The earnings season is almost over; it is again time for deep analysis. As usual, the facts are buried deep under a layer of corporate candyfloss spread to present average corporations (on average, they are average) as unique market leaders.

While I am guilty of manufacturing corporate candyfloss, it never satisfied me. A large proportion of corporate work is associated with making things look better rather than making things better.

This is not only at a corporate level but also permeates all departments and teams. Everybody is trying to look better than they are. Endless performance reviews have taught us a Pavlovian response, where you are being fairly or unfairly compared to others in the organisation you will cover your ass and not expose yourself.

While uncovering valuable information about the relationship between where the design work was done and where the business was booked, I was told to “Bury that shit”

The research could have helped my corporation deploy resources more effectively, but it also exposed the flawed system, which ended my career.

Forced rankings are not uncommon. Every leader must identify a specific number of high performers and low performers. On average, all teams need to be average in average. This is designed to prevent a middle manager from protecting her team, even though it might be a group of stellar high performers.

Favouritism is exclusively the privilege of senior management.

Most organisations also have pay grades that create “an average” mindset. You are told to do your best, but you cannot be paid more than your peers in the same pay grade. You are not better than the others. You are average!

This can promote a “Sufficient effort not to get fired” culture that I am pretty sure I am not the only one who has experienced.

To get better pay, you must work hard to get a corporate non-managerial non-title such as Senior-x, Principal-x, Staff-x, Corporate-x or Lead-x. You must also accept that you will never receive more pay than the manager at the end of your leash.

Only a few tech companies allow employees to make more money than their bosses.

So, most semiconductor companies use the same average methods to run their businesses. Yet, every CEO tries to convince us that their company is the leader of (indiscernible) or the best company in the (indiscernible) market.

I am not blaming the CEOS for their well-rehearsed tap dance. They do what is expected of them and deliver a meal low in nutritional facts.

In the recent Globalfoundries call, it was said:

"Achieving manufacturing scale and technology diversity across our footprint has been a multi-year strategy to invest in capacity with differentiated features. To that end, we have deployed over $7 billion into our U.S., Germany and Singapore facilities since 2021."

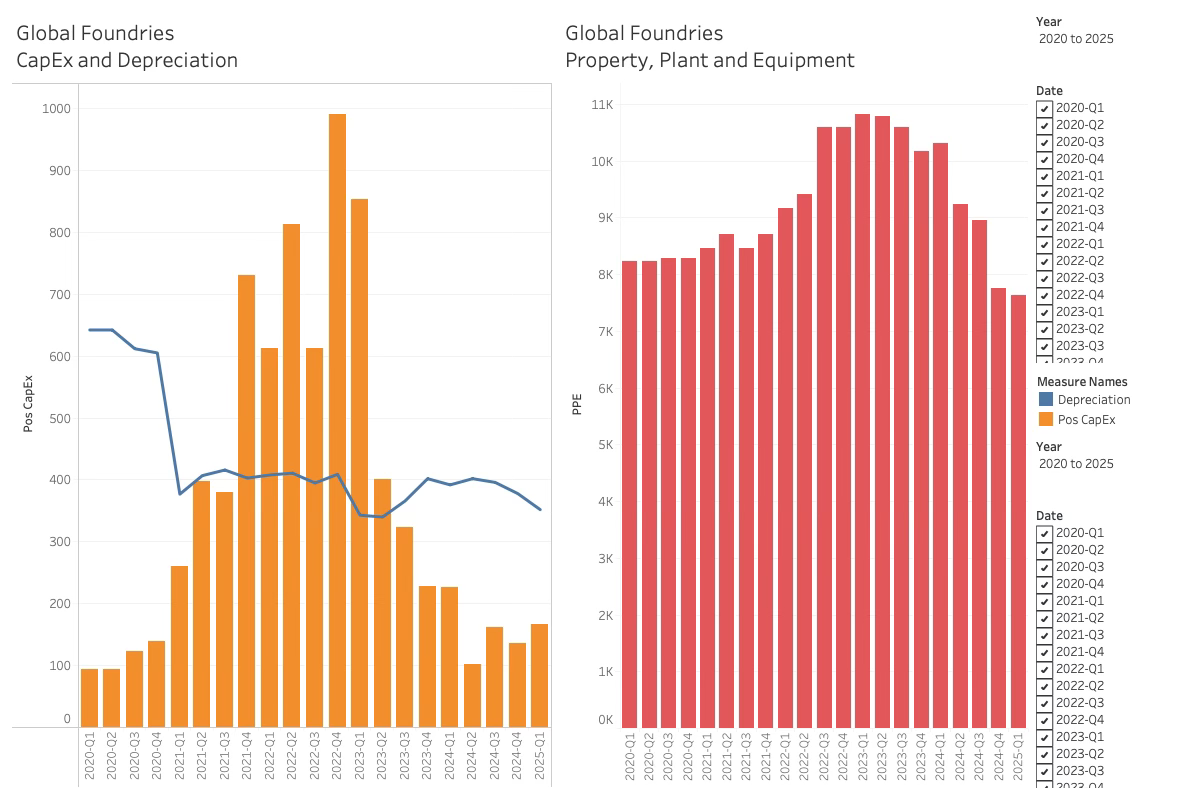

It is a true statement. Globalfoundries deployed close to 7.4 B in the period, raising all my analyst fur. Why 2021? 17 quarters?

A fast analysis of the CapEx on a time axis revealed this:

What could also have been said is that our CapEx has been lower than what is needed to maintain capacity for the last seven quarters, or the financial value of our manufacturing capacity has been declining for eight quarters.

Comparing GlobalFoundries to its peer group can give more insight into the actual value of the statement. Here, I use the CapEx to Revenue ratio to get a comparable view:

While it might be hard to distinguish, GlobalFoundries is at the bottom of the list of foundries spending only 7.4$ out of 100$ revenue on CapEx. TSMC is over 42$ and Hua Hong spends nearly 3x its revenue in CapEx.

I can only interpret GlobalFoundry's statement as "look at how good we are." The reality is that the company is not investing as much as its competitors at the moment.

I want to apologise for picking on GlobalFoundries. They are not unique. All CEOS are sugarcoating the facts to the point of borderline lying.

The average performance of Semiconductor companies

While the earnings season is almost over and I can deliver fresh Q1-25 insights, Q4-24 is fully resolved and can give us an idea of what average looks like.

The two performance metrics I consider most important are Revenue and operating profits. To get a good overview of the semiconductor market, I use a scatter chart, as seen here, for Q4-24 vs Q3-24.

While it is not easy to see the bulk of the semiconductor companies, it is evident that most of the increases in revenue and operating profits come from very few companies. All of these companies are involved in the Datacenter and AI business.

The average revenue increase is 124 m, while the median increase is only 3 m. For operating profits, the increase is 57M$ on average and just 1M$ on median.

In other words, almost all companies in the semiconductor industry performed worse than average from an absolute perspective.

Before I get accused of misleading my audience (this is exclusively a CEO task), I must show a similar chart of relative growth: