The SK Hynix conference call has gained popularity as the Korean memory company has begun embarrassing its larger competitor, which is busy tripping over its legs.

While I greatly respect both the memory giants of the Korean Peninsula, SK Hynix is stealing the show right now.

Like most (without a life), I looked forward to understanding the growth in high-bandwidth memories sold mainly to SK Hynix. The superior memory company did not disappoint, so let’s immediately get the HBM growth out of the way.

With close to $4.2B in HBM revenue, SK Hynix grew the most critical category in the memory market by 58% sequentially and more than sixfold year over year. HBM now represents 40% of the DRAM revenue, and more than half of the HBM revenue is now HBM3E. In Q4-24, SK Hynix also recorded the first revenue for HBM3E with a stack of DRAM 12 High. This is going to be the dominating product within a couple of quarters.

The overall result was also excellent.

The Q4-24 Result

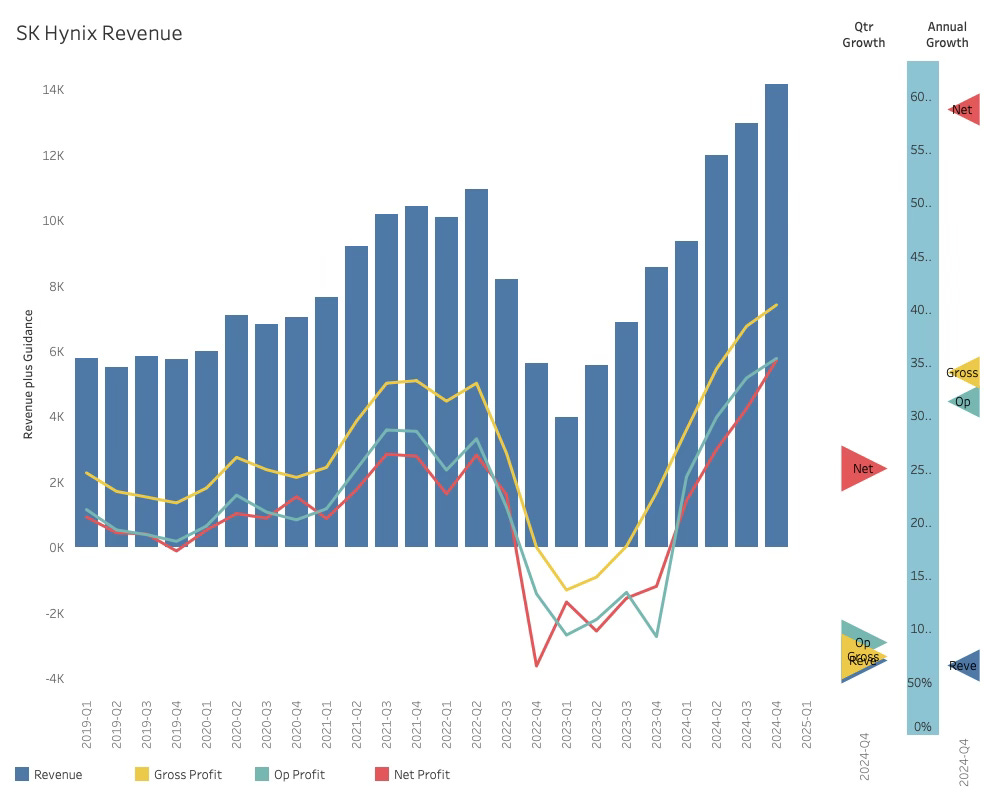

SK Hynix achieved a record-high quarterly revenue of $14.16B in Q4 2024, a 9% increase over the previous quarter and 65% higher than last year. This growth was once again driven by strong demand for AI memory products and data centres, which led to a significant increase in sales of high-value products like HBM and enterprise SSDs. This was despite a delay in the demand recovery for consumer products like PCs and smartphones.

Profitability continued to increase, with gross profit up 9.6%, Operating profit up 11.5%, and Net profit up a whopping 35% over the last quarter.

The outlook was impacted by seasonality. It suggested negative revenue growth in Q1-25 without stating an absolute number. The market response was negative overall, sending Hynix shares down a few percent in post-release trading.

A stronger outlook for 2025 did not ease this. The projected 15% bit growth was not sufficient to impress Wall Street. Both the PC and Mobile markets are expected to grow in the low single digits, while the Server market will reach the high single digits. The bit growth is 2x the market growth, highlighting the continuous trend of more bits per unit. How this translates into revenue was not disclosed.

Hynix continued its climb out of the abyss of the first quarter of 2023. Seven quarters later, the revenue is 3.5x higher than the low point and 29% higher than the last peak in Q2-2022.

While this all looks like dejavu all over again, SK Hynix is a transformed company that is on the edge of leaving the commodity memory roller coaster. This can have a profound impact on the companys future and its valuation. The boom bust cycle might be coming to an end.

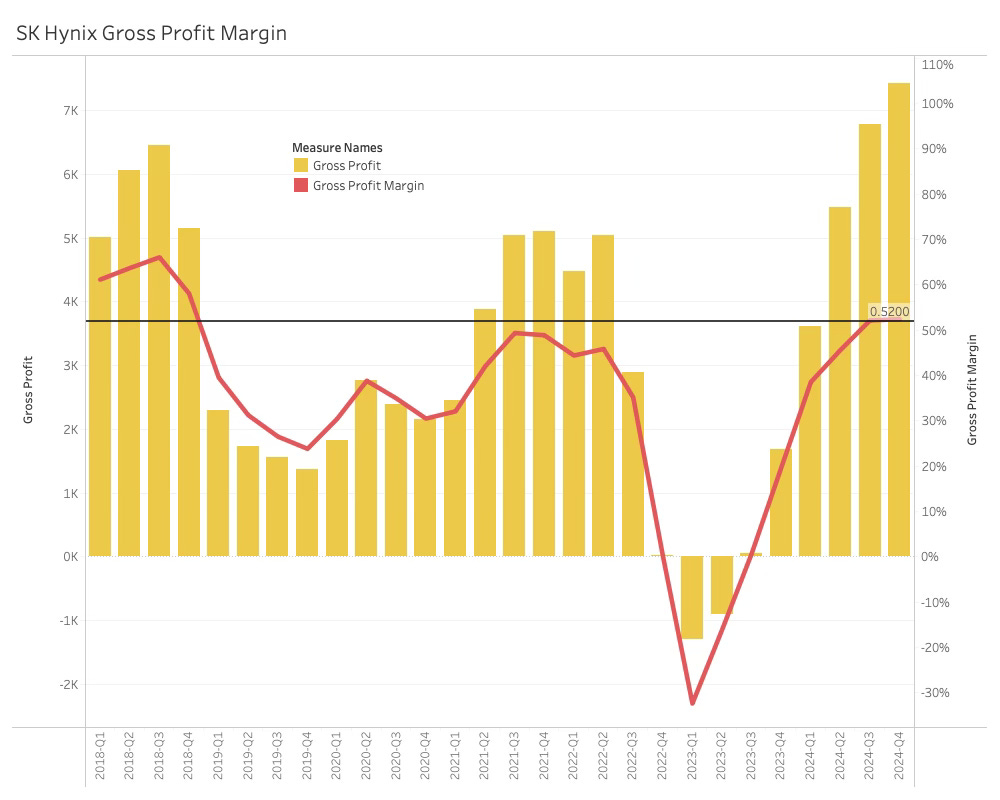

When investigating gross profit and margin, the boom-bust cycles of the memory industry are apparent. The last peak-to-peak cycle was 15 quarters or close to the 4-year average. We are now in quarter 10 of the current cycle, suggesting there are still some miles in this upturn if it follows the traditional pattern.

The Q1 seasonality is best seen in the plateau of 2021/2, which represented a 12% decline. The corresponding quarter in the last cycle was 2021-Q1, suggesting that SK Hynix has a lot of growth ahead.

However, the new business model might be changing that trend.

The Product insights

The SK Hynix divisional structure at a high level is product-based by DRAM, NAND, and another category that mainly consists of legacy NOR flash memory.

With declining NAND revenues over the last couple of quarters, it would be natural to assume that SK Hynix is losing the appetite for NAND as the HBM business is booming. Is SK Hynix becoming a DRAM company?

It is not as simple as that. The Subdivision analysis shows that a lot is happening in the NAND category. The NAND for servers are now dominating the declining NAND revenue, so it is becoming less about products and more about markets.

An analysis of the SK Hynix markets makes the Server market's dominance completely clear.

Keep reading with a 7-day free trial

Subscribe to Semiconductor Business Intelligence to keep reading this post and get 7 days of free access to the full post archives.