Marvells Transformation into an AI Company

Strong revenue growth, with Special Charges raining on the parade

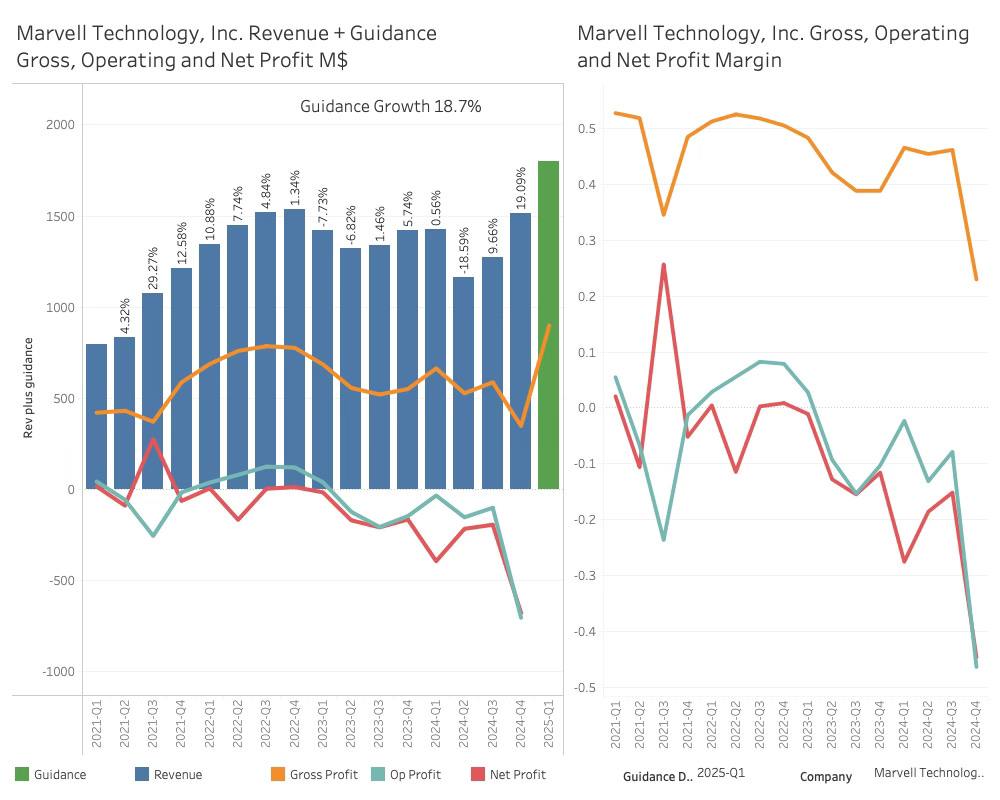

Marvell's revenue performance in Q3 showed a strong 19% growth, and the company is guiding for another 19% revenue growth next quarter.

From a GAAP (Generally Accepted Accounting Principles) perspective, the result was negative as Marvell introduced two restructuring charges that impacted Gross, Operating and Net margins.

From a non-GAAP perspective, the Gross margin was 60.5%, and the operating margin was 29.6%. This is much better than GAAP but still yields a somewhat mixed profit result.

While non-GAAP can help us understand the business without the charges, we use GAAP for our industry and supply chain overviews. Although not all charges have a cash impact on the company, they all have a valuation and reputational impact.

While the charge might be warranted (mostly the case), it also demonstrates that something has happened that makes management reassess the value of business assets or the necessity to restructure in response to something happening. And it is rarely something good happening.

The charges

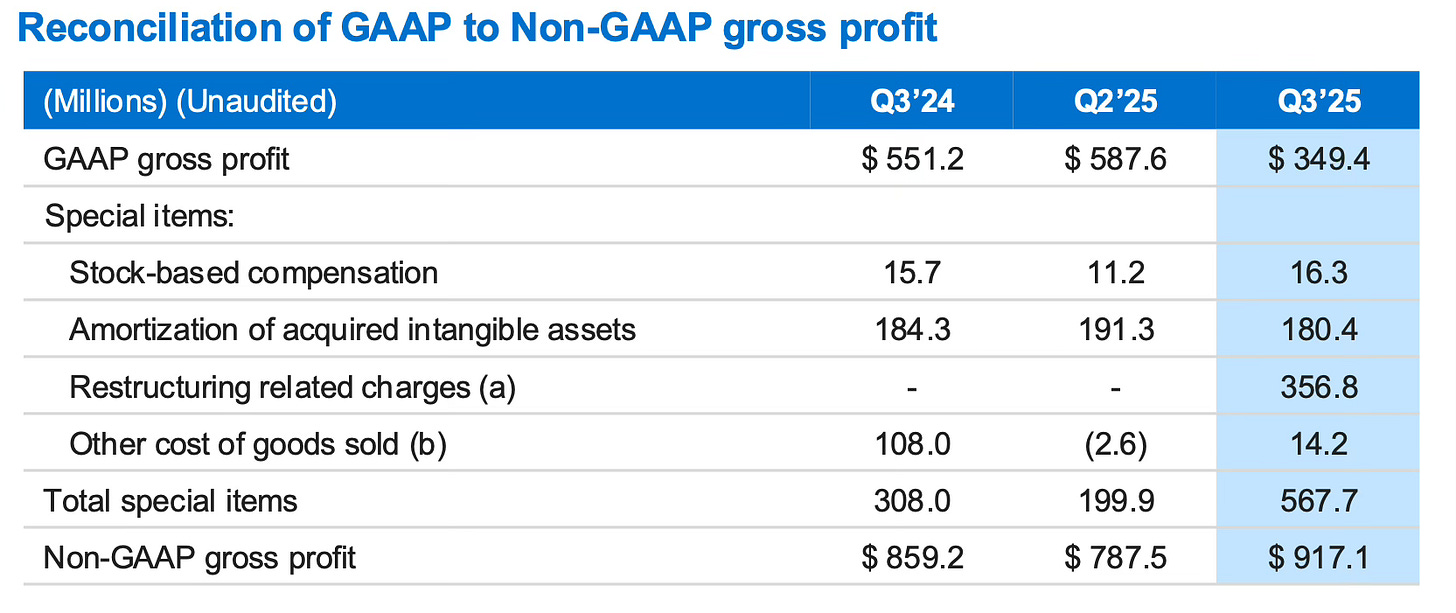

The special charges impacted the gross profit (and COGS) as follows.

(a) Restructuring and other related items include asset impairment charges, recognition of future contractual obligations, employee severance costs, facilities related charges, and other.

(b) Other cost of goods sold includes charges for an intellectual property licensing claim, product claim-related matters that were fully resolved in the fourth quarter of fiscal 2024, and acquisition integration-related inventory costs.

The commentary on the investor call was:

“This resulted in an aggregate restructuring charge of 715 million, which is reflected in our GAAP results for the third quarter. The two largest components were impairment charges for acquired intangible assets and certain purchase technology licenses and their future contractual obligations. I would also note that approximately three quarters of these restructuring charges are noncash in nature and that the aggregate restructuring charges are now largely behind us. These charges are a reflection of the fact that we have invested significantly in updating our enterprise and carrier product portfolios over several years, and we plan on more targeted investments in these end markets going forward”

This suggests that some technological elements in the carrier business are not needed anymore. This carried a value on the balance sheet that is now written off. Overall this suggests the Carrier group is going to see less love moving forward.