The Latest Drivers and Trends in the Semiconductor Tools Market

Everything in the semiconductor industry begins with a tool.

When I started in the Semiconductor industry many moons ago, I also began a lifelong journey of learning. This incredible industry moves so fast that you only need to understand the last couple of years of developments to navigate. What happened before that has become a nostalgic and anecdotal memory.

Older knowledge is not irrelevant; however, it has become foundational and has ceased to drive the business.

When I got into leadership, I moved from the back seat of the car to the front seat. While I still got instructions from above, I now also had a team to develop, and for that, I needed direction. This was the first time I lifted my gaze above my desk and into the horizon.

This was the time of the “Market Research” (it still is), where companies navigated by looking at an Excel developed by a low-level analyst in a research company that had been told to “fill in the blanks”.

Navigating using three-year-old Excel data was like driving a car, only looking in the rear-view mirror. Nokia was researching Motorola and Sony-Ericsson when the iPhone was introduced. After ridiculing the lack of buttons for a few years, the market research was still favourable for Nokia, although the mobile phone market itself had changed.

I quickly realised that my peers were not as interested in the market as I was. They were busy doing what they were told (not one of my strengths) and finding the next piece of business.

While I was fortunate to resonate with senior leadership and was allowed to follow my curiosity, I also quickly realised that I was navigating in dangerous waters. A large proportion of the leaders based their plans on self-interest rather than considering the actual situation. These leaders were looking for data to support their plan rather than creating a plan that was supported by the data.

Even though I stayed in Semiconductors, this marked the end of my career, and I knew I had to become independent to swim with the school of data without disturbing it.

When I began analysing the financials of semiconductor companies, I could see the movements in the markets and gain a better understanding of the cyclical nature of the semiconductor industry. It was like looking out the car door windows and seeing what was going on at the moment.

However, it was not before I began to analyse the balance sheets and cash flows of semiconductor companies that I started to look through the windscreen and peek into the future.

Analysis of CapEx, Depreciation, and PPE (Property, Plant and Equipment) allowed me to look further ahead and predict the ebb and flow of the industry.

You should not be in this line of business if you are not curious, and it was not long before I started to realise that there was a completely new market to research. The semiconductor industry cannot be seen in isolation (except if you are a politician). It is embedded in a global and intricate supply network with a highly specialised product. Some of them were so specialised that the entire industry hinged on their technology.

And it all starts with a tool (that is not entirely true, but that's another story - sorry, Trumpf and Zeiss). While I track in the range of 50 segments in and around the semiconductor industry, the tools market is one of my favourites as it is 4-5 years ahead of the “Market research”, my old colleagues are still chewing through.

The tool cycle, or lack thereof

The reason the semiconductor industry is cyclical is intimately connected with the time it takes to build a fab and fill it with expensive toys. The timeline for constructing a semiconductor fab is approximately two years. As everyone invests in good times, all the capacity comes online simultaneously, creating bad times—a recurring pattern.

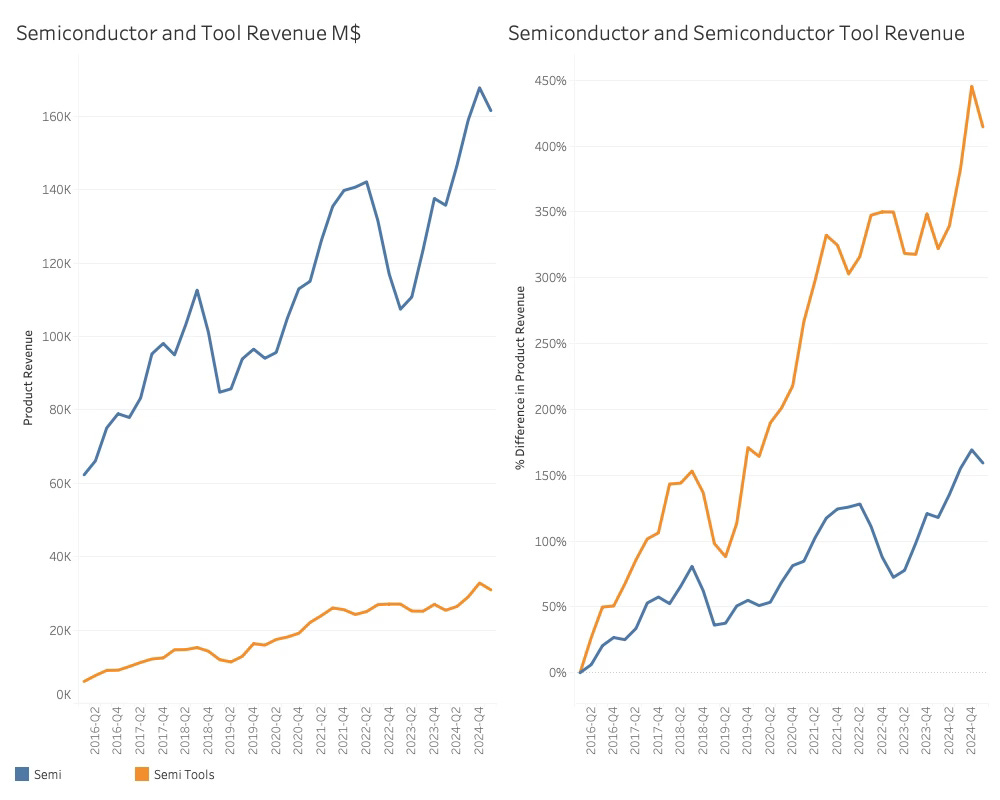

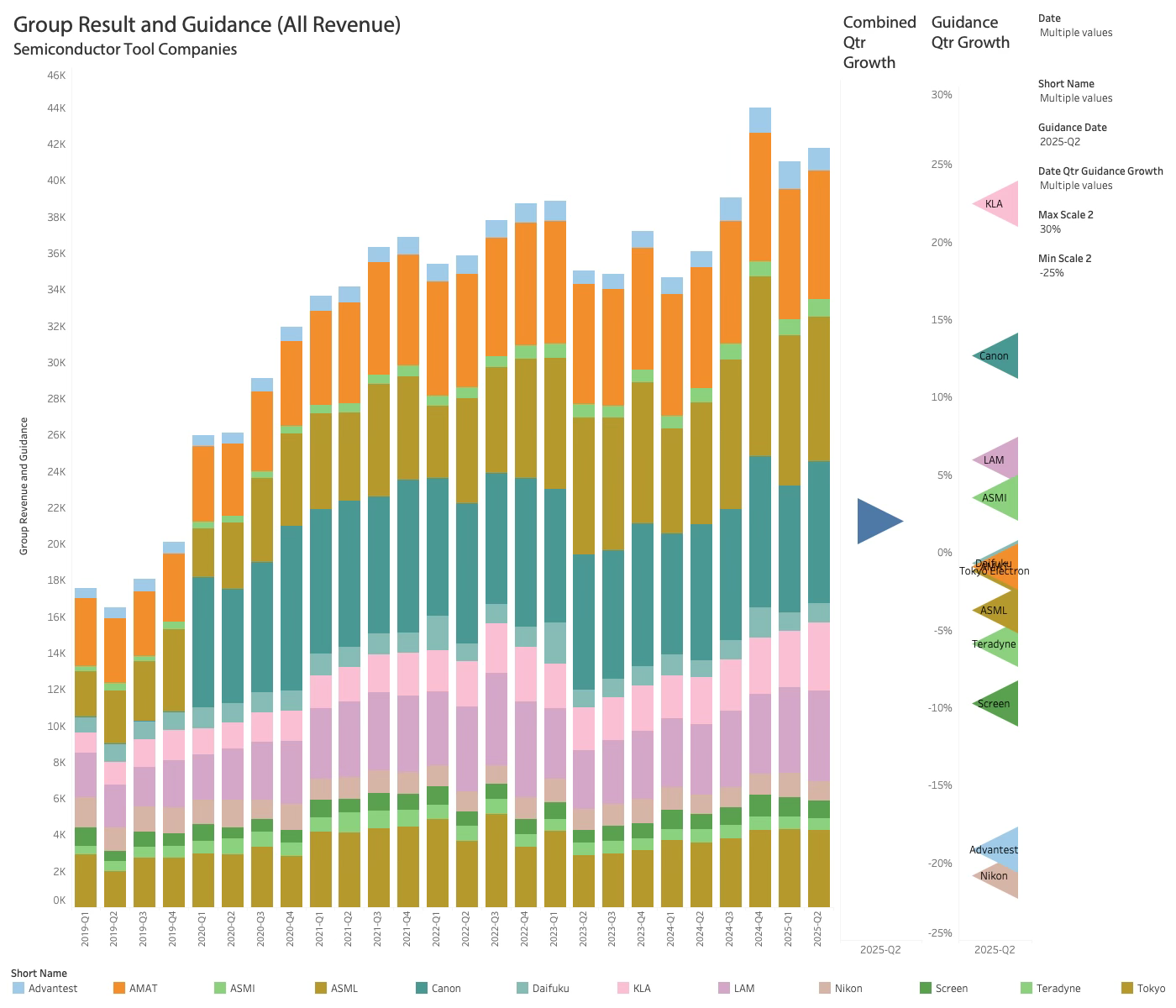

The cycle has been consistent for four years, and neither the financial crisis nor COVID-19 has managed to alter it significantly. This is illustrated in the chart below.

What can also be seen is that the tool cycle was in sync with the semiconductor cycle in the 2018 peak.

This did not repeat in the 2022 upcycle. The tool market skipped the downcycle of 2023 and remained flat until the end of 2024, where it joined the upcycle again.

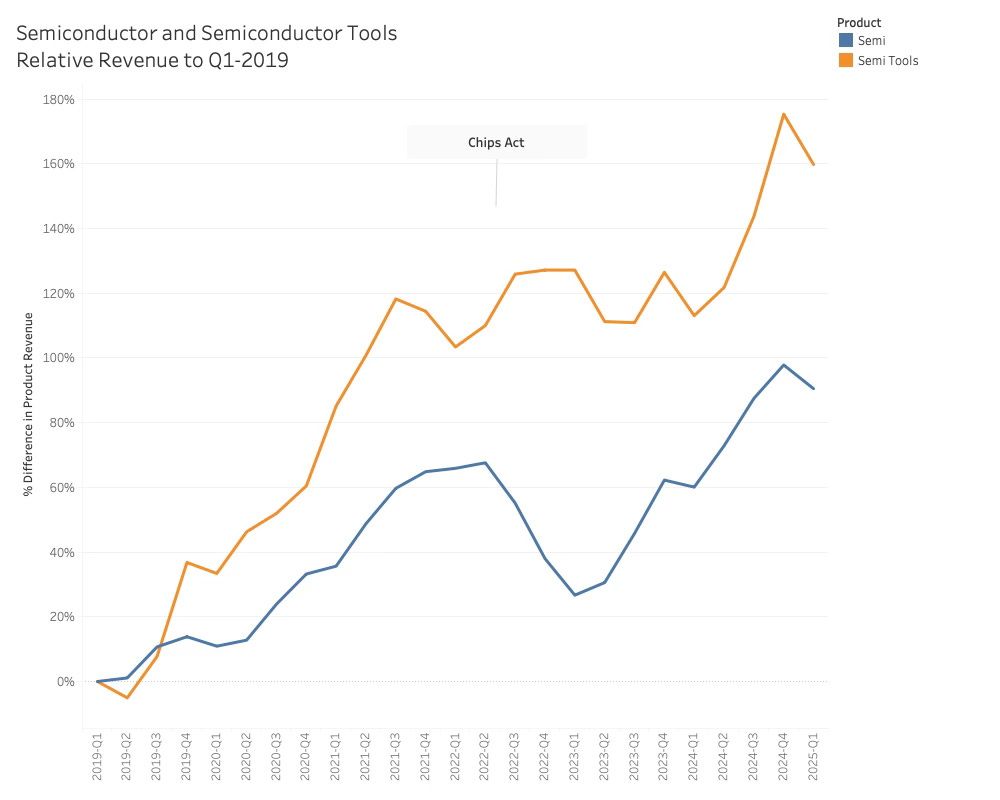

This represents a significant and well-known shift in the semiconductor industry. While the US embargoes against China had been underway for some time, the ratification of the US Chips Act represented a shift from economic logic to political logic.

Fabs were no longer built according to economic logic based on supply and demand, but on the availability of fat subsidies from the US and other major trade blocs.

While the Chinese semiconductor industry has always benefited from government subsidies, the embargoes and the chips act accelerated this development, and Chinese semiconductor companies began to buy all the tools they could get their hands on.

This is where the story about Q1-2025 begins.

The current state of the Semiconductor Tools Market

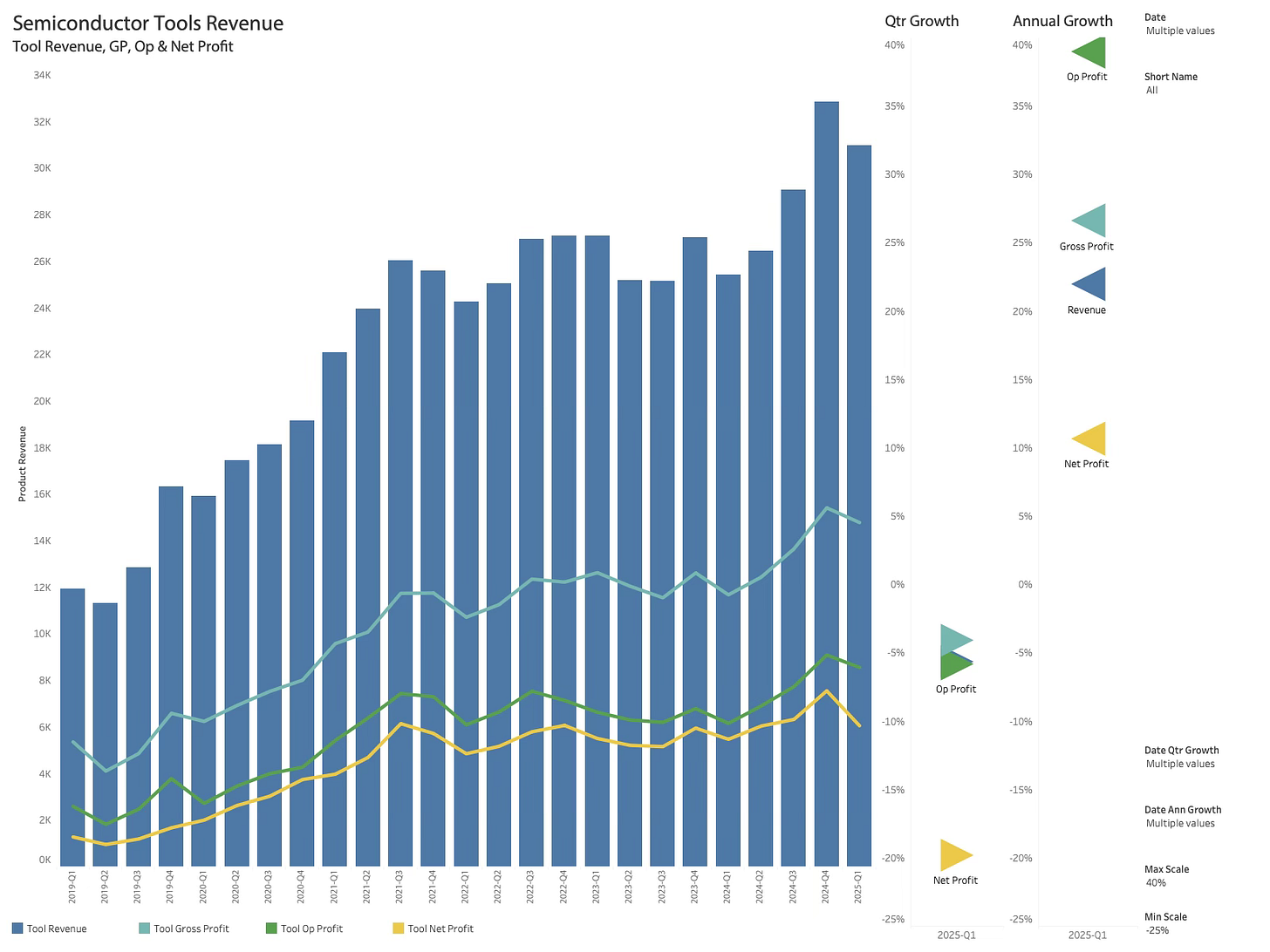

When analysing the combined tool revenue, it is worth noting that this is tool revenue only and does not include service or other revenue.

Although the combined tool revenue declined by 5.5% in Q1-25, it remained at an elevated level with 22% year-over-year (YoY) growth. This is once again ahead of the growth of the semiconductor market, which was 19% for YoY in Q1-25.

The chart shows tool sales only, with no service revenue. Although the net profit declined more than revenue, the operating profits were not impacted. The decline was mainly due to financial adjustments that have no long-term ramifications.

As can be seen, the year-over-year revenue growth has been achieved with significantly higher operating profits, suggesting that the tool companies have a powerful market position at the moment.

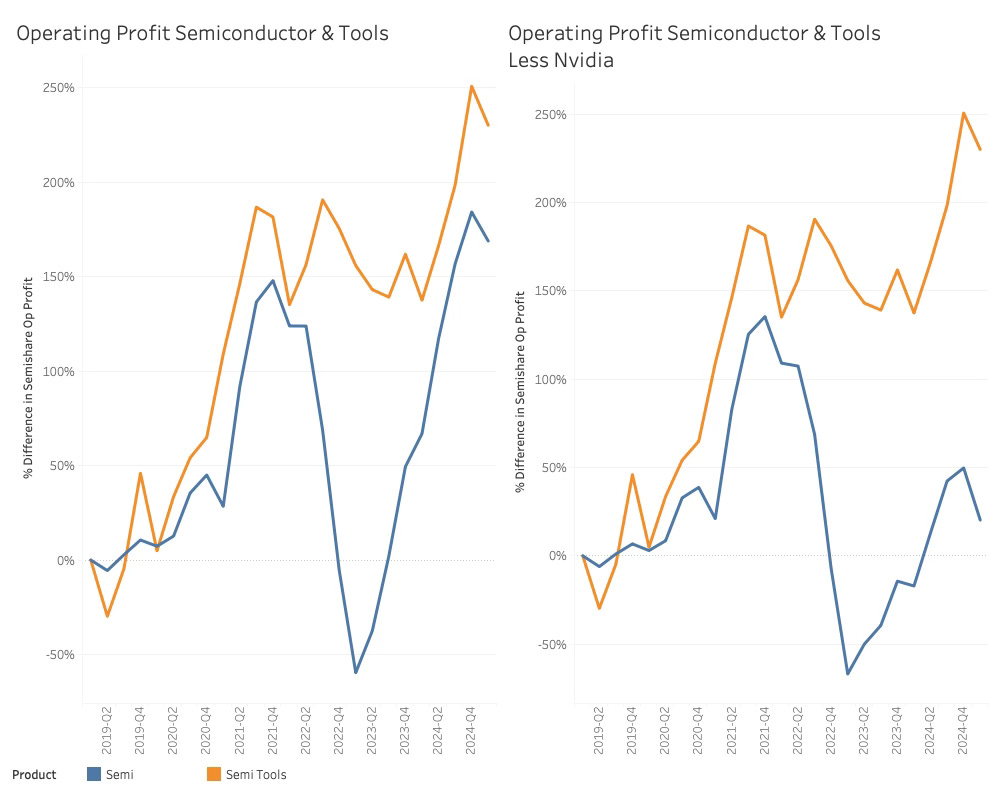

If you are an investor in the semiconductor space, this is worth noting. While the operating profitability of tools and semiconductors has been similar over the last few years, this is clouded by the success of Nvidia. Without Nvidia, tools operating profits have grown significantly faster than Semiconductor operating profits.

Turning to guidance, the revenue view now encompasses corporate revenue, which includes services and other products. The guidance analysis is done on the top 12 companies.

Overall, the guidance is positive, with 1.7% growth, which translates to 15.7% YoY growth. In general, the tool companies were upbeat and expect that their particular area of the tool chain will outgrow the rest.

Moving the focus back to pure semiconductor tool revenue, the winners and losers are listed below.

The sharp decline of Canon’s revenue is not unusual, as the lithography business is lumpy, but it also impacts the annual growth. Canon is affected by the low growth in smartphones and PC’s, and customers are pushing out purchases.

Like in the semiconductor industry, it is vital to be able to deliver to the manufacturers that are part of the AI Server boom. For lithography that exclusively benefits ASML.

Advantest was the clear winner from an annual perspective. The growth is exclusively derived from AI applications and includes both support for the increasing complexity of GPUs (TSMC) and high-bandwidth memory (Korea Heavy).

Advantest believe this trend will continue for the foreseeable future.

The combined inventories were flat, suggesting a good balance between demand and supply, which also indicates that the China boom and elevated backlog are coming to an end. I will explore this in more detail later.

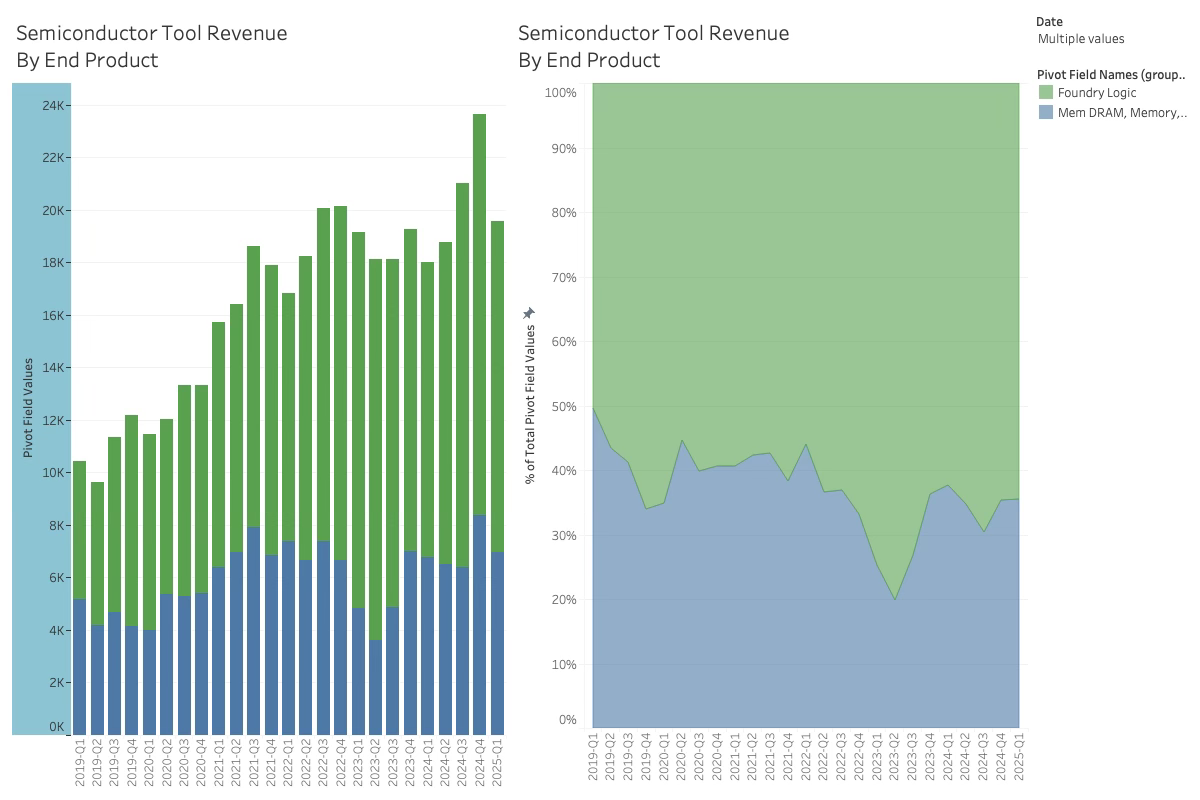

The end-use for tools remained stable, with both Logic/Foundry and memory flat at a 65%/35% split. The trend of declining memory tool revenue can reverse quite quickly once the memory companies decide that the market is so hot that the downturns are forgotten.

AI servers drive the current semiconductor cycle; however, AI servers require large amounts of memory, so I would expect the ratio to remain relatively stable. More about this later.

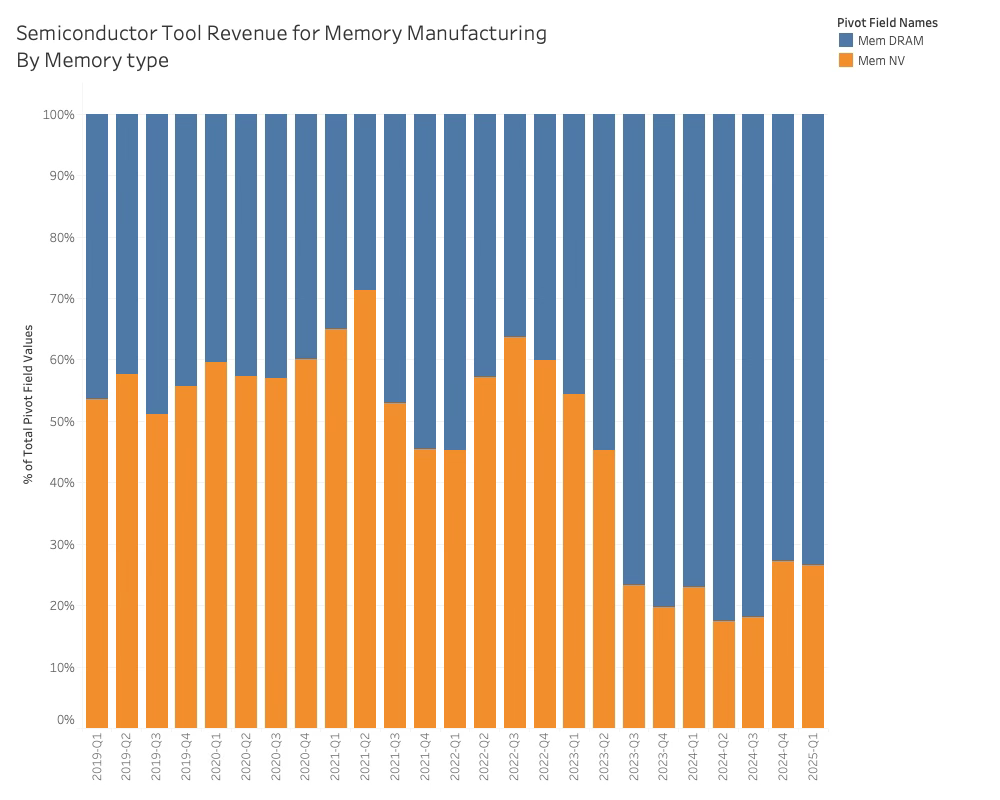

Within memory tool revenue, the dominance of DRAM, particularly HBM, continues, while investments in NAND show signs of life after being quite depressed.

Revenue by Country of Incorporation

In the geopolitical semiconductor chess game, the tool companies are the queens of the board. While the Nvidia H20 embargo is a short-term nuisance for the Chinese semiconductor industry, the EUV tool embargo is an open fracture that takes time to recover from.

As can be seen from the chart, Japan and the Netherlands play a pivotal role in the US embargo battle and have traditionally bent to the soft power that the US has invested in over the decades.

The new US administration has thrown all of that overboard and is engaging in Twitter wars and tariff threats against countries that thought of themselves as US allies a few months ago. This makes the country of incorporation even more crucial than before.

Not that China needed motivation, the tool embargoes have made the resolve to develop a domestic industry in this area.