Ripples and Tsunamis in the Semiconductor Supply Chain.

The Datacenter revenue now accounts for more than 38% of the entire semiconductor market.

It is near the end of the Q1-25 earnings season, and while I try to catch up on sleep, it is also time for a helicopter view of the state of the Semiconductor industry.

Not all companies have reported Q1-25, but Q4-24 is fully resolved, and the data has been harvested and stored. This post will provide my first and most comprehensive overview of the industry.

For new readers, I will recap my methodology, including how I map sectors to gain multidimensional insights into the Semiconductor Supply network.

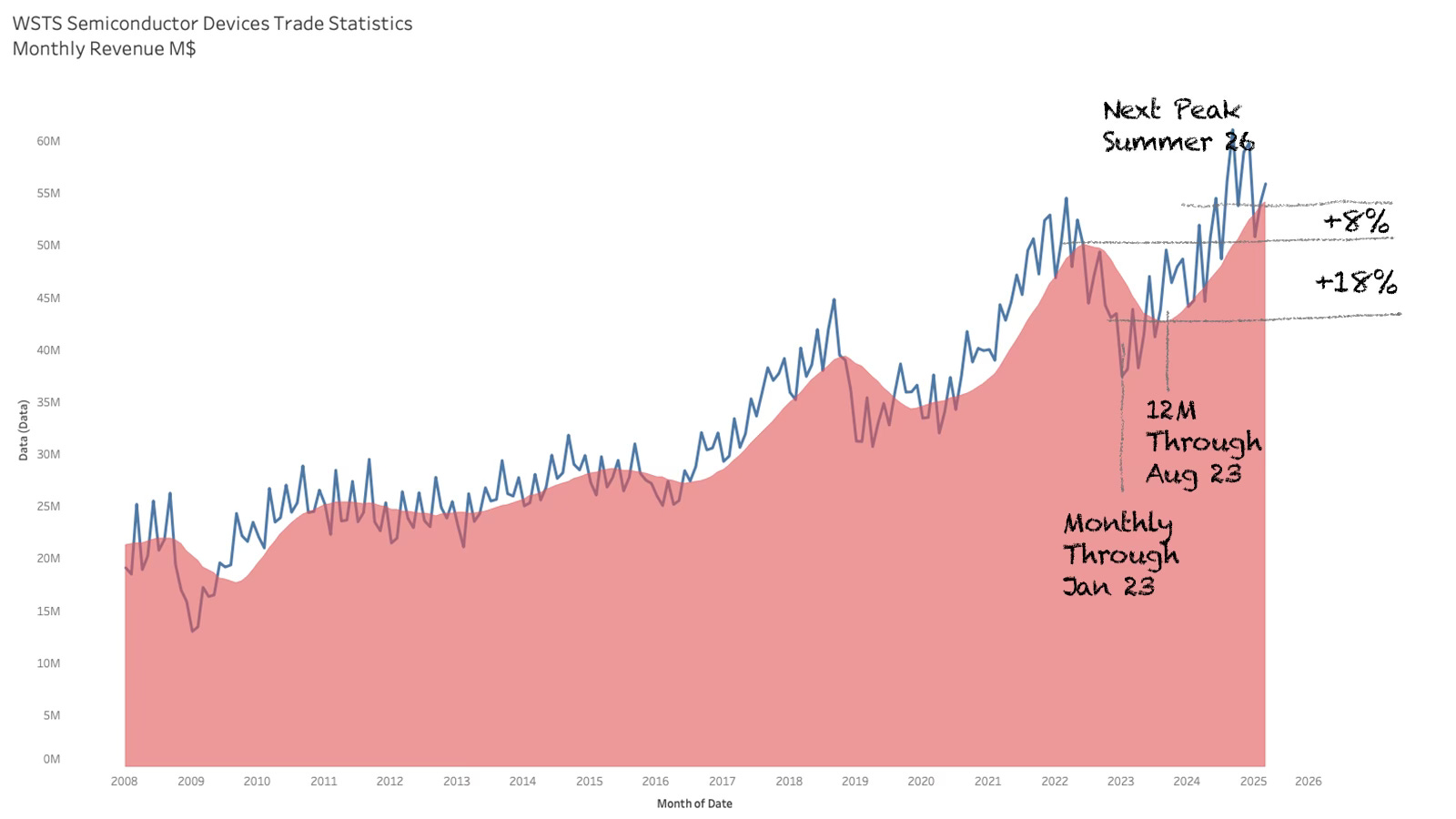

The one-dimensional view of the Semiconductor market comes from WSTS, which has released its March “statistics” confirming that we are deep into a solid upturn.

The 12-month averages are now up 26% from the last dip in 2020 and more than halfway through the upcycle that resulted in 46% growth in the previous upcycle, Nov 19- June 22.

Depending on the method, we are 1.5 to 2 years into the upcycle and can expect the next average peak around the summer of 2026, with the monthly peak occurring a little under a year from now.

If this is your primary source of macro information to guide your business, along with dodgy 3-year-old market data from Excel sweatshops, you can get back to work. There is nothing to worry about - all is well.

I was born and bred in the semiconductor industry when it was full of silicon cowboys with their own fabs. This was not a time for the faint of heart. They carried a big stick and spoke the truth.

Real men have fabs. Jerry Saunders, AMD

They would both publicly and internally declare the state of things so everybody knew where we were and what we had to do. You did not want to disappoint them.

Fast forward to today. The modern semiconductor CEO has now become the Chief Excitement Officer, and as a result, all companies are performing better than average; on average, they are not surprisingly average. The earnings call meal is devoid of nutrition; it is all corporate candy floss. If you are a reader of my blog, you know this is why I founded Semiconductor Business Intelligence.

When writing about a company, I often observe that I receive a high number of signups from that company, and I am told it is a result of the internal narrative aligning with the external one: Corporate Candyfloss. Many companies are currently telling their employees (our greatest strength) that the company (the CEO) is doing well. Unfortunately, we will still have to lay off a significant number of you.

The semiconductor management teams are not misleading the markets; they are misleading themselves and their teams.

All good strategy is based on the facts of the market, what the current state is, and what is changing? Only the brutally honest truth works when developing strategy. That was buried with the Silicon Cowboys - may they rest in peace.

I listen to the earnings calls, but if you remove the well-rehearsed dramatic read of the ledger and the analyst questions about next quarter's KPI, there are a limited number of inside nuggets in a call. Data is needed. And not just from the company being analysed, but also its suppliers, competitors, and customers. Then insight emerges.

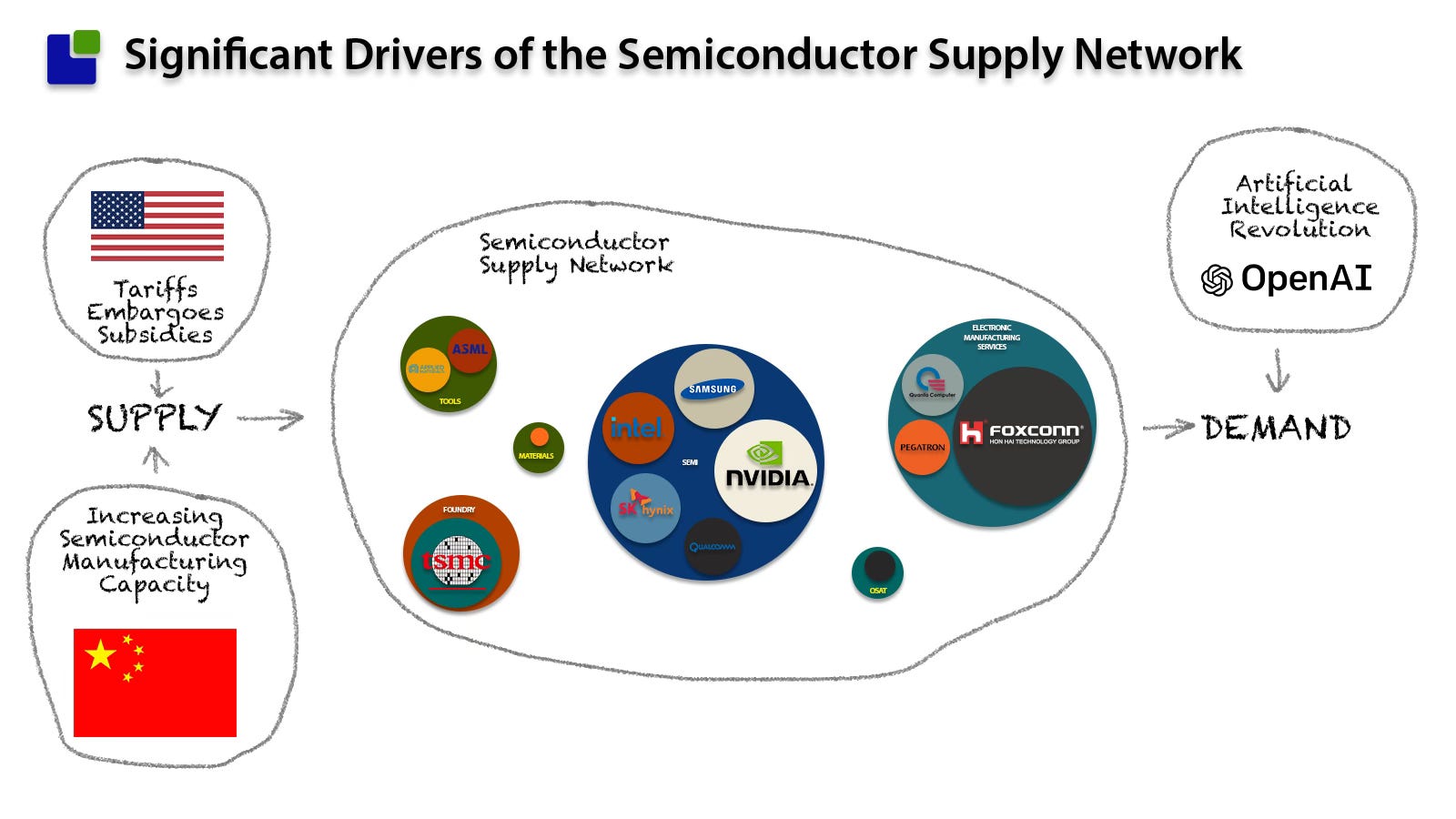

I view the semiconductor industry as an interconnected network, as can be seen below:

In total, I track 50 different segments, both inside and outside the industry, with nearly 400 companies. This allows me to respond to events in near real time as supplies propagate through the supply chain and can be observed.

While I track industries that depend on semiconductors to observe demand patterns, my primary focus is the Semiconductor supply network itself, as can be seen below:

While the EMS/ODM bubble is not technically part of the Semiconductor industry, it is a key source of insights for me, as these companies are the largest consumers of semiconductors on behalf of their brand-owning masters, such as Apple, Nvidia, and HP.

Three significant forces are currently reshaping the semiconductor industry:

While Chinese investments in the Semiconductor industry have been a multidecade venture through the government’s Big Funds, the US reshoring ambitions are now also dramatically changing the fabric of the semiconductor industry. The days are gone when investment decisions were based on supply and demand. This has been replaced by the US government’s big buffet of free semiconductor money.

These two drivers are not impacting the demand of the semiconductor industry. Not one more chip will be consumed as a result of these drivers, but there will be a significant increase in supply. While governments support the construction of new fabs, they rarely offer support to surplus, idle factories during downturns.

The only demand driver in the semiconductor industry is the AI and server revolution, driven by the insatiable demand for faster and more advanced large language models (LLMS).

So what?

While I am obsessed (when relaxed) with the semiconductor industry and its myriad interdependencies, I often get met with questions about the relevance of understanding its dynamics. Relax, Claus - things go up and they go down - why worry?

For some, it might not matter—and I am okay with that —but the industry has two distinct cycles, and the timing of your investments makes a significant difference.

Most companies find it easiest to invest when they can do so with retained earnings, but this is the most expensive time for semiconductor companies to invest. Investing in upcycling also means your capacity comes online during the downcycle, when it is not needed. For many companies, timing the cycle is vital.

Secondly, I am told that every cycle has been driven by something: PCS, Smartphones, and Cloud computing - now it is AI. Just relax - it will be fine.

This is a valid argument, but although both are winds, there is a notable difference between a breeze and a hurricane.

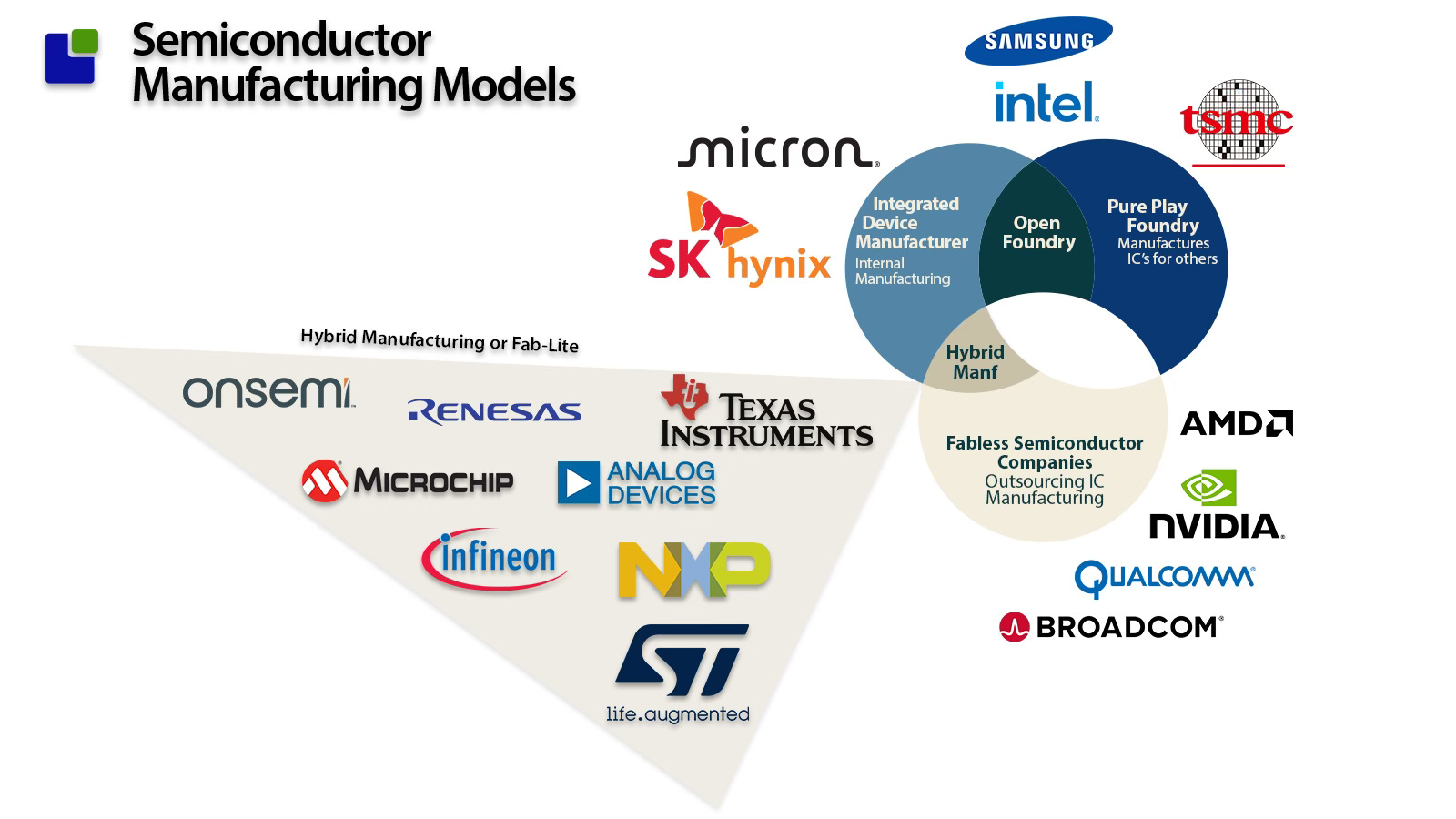

To gain more insight, I divide semiconductor companies into different subsegments based on their manufacturing strategy. This makes them more comparable from a cash flow and balance sheet perspective.

From the most traditional IDM model, most companies have now outsourced their manufacturing to pure-play foundries, forming the Fabless semiconductor group.

Some companies, mostly involved in power and analogue products widely used in automotive and industrial applications, decided to keep their factories.

These companies get their high-end digital products from Foundries, thus deploying a hybrid model.

The stage is now set for a more advanced analysis of the Semiconductor market.

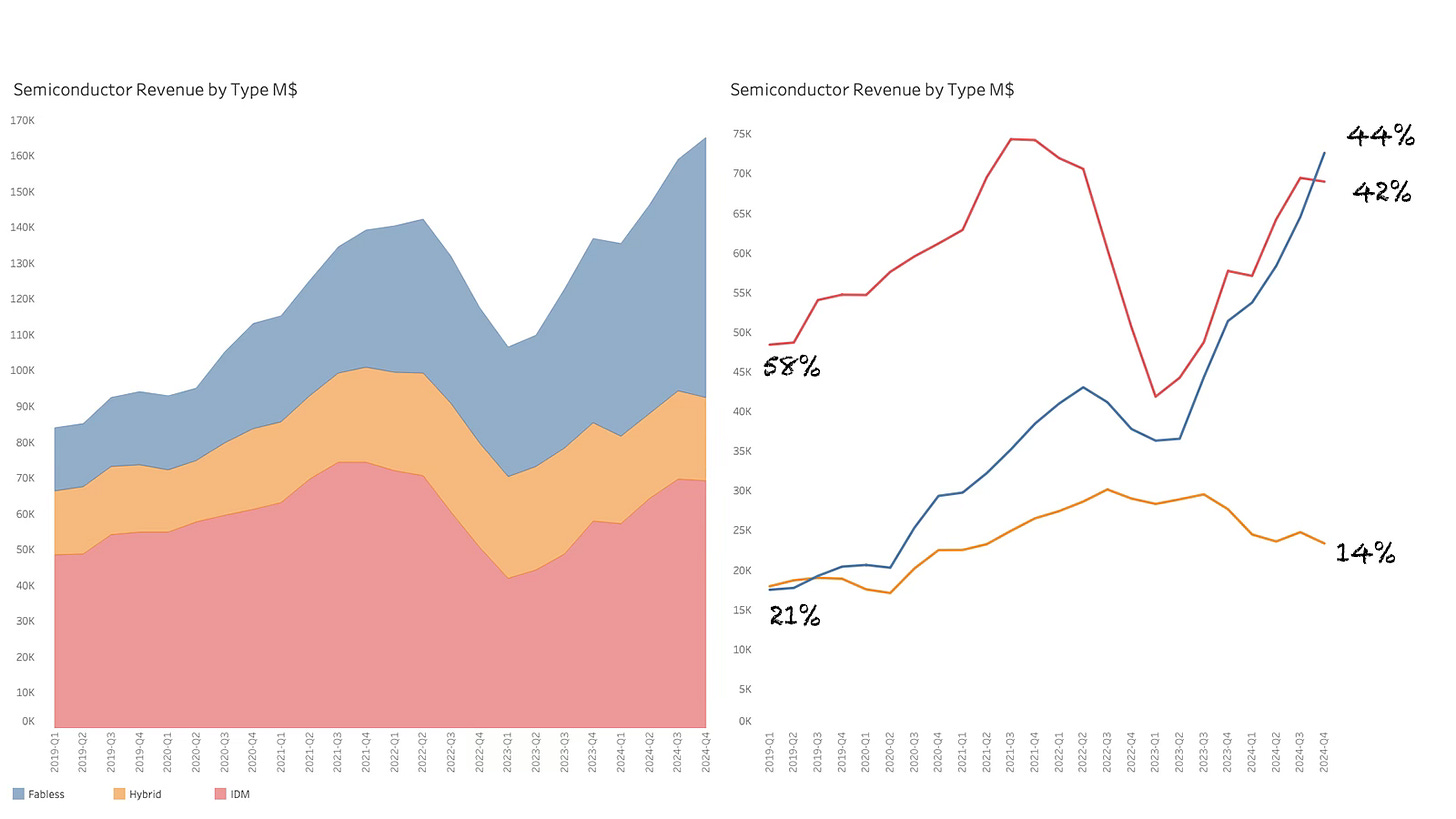

Analysing semiconductor revenue by primary manufacturing method reveals that this cycle differs from the prior one. This is not cyclical but a systemic change.

While the three types were in sync in the last up and down cycle, the Hybrid manufacturing companies are now decoupled from the cycle. The hybrid companies are now declining in isolation.

While these companies still follow the WSTS numbers, they have as much practical use as Christmas tree ornaments during the summer time (My apologies to Bruce and Sheila). The hybrids are in their own downward spiral.