On a New Path or More of the Same?

Despite Billions in investments, onsemi is back to where it began the Cycle.

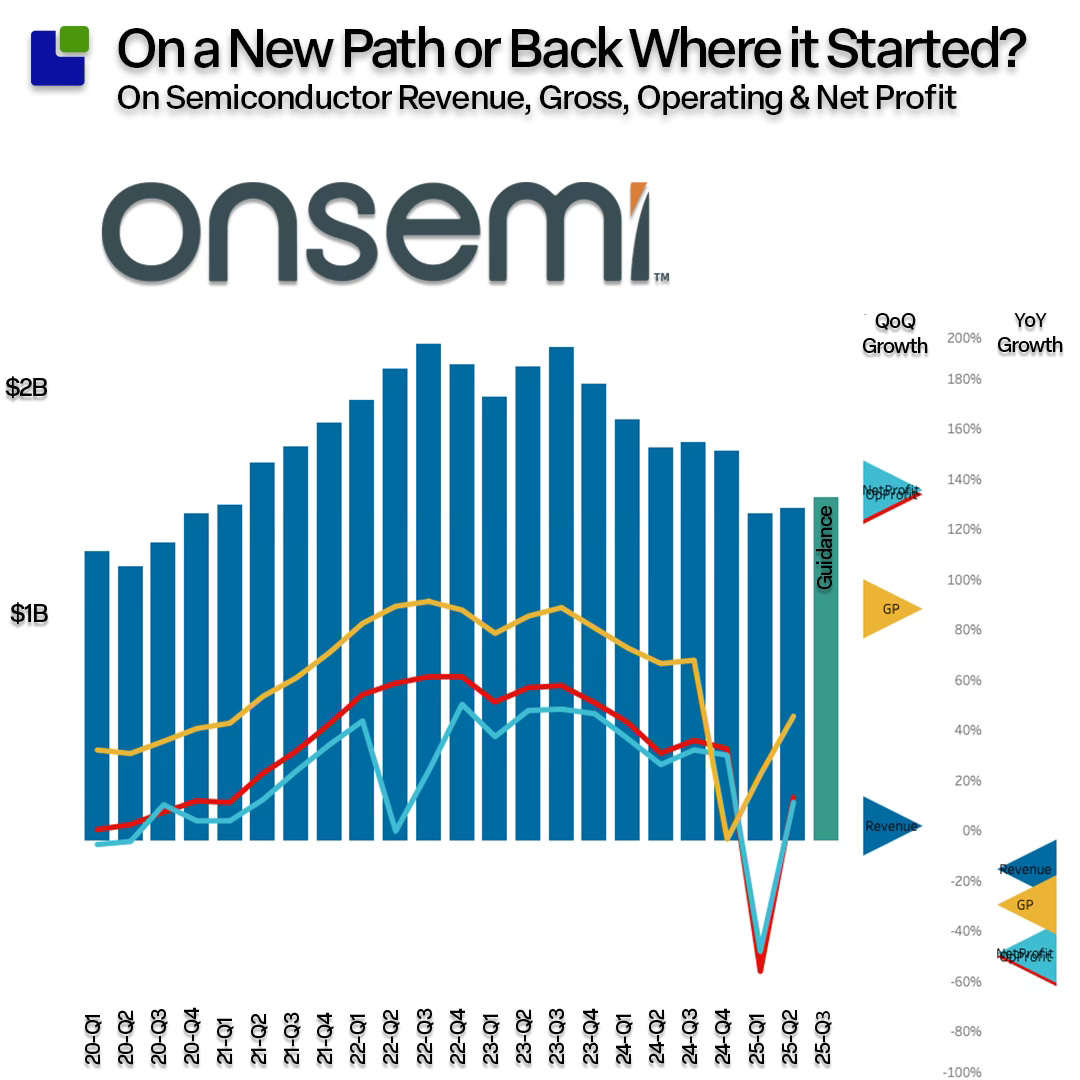

While billions have been spent on developing new capacity for a new strategy, onsemi appears to be back at the same point where Hassane El-Khoury assumed the role of CEO, from a profit perspective.

Is the company in a better position than it was at the beginning of the upcycle 4 years ago, or is it all CEO bluster and overconfidence?

For now, the guidance numbers are far from as confident as management.

Before diving into the deeper strategic analysis, it is worth getting a grip on the latest results of onsemi.

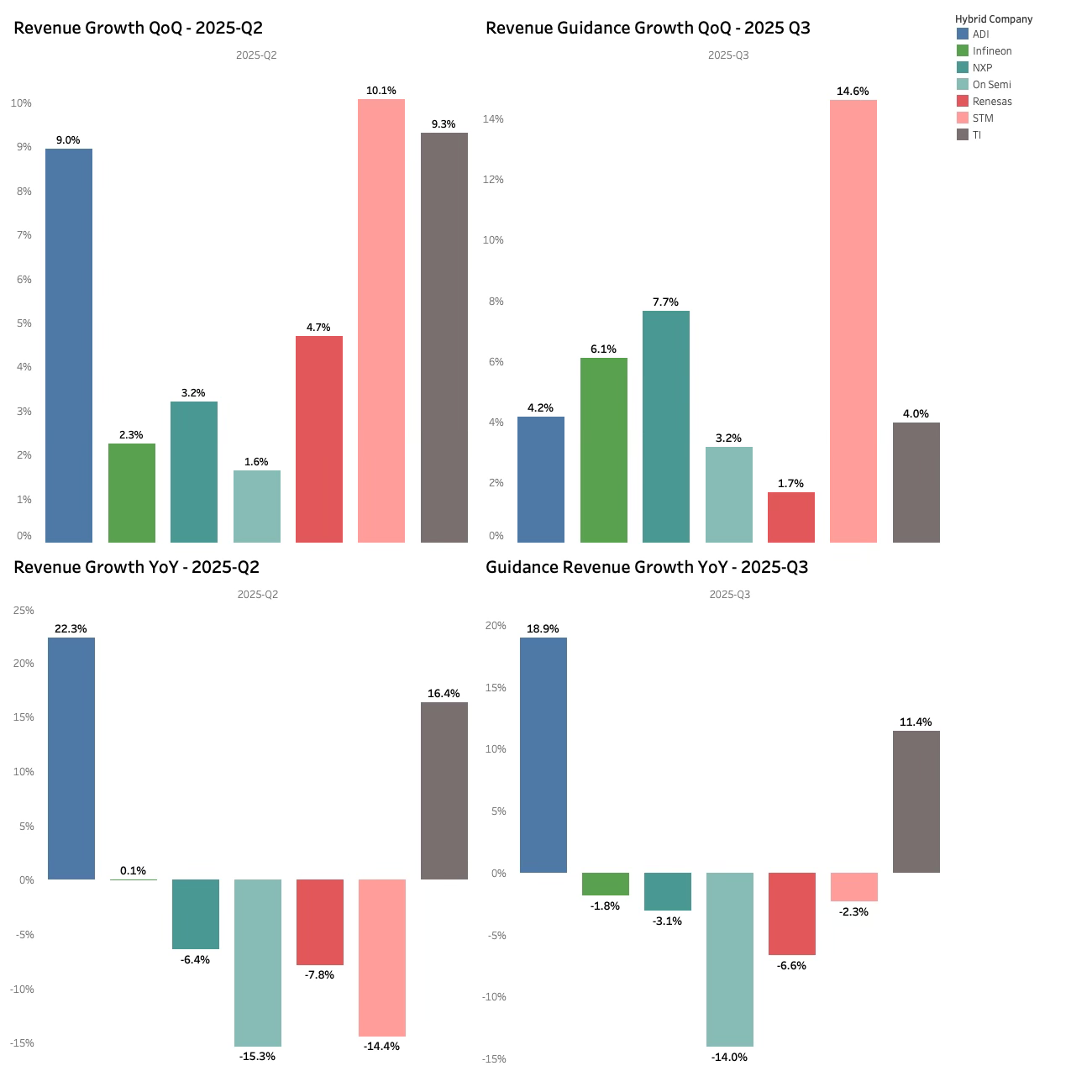

Comparing the Q2 result and the Q3 guidance with the other companies using the hybrid manufacturing model does not create cause for celebration.

On’s Q2-25 result is the weakest of the companies that have reported, both QoQ and YoY.

Should onsemi meet its guidance, it will still be 14% behind the same quarter last year. It is only Renesas that guides more carefully, quarter over quarter.

The Q2-25 Result of onsemi was up 1.6% while guidance for Q3 was at 3.2%, hardly breathtaking after a 10-quarter downturn, but a turn nevertheless.

After finishing being self-congratulatory for beating the midpoint of the guidance (0.3% growth), the mood was lowered as the demand situation was described as “stabilising”.

Both revenue and operating profit are at the same level as 17 quarters ago. On Semi has been going nowhere for an entire cycle. As the long-term growth of the industry (before AI) was 8% annually, onsemi should have grown 36% over the whole Semiconductor cycle if it were an average company.

It was onsemis first quarter after the spring cleaning exercise last quarter, which used restructuring charges to get rid of people and asset impairment charges to get rid of manufacturing capacity.

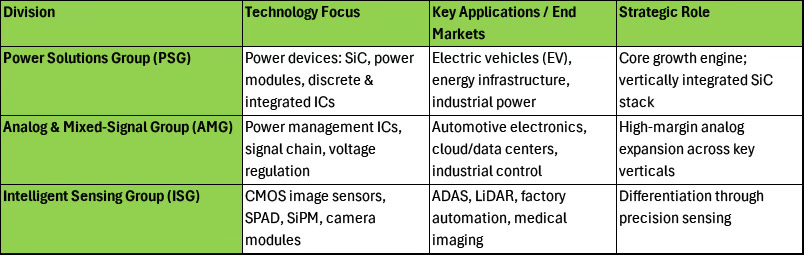

onsemi has three divisions:

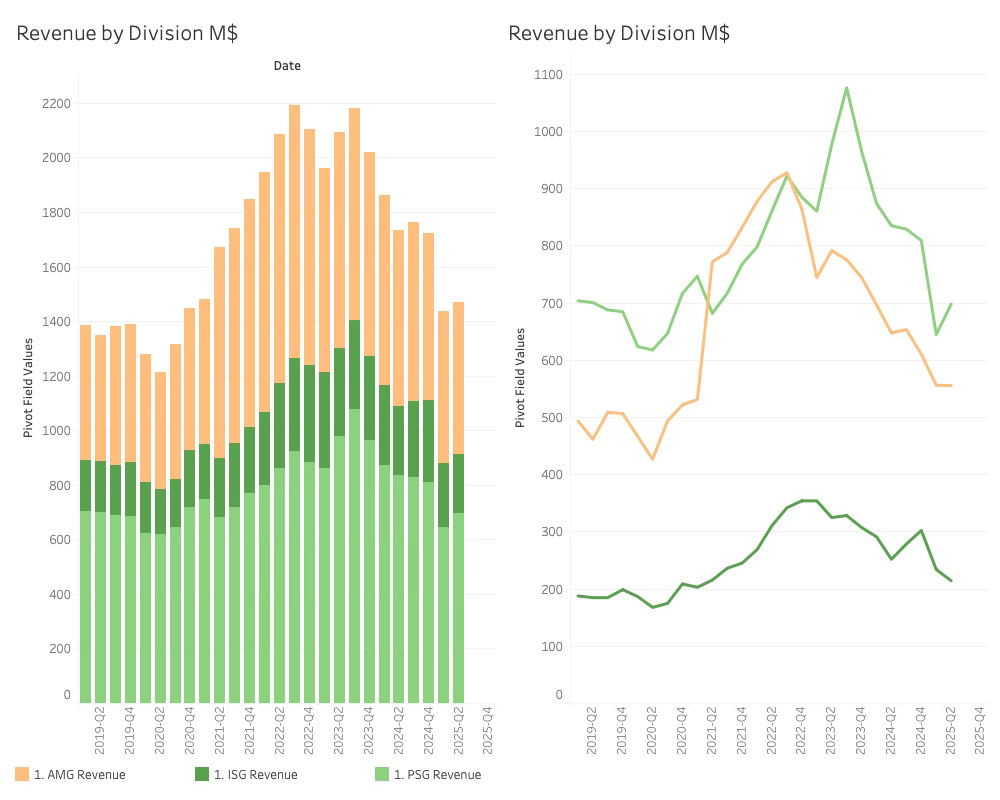

From a divisional revenue perspective, it can be seen that the Power Solution group, which is central to the SIC business, has been undergoing significant decline, but was also the force behind the reversal in revenue growth, while the two other divisions are still in decline.

The company looks more or less the same as it did back in 2019. While this might not be surprising during the former onsemi CEO, it was most certainly not the intention of the current CEO.

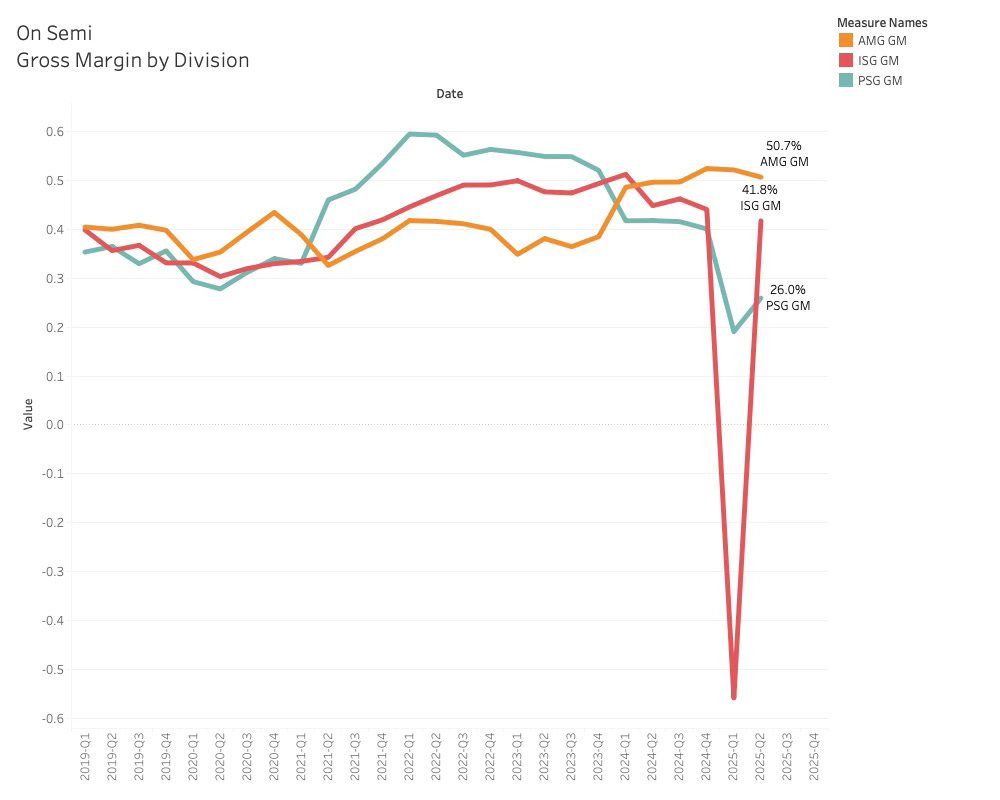

A gross margin analysis of the divisions adds colour to onsemi’s results.

The Intelligent Sensing Group reported a gross margin of –55.6% in Q1 2025. Underutilisation charges and restructuring efforts primarily drove the decline. ON is phasing out lower-margin legacy sensing products and shifting focus toward higher-value applications such as machine vision and LiDAR. These changes are expected to reduce ISG’s revenue in the short term while supporting longer-term margin expansion. onsemi anticipates a temporary revenue impact of $50–100 million from its ISG restructuring, with a 5% headwind to total revenue in 2025.

What can also be seen is that the Power Solution Group has been suffering declining gross margins in most of this cycle. This mirrors the situation of the other companies that decided to have a complete SIC value chain, such as STM and Wolfspeed.

Seen in hindsight, this was not the right strategy to pursue, at least for now.

The On Semiconductor Strategy: Demand

Over the past decade, onsemi has undergone a transformation — not just in technology, but in identity. That shift has been shaped by the starkly contrasting strategies of two CEOs: Keith Jackson, who led the company from 2002 to 2020, and his successor Hassane El-Khoury, who took the reins in late 2020.

Keith Jackson spent nearly two decades scaling onsemi into a global semiconductor powerhouse. His strategy emphasised breadth, efficiency, and acquisition-driven growth, with significant moves like the $2.4 billion acquisition of Fairchild Semiconductor in 2016, which expanded onsemi’s footprint in power devices and analogue. Under Jackson, onsemi became known as a reliable, cost-efficient supplier serving a wide swath of markets — from consumer electronics to automotive to industrial.

Enter Hassane El-Khoury, who brought a radically different vision.

Since stepping in as CEO in 2020, El-Khoury has followed a more focused strategy, divesting over $500 million worth of low-margin product lines.

The CapEx was expanded to create in-house 300mm and silicon carbide (SiC) capacity, and repositioned onsemi as a high-performance provider of intelligent power and sensing solutions. Under his leadership, onsemi has shifted away from commoditised markets and toward premium, mission-critical applications — especially in electric vehicles and industrial automation.

The initial results were good. Gross margins have climbed from ~37% under Jackson to over 47% today, with further expansion expected. And onsemi is no longer just a component supplier — it’s becoming a strategic partner to EV makers, powertrain designers, and infrastructure players worldwide.

The margins in PSG show that this is not a good time to have SIC capacity. While onsemi might be helped by the troubles of Wolfspeed, which can take some of the supply pressure out of the market, this is not likely to be sufficient, as the Chinese are building capacity fast.

In the investor calls, onsemi is still very confident in their project funnel and their technological leadership and believes they will rebound.

While this might be true, in the real world, this will require a significant R&D budget, especially when compared to onsemi’s competitors, but as can be seen, this is far from the case:

The R&D budget of onsemi is small compared to the larger hybrid companies, and the company has the lowest spend relative to its revenue.

While a focused approach can utilise R&D better than a broader distribution, there is an economic relationship between technological product leadership and the R&D spend, and this is not favourable for On at the moment.

The second problem with the onsemi's confidence in product leadership is the high reliance on China and distribution.