The First Canary in the Hybrid Semiconductor Coal Mine

Despite a good result, it seemed like ADI was pulling "An Epstein"

The ADI investor call is always interesting, as the analog specialist has a fiscal quarter that is not aligned with the calendar quarter months.

In my research, I assign all the revenue of a quarter to the quarter in which it ends, which means I assign the ADI revenue of the third fiscal quarter, May-June-July, to Calendar Q3 July-Sep-Aug.

Using this approach, ADI is giving us the first look at Q3-25 for the hybrid companies.

I did my numbers research before the investor call and thought it was a reasonably good quarter, even though the guidance was a bit soft. This could emanate from a cautious approach from management, as various macroeconomic factors can impact the numbers.

As I expected the Investor call to be pretty dull, I did not bother to make popcorn as I would for an exciting call. But it would not be long before my analyst fur stood up.

Vincent Roche quickly got around to telling us that: “For today's call, I'm going to focus on our billion-dollar-plus industrial automation business.”

While I generally care more about what the banking boys want to talk about rather than the CEO, I understand that it is only in analyst heaven where an investor call is found under the heading of enlightenment. Everywhere else, it can be found under cringe marketing.

I immediately got the feeling the ADI CEO was pulling an Epstein. He wanted to talk about everything but Epstein. But what was his Epstein?

What was it about the industrial automation market that suddenly made it urgent?

There was a nice 11% sequential growth in the industrial market overall, but this is not AI-style exciting, and Industrial is more than automation for ADI. It also includes instrumentation, health care, aerospace, defence and energy management.

Vincent continued by talking about the important partnership with Teradyne Robotics. The 75M$/Qtr revenue outfit is not yet a meaningful player in Robotics, and I could not see the reason for mentioning them in what was now deemed a “multiples of hundreds of millions of dollars” division.

I know when somebody is trying to sell me rubber bands by the yard, and that was happening when the attention was turned to the opportunity funnel in one of the questions. ADI allegedly has a strong opportunity funnel and an equally strong R&D pipeline in industrial automation.

For outsiders, a strong opportunity funnel sounds like a good thing, and it is. Many projects will drive more revenue later. The problem is that a CEO who promotes “the funnel” is the same CEO who is complaining about the unreliability of the opportunity Sales funnel in internal meetings and tells the salespeople that they are entering garbage into the system (often Salesforce, which is the industry’s preferred Waste Management Company)

The concept of “cleaning the Sales Force funnel” tells much of the story. When you reward your salespeople for increasing the project funnel, it magically grows. When you punish your salespeople for removing projects, they magically stay even though the customer killed the project many moons ago.

The funnel conversion ratios are a key metric for a semiconductor company as they measure the percentage of project dollars that convert into revenue dollars. The problem is that it is very low for most companies. The proprietary analogue products from ADI will have some of the highest resolution ratios in the industry at around 15% and you can be sure that sales are being beaten up as a result of this.

A CEO who wants more funnel gets more funnel. The reality stays the same.

And I have never heard about a CEO that had a low funnel in any product line ever, so when a CEO starts promoting “Funnel dollars”, there usually is something else the CEO is not proud of.

Before I get carried away with my conspiracy theories, it is worth analysing the ADI result. I'll make sure to indulge myself later in this post.

The ADI Q3-35 Result.

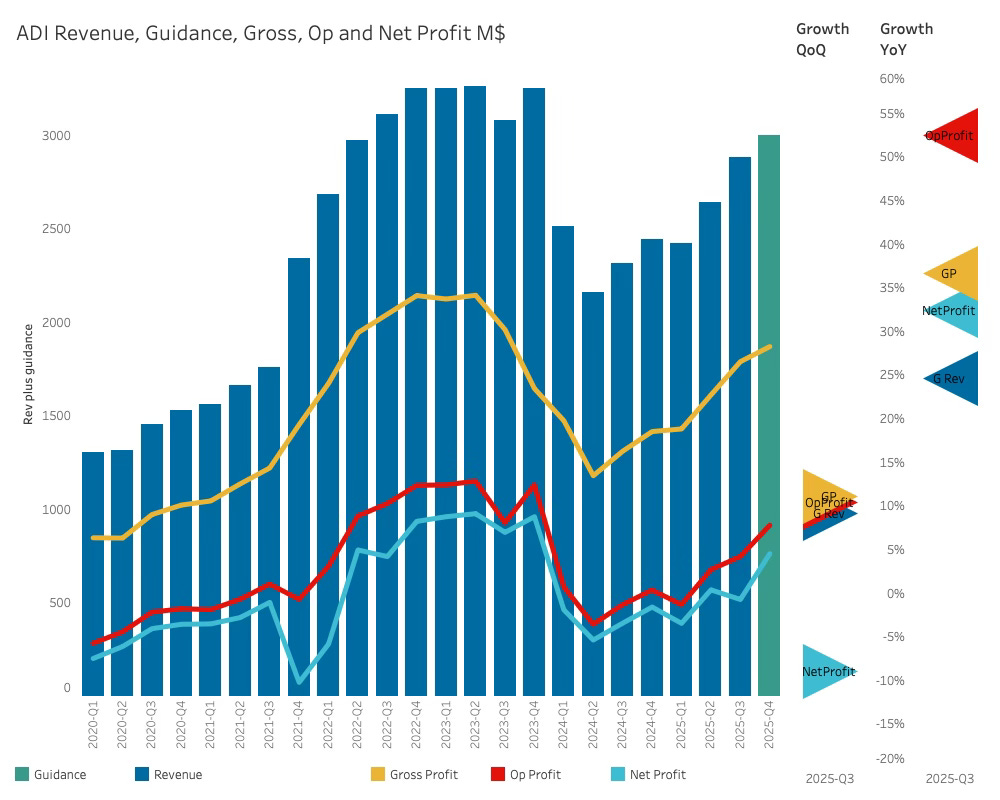

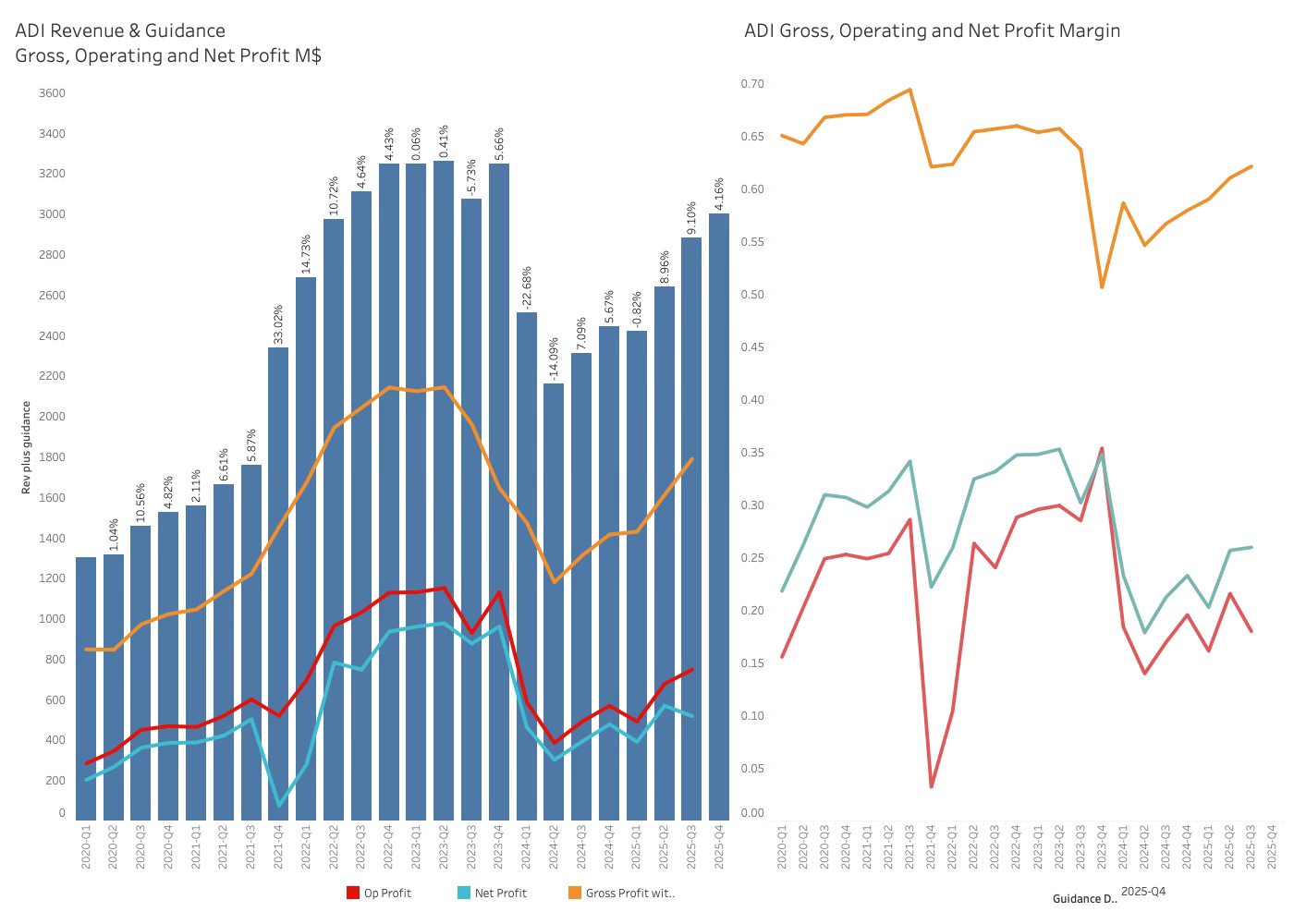

Overall, it was a good result that beat the guidance by 4.7% confirming that the upturn is indeed happening. The 9.1% quarter-over-quarter growth suggested that a lot of the growth was unexpected, or the ADI management chose to hedge the bet with significant padding. This is not unreasonable given the current environment.

The profitabilities went up except for the net profit, which took a hit, allegedly as a result of a manufacturing hiccup. Still, it is of no great concern as the guided profitabilities look good.

The gross margin is heading in the right direction, although the operating and net margins are still awaiting a more solid takeoff. This is normal when operating in a low utilisation mode, as ADI currently is.

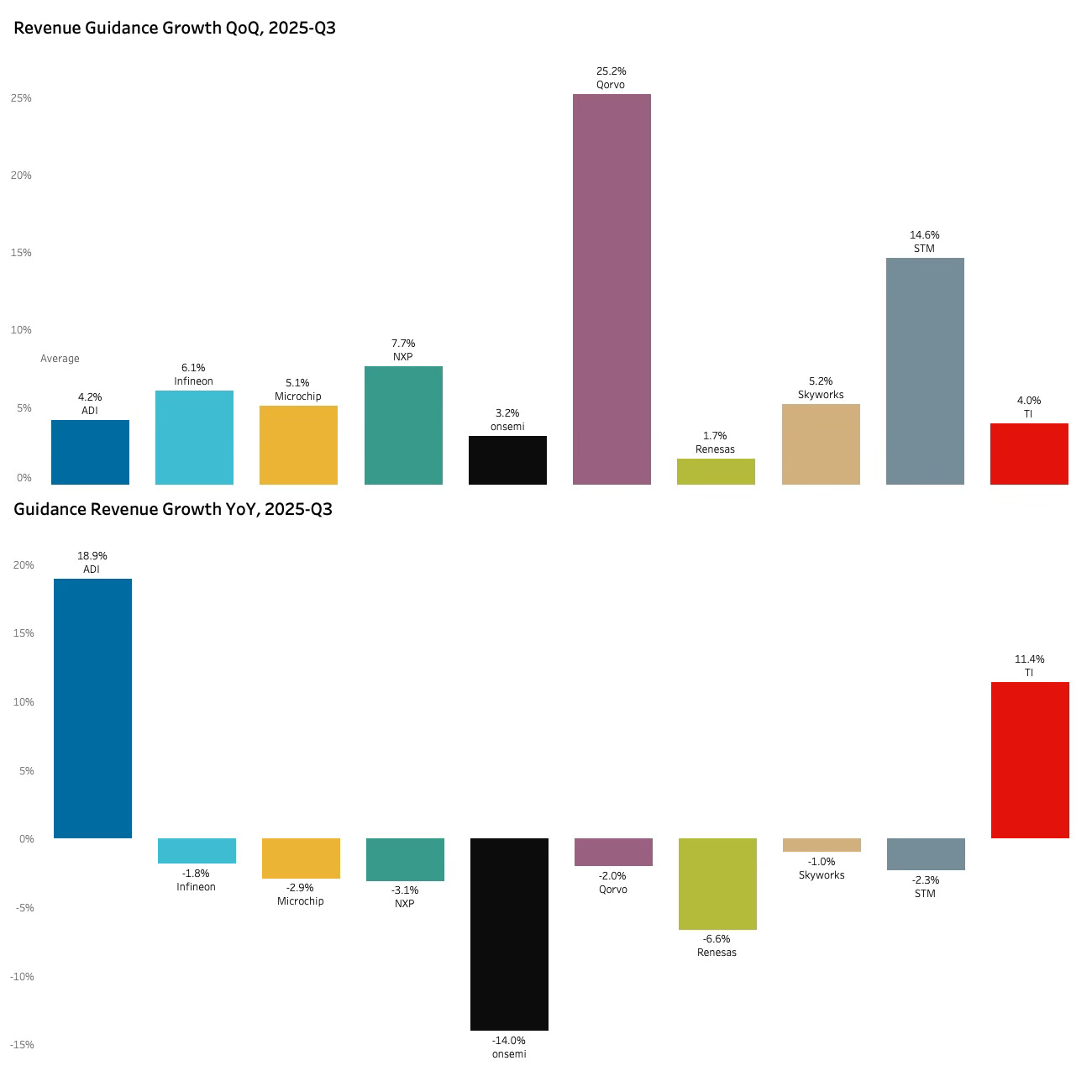

The guidance was soft, considering the quite upbeat CEO speak, but could be full of conservative padding, as last quarter, when the guidance was slightly higher at 4.2%

This was well below average, as shown below, although the result beat the guidance average of the hybrid semiconductor companies.

It would not be unheard of for a CEO with weak guidance to begin to talk about funnel dollars.

All in all, a good result and ADI has moved meaningfully away from the last revenue dip and can get into record revenue levels within a few quarters.

From an annual growth perspective, ADI is leading the pack, followed by TI suggesting the analog market is faring better than the rest.

The average annual growth rate in the semiconductor industry is around 8% so the 19% YoY growth in the upcycle is where it should be. The other hybrids are earlier in their upcycle than ADI and TI.

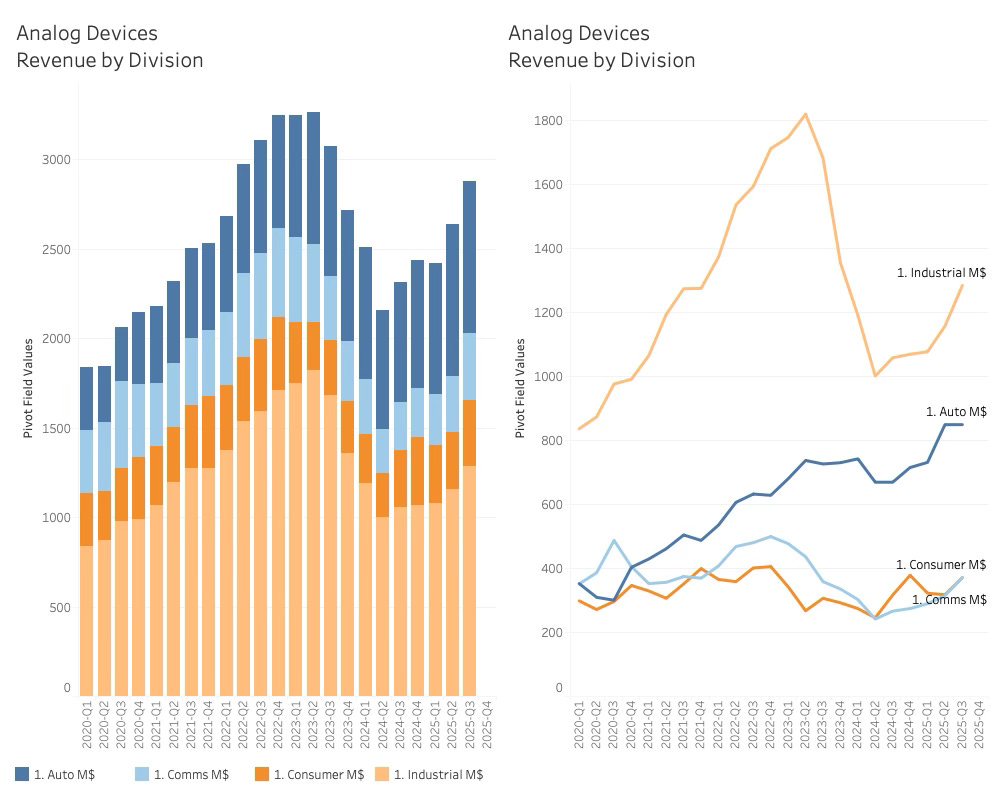

The divisional revenue could give us a hint of the need to discuss industrial automation. Still, ADI had no problem discussing the flat quarter of Automotive revenue that was impacted by the end of Chinese subsidies. This is in line with the reporting from the other companies.

The Industrial growth was 10.9% and the key driver behind the good ADI quarter. As can be seen, ADI has consistently grown the Automotive revenue despite the downcycle. This is mainly due to the acquisitions ADI has made in the period, bringing the existing automotive business under the ADI logo.

It is also apparent that the industrial revenue is significantly lower than its former glory and much work still needs to be done.

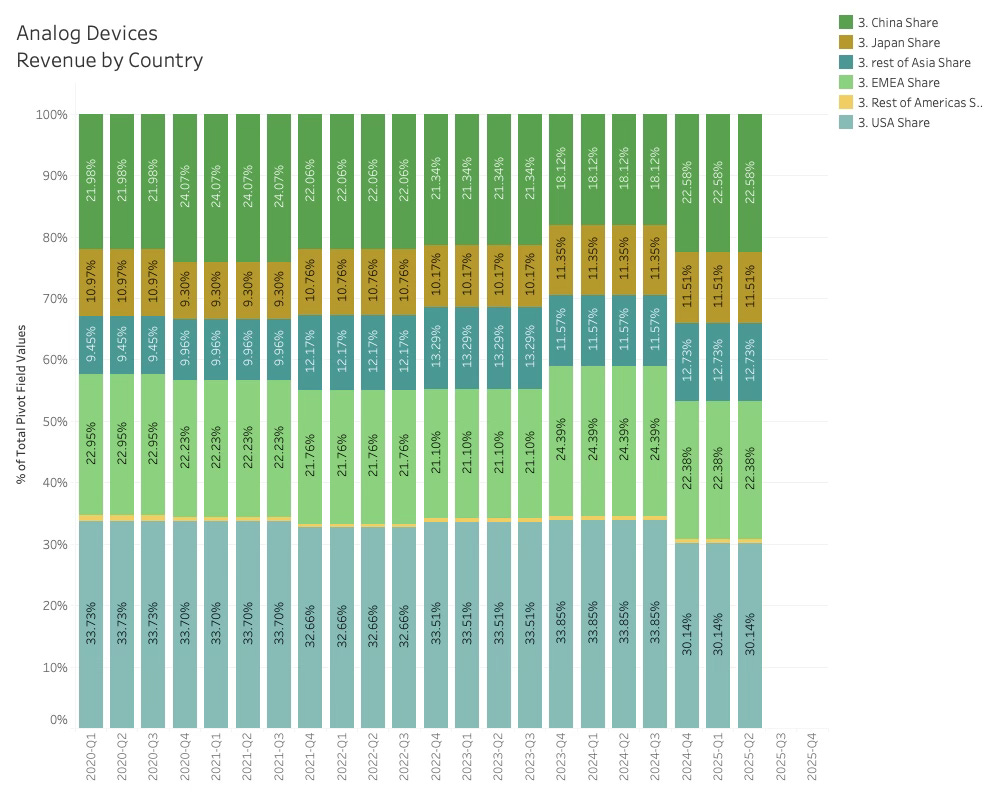

From a revenue by country perspective, there was not a lot of new data to be derived as ADI reports this annually. The China comments were positive, indicating growth in all industrial markets, and there had been automotive pull-ins in Q3, similar to what happened in the West in Q2.

Both the US and Europe are surprisingly strong markets for ADI, while China is either second or third. In the last reporting, the China share had increased significantly from the cycle low of 18%.

ADI delivered a good quarter above expectations, and to his credit, Vincent Roche refrained from bragging and unwrapped the quarter factually. While I don’t want to diminish the good ADI quarter, I am pretty sure the salespeople are not in bonus territory yet. I could have filed the reporting under "Suddenly nothing happened”, but my conspiratorial sensors had been activated.

I made popcorn as preparation for a deeper dive.