Nvidia's Enterprise Segment

IT infrastructure for Semiconductor dummies.

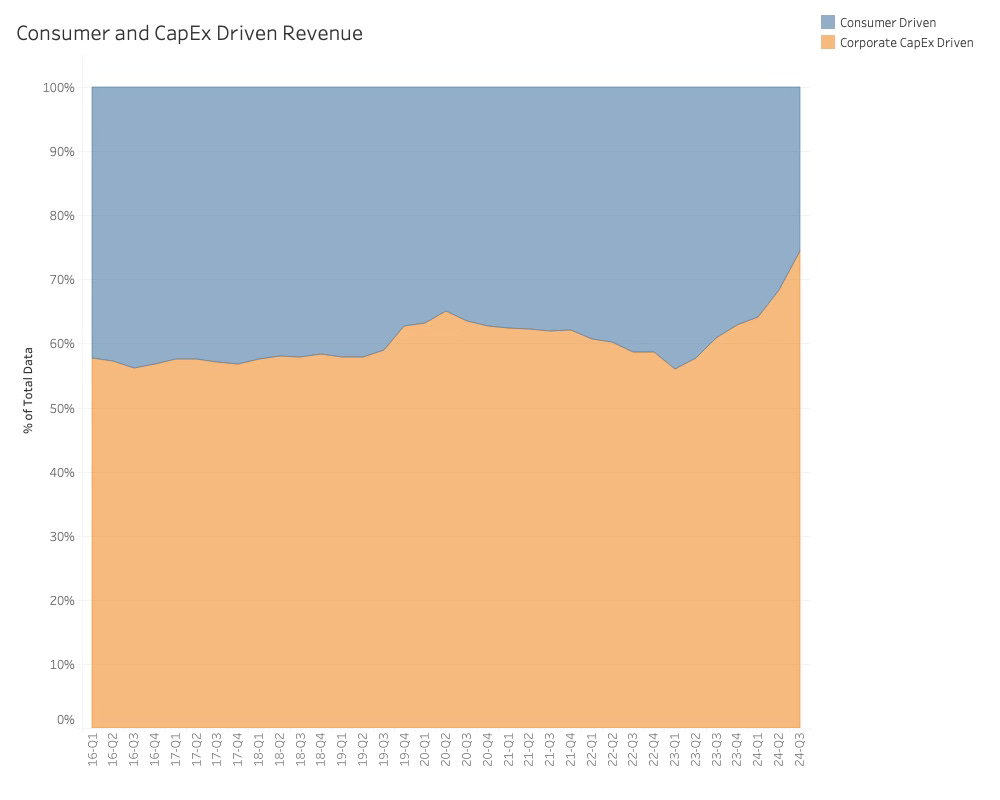

The Semiconductor industry used to be driven by balanced consumer demand and corporate CapEx. However, Corporate CapEx accelerated as the industry entered the cloud era. Since the AI revolution began over a year ago, almost all of the industry's growth has come from CapEx. Thus, we are entering a new phase in the Semiconductor industry.

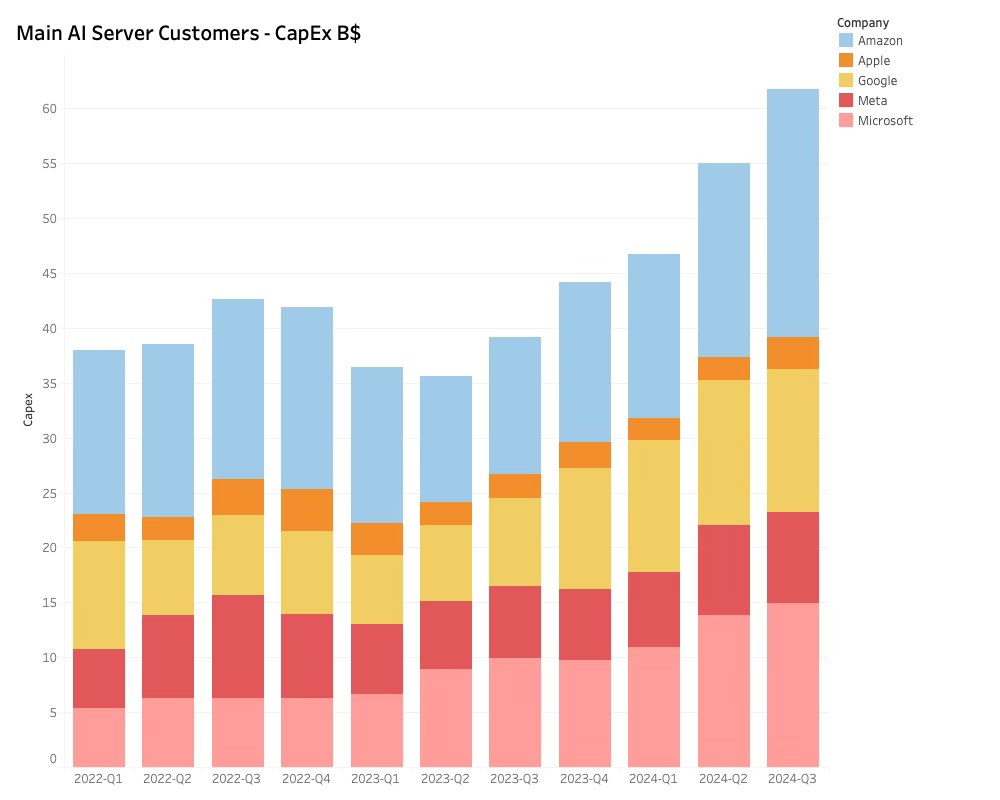

The current AI CapEx comes from supercomputing, sovereign AI (national AI), and industrial AI/robotics, but above all, it comes from investments in cloud and enterprise computing. Half of Nvidia’s Datacenter revenue is derived from Cloud Customers alone. The cloud companies have publicly thrown significant amounts of money into the AI fire, promising there will be much more.

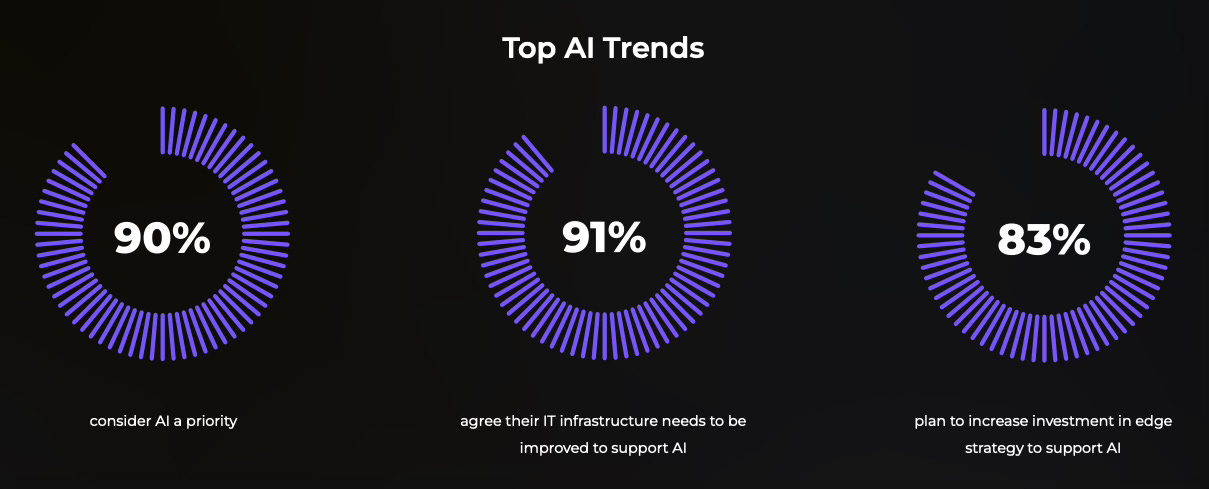

Enterprise companies' AI investments are more complex to unravel. However, their commitment to AI is strong.

According to a study by VansonBourne, almost all enterprise companies will address AI, so it is essential to understand this Nvidia customer segment better to understand Nvidia's long-term prospects.

Supply chain research method

My field of play is semiconductors, specifically the upstream and downstream Semiconductor supply chain. Rather than examining a sector or company in isolation, I gather information about supply, demand, competition, and the macro scenario.

Before I became a corporate dropout, I worked with data in a corporate environment. Corporate business data was revered in this environment, while external business data was ignored.

Not all that was treated as data was data. Customer project information was especially sacred even though it was well-known that sales and product divisions could get out of revenue to budget deficits by inflating the value of customer projects.

There are lies, damn lies and Salesforce data.

A finger on the Salesforce scale was the easiest way out of trouble.

The other area of interest was market research. This was used less as a basis for strategy formation and more as a justification tool. The data had to show that the company and each division were growing, or it would be deemed “wrong”.

Rather than tampering with the research data, you keep sweeping for market research data from reputable institutions to Asian Research Sweatshops until you find the market data that confirms the corporate narratives.

I know that the true story of a company is not told by the internal data alone. You need to understand the context and preferably deliver hard financial facts. This is also the foundation of my research. More often than not, things emerge when I wander outside the walls of the company I am researching.