There is a direct causal effect between a company’s ability to generate future free cash flow and the company’s valuation. For startups, that horizon is longer than for operational companies, but the risk is also higher. While valuation can mean many different things, stock market valuation is the most easily tracked and understood.

I have customers in the investment community who purchase my insights and data for valuing semiconductor companies, and I have often considered using my data for direct stock recommendations.

I am comfortable doing that with my portfolio, which is a long-term investment, and over time, I have been able to get a handsome return on my savings.

Unfortunately, the short-term stock market is akin to a game of roulette, responding to rumours, opinions and analysts that have a direct interest in a particular outcome and, as such, cannot be considered neutral.

There is a silly amount of energy that goes into predicting a quarterly guidance number, both from the side of the semiconductor companies and the analysts that “cover” them.

Somehow, hitting the number has become good, while missing it has become bad. As I have worked in Semiconductor companies, I know you hit the brakes when the numbers are home safe, and save the surplus for next quarter.

The proper way of running a business is to optimise your business to customers’ demand and not spend any resources on trying to “hit” a number. Investors would be scared if they ever found out how much internal resource is spent on “hitting” the number that should have been spent on developing the business.

While the short-term stock market is unpredictable, it is still worth following, and for me, it often provides a good source of questions to research.

The Nvidia stock price ended its AI run on October 24, when it reached the lows, it started to wobble between $90 and $150 and is currently atere it was on October 130s. Afterward around $140, or more or less wh 24.

The simple interpretation is that the stock market does not believe Nvidia's prospects are any better than they were 8 months ago.

For me, this is an interesting question to investigate:

Is Nvidia in a stronger position now than 3 quarters ago?

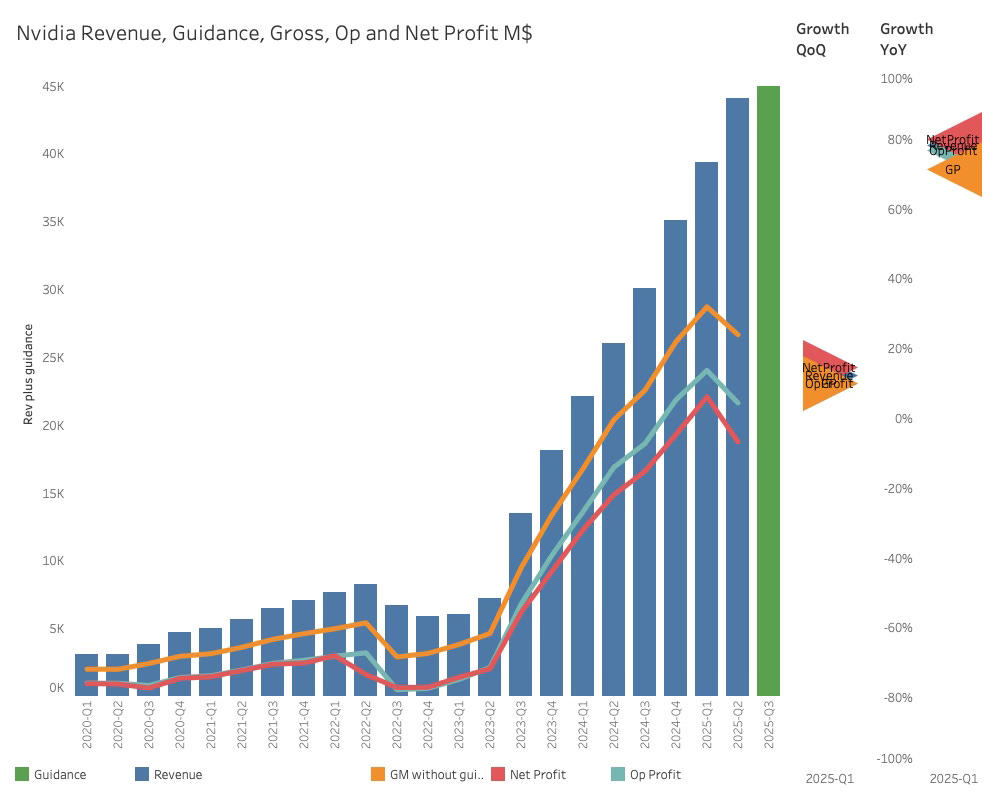

From a revenue and profits perspective, Nvidia is a lot stronger. It has delivered consistent profitable growth in line with expectations. You can read more about the result of Nvidia in: Nvidia's Next Strategic Power Move is Now Visible.

While the Nvidia stock may have been at a hype level and is now at a less hyped level, the stronger result has not been sufficient to increase the market cap of the AI leader meaningfully.

This could be an effect of the embargo headwinds that have prevented Nvidia from continuing the lucrative China business based on the downscaled H20 processor. H20 could pass the old embargo rules but not the new ones, and Nvidia recorded a hit to both revenue and profits.

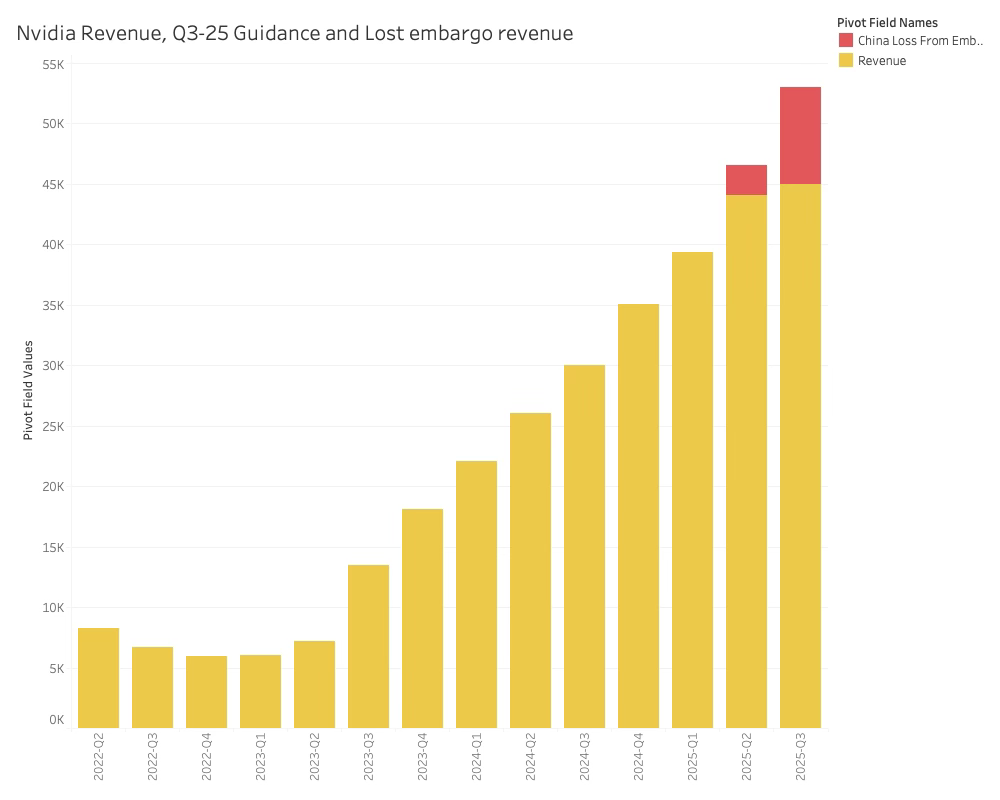

The impact of the embargoed revenue is illustrated below.

Nvidia is expecting to lose almost all of its forecasted $8 billion in China revenue next quarter, which impacts the company's revenue guidance for Q3-25, which is an unusual low of 2.1%, although the annual revenue guidance is a strong 49.8%.

While the Q2 revenue impact of the China embargoes is “limited” to 2.5 B in Q2-25, Nvidia took a materials charge due to the scrapping of H20 material.

It also had an impact on the cumulative purchase commitments of Nvidia, which fell by 1.5 B. This is surprisingly low considering the China business accounts for 15% of the total revenue.

I would have expected a drop of 6-7B, although there is no evidence that the material purchases for H20 are similar to the rest of the product range. Nevertheless, the low decline suggests that Nvidia's supply chain engine is still running smoothly.

Despite the downside, this does not suggest that Nvidia is about to drive off a cliff. It is time to investigate what goes on in Nvidia's backyard and see if there are upsides amongst the weeds.

The known upsides

In my update on the Nvidia earnings call (Nvidia's Next Strategic Power Move is Now Visible), I already highlighted two significant upsides.

One being the significant 60% quarter-over-quarter (QoQ) jump in networking revenue, and the strong start of NVLink revenue, which reached $1.2B. This is more than double the combined revenue of AMD and Intel and cements NVIDIA's position as the dominant scale-up network.

Additionally, there is the massive increase in Dell’s AI business, which is expected to jump from less than $2 billion a quarter to $7 billion next quarter. This is significant, knowing that more than 60% of the costs are going directly to Nvidia. You can read more about this in Semiconductor Match stats just before the bell

These two upsides are likely to offset most of the loss in China. Maybe not sufficiently fast to save Q3-25, but they will undoubtedly have an immediate impact.

The latest developments

I should be accustomed to the pace of the AI revolution by now and easily be able to shift between analysing growth on the second decimal to trying to catch up with Nvidia’s business. It is not like the tracks are not there - it is more about which ones to follow.

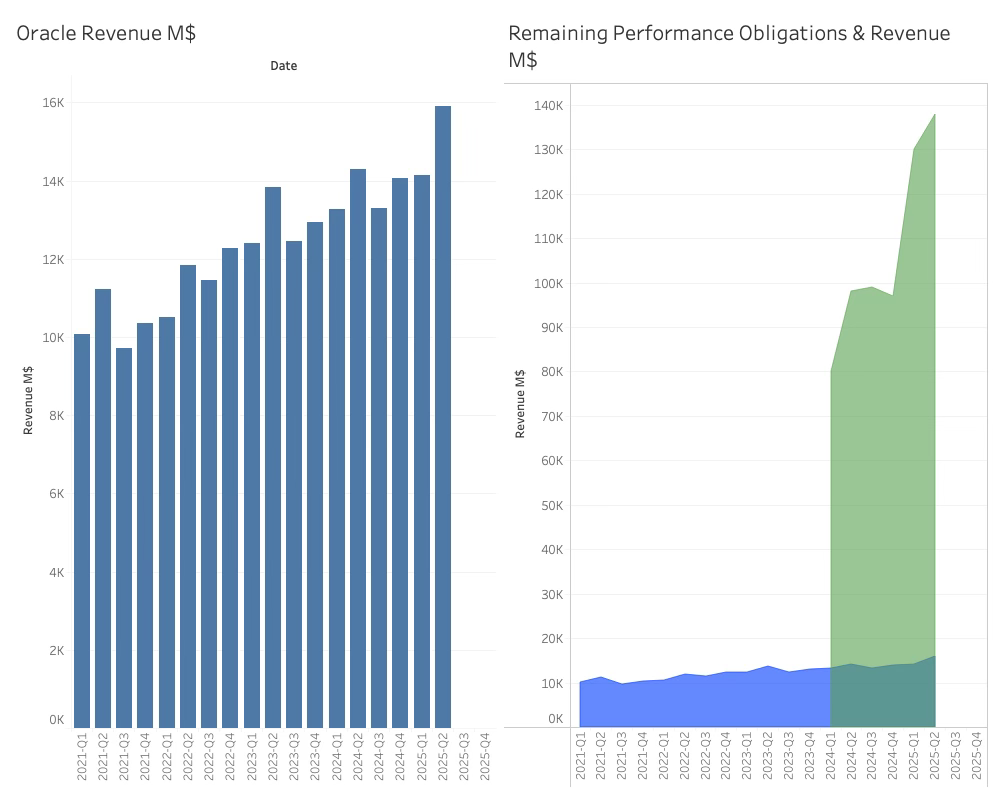

One of the most interesting developments came out of the Oracle quarterly earnings announcements and call, which was extremely upbeat. While the guidance for the next fiscal was a solid 16%, it was not outrageous. Larry Ellison took the stage:

Oracle will be the #1 cloud applications company, and Oracle will be the #1 builder and operator of cloud infrastructure data centres.

We will build and operate more cloud infrastructure data centres than all of our cloud infrastructure competitors combined.

Ellison shifted the focus to RPOs: The Remaining Performance Obligations (RPOs) that eventually generate revenue have grown significantly and are a key source of Oracle's optimism. The RPO is now over 8 times the quarterly revenue.

Larry Ellison Continued:

Let me add -- we recently got an order that said we'll take all the capacity you have, wherever it is. It could be in Europe, it could be in Asia, we'll just take everything. I mean we might not order like that before. The -- we had to move things around, and we did the best we could to give them the capacity they needed. The demand is astronomical.

There were two customers mentioned in the call: Temu and OpenAI, and the “order” sounds like one that Sam Altman from OpenAI would give Oracle.

This coincides with OpenAI's accusations that Microsoft is directly competing with the ChatGPT company, despite being a customer of Microsoft. I do not look shocked while I write this.

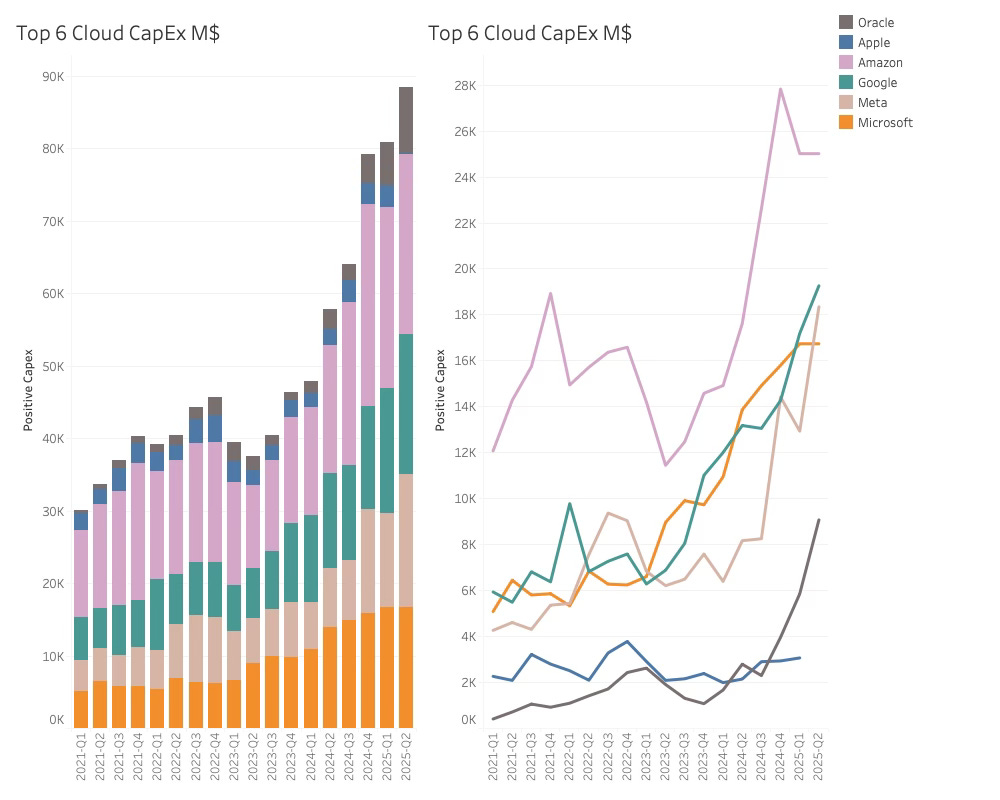

From a CapEx perspective, Oracle has been behind the four largest cloud companies, but surprised the market by adding 5 B more CapEx this quarter than expected. This makes Oracle the 5th significant cloud company and significantly increases the Nvidia opportunity.

As Oracle doesn’t own its cloud premises but rents them, all of this CapEx is for server equipment. The company stated that they had an opportunity to accelerate equipment purchases and took it.