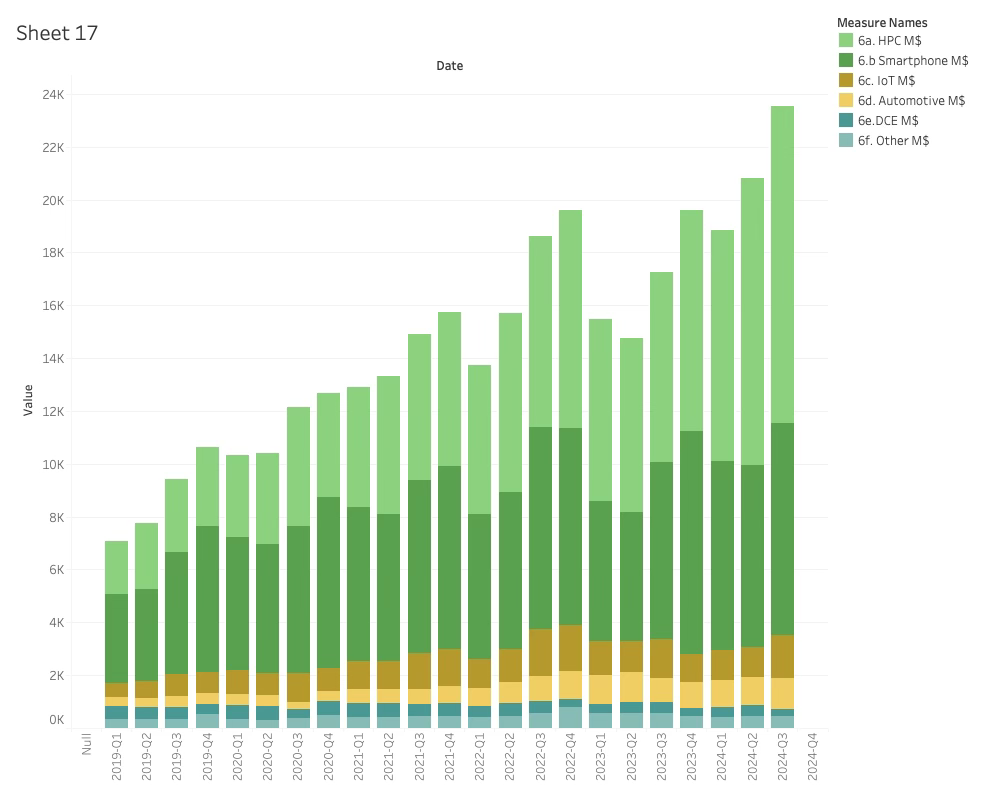

It can also be seen that the revenue effect of 3nm is already significant. While it is not driven exclusively by the High Performance Computing Division, as Apple is a major 3nm customer, the overall impact of HPC is very visible.

The effect of the new node introductions impacts profits negatively, which confirms TSMC’s business model of absorbing the initial cost of making the latest technology profitable. TSMC gives customers the benefit of the longer-term economic gain of upgrading to a new technology upfront and deals with the cost internally. This would probably not have happened if TSMC was a US corporation and something Intel would struggle with as profitability would be delayed.

TSMC Capex

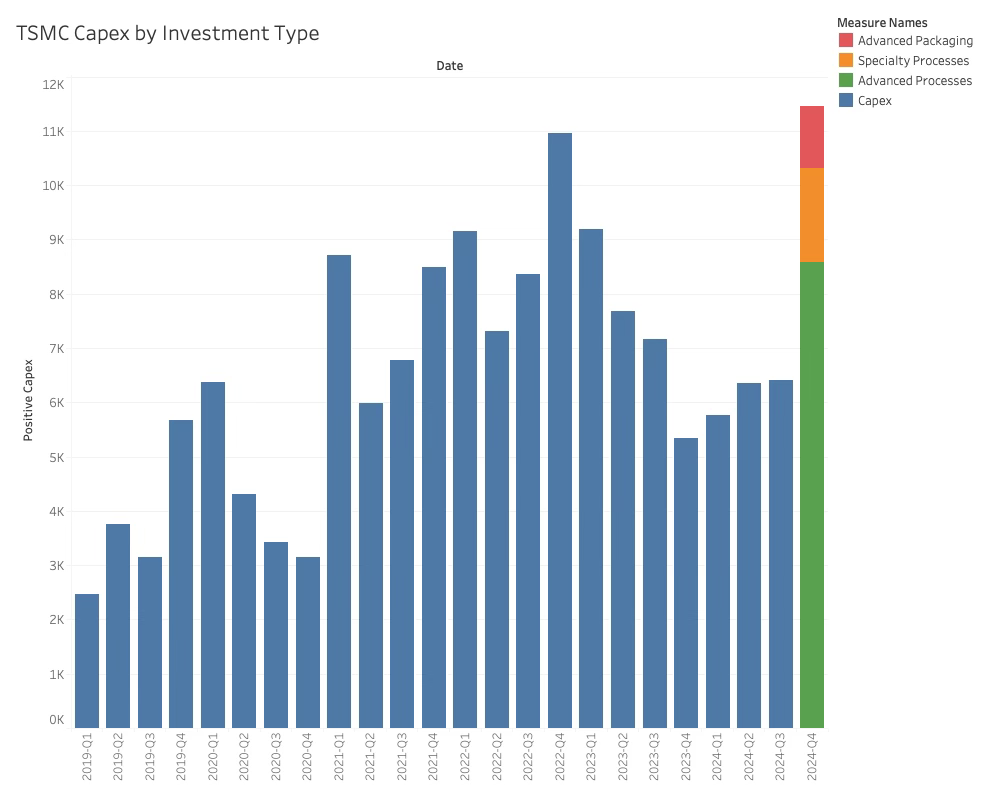

While being challenged on flat CapEx in 2024 (similar to 21 & 22 and down on 23), the Q4-24 investment would be a new record for TSMC, as seen below.

The allocation will be heavily distributed towards advanced processes but in line with TSMC’s Foundry 2.0 strategy, there will be allocations towards advanced packaging in line with the strategy.

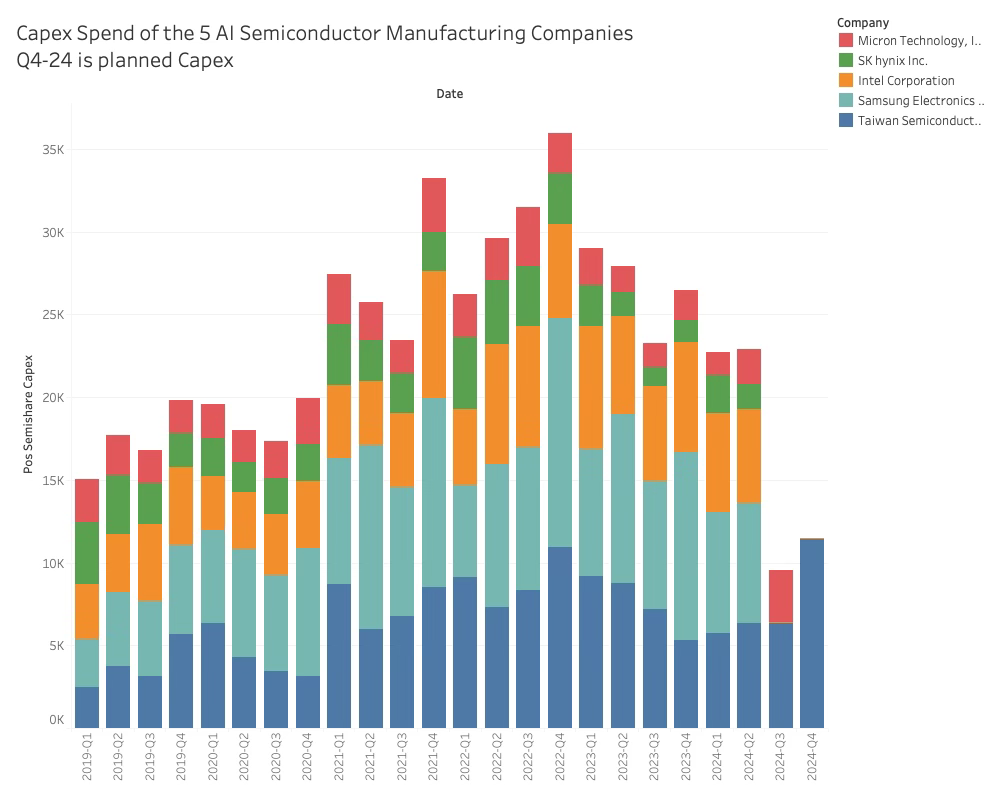

The CapEx guidance can be seen in the light of the other top 5 Semiconductor company capex in the chart below. While Intel and Samsung are hitting the brakes, TSMC is now pushing the accelerator again. The TSMC moat is not getting narrower.

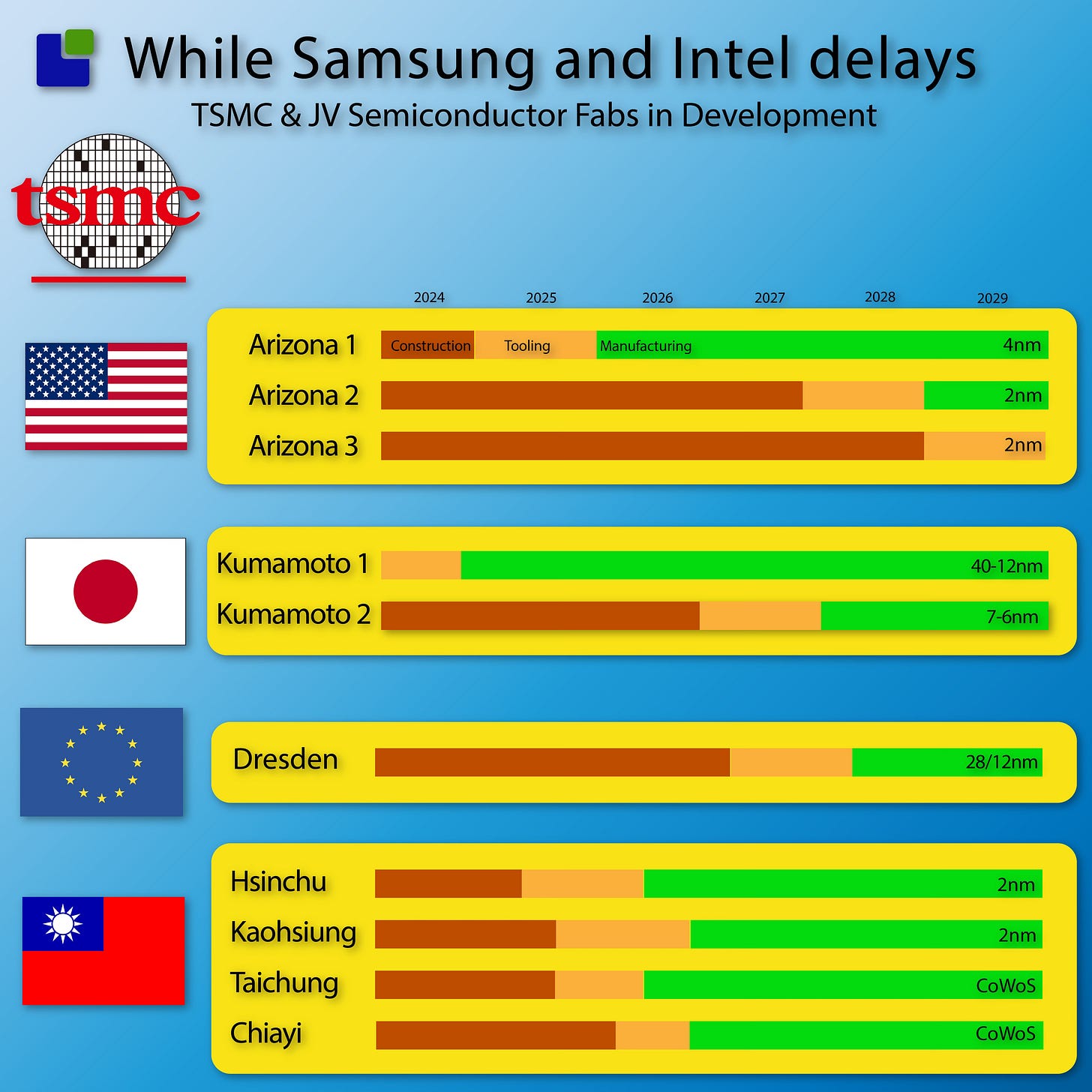

TSMC gave an update on the fab construction progress, which must have sent shivers down the competitors' spines. TSMC commented on the Arizona fabs, noting that they had twice the cleanroom area that was normal for a wafer fab.

The overseas projects, especially in Arizona and Kumamoto, will cause a 2-3% gross profit drag due to the staggered construction plan. When the first Arizona fab becomes profitable, the second one will go into construction and drag the margin down.

TSMC outlook

Overall TSMC has been able to grow more than 25% over the last half decade except for 2023. Pressed on the longer term future growth potential, TSMC would not give guidance but said that they hoped for similar levels given the violent AI demand.

In the near term, TSMC expects the revenue contribtuion for AI processors to more than triple in 2024 and account for for mid-teens percentage. Supported by technology leadership and broad customer base, the company feels well-positioned to address this opportunity.

TSMC still expected a lot of business over the coming period, from Intel, which they consider a really good customer. TSMC has no interest whatsoever in acquiring any Intel assets.

On AI demand

TSMC highlighted that they were really the only show in town for AI related semiconductor manufacturing and rightfully commented that they hear from all of their customers that the demand is real and solid. Also TSMC commented that they are also a user of AI in their manufacturing and have already seen productivity gains of $1B from AI.

The AI demand is really outside the Semiconductor cycle and will last for many years. The rest of the demand that follows the cycle is in uptick right now. TSMC is really the only show in town with regards to AI

Even though you could suspect that Chiplet technology would reduce the demand of 2nm nodes as it combines different nodes of which not all need to be leading edge, TSMC does not see this as a treat. The 2nm demand is already much stronger that what TSMC saw from 2nm and significant investments will be made in both 2nm and A16.

The advanced packaging outlook is to double capacity again next year, the same as last year. Packaging revenue is currenly in the high single digit share of revenue.

It is time to get into the machine room