The Next Modest Chapter in the TSMC Chronicles

Towards the half-trillion US Dollar in Revenue

Being a Semiconductor analyst (whatever that means), you have to be good at cleaning your ears for corporate candyfloss generously spread by the Chief Excitement officers and their minions.

But then you also have the joy of joining the TSMC investor call, now on video, so I can waste time deciphering Dr. C.C. Wei’s grimace when he is showered with analyst questions that are shrouded encouragements to increase the guidance and growth rates. All I know is that if you are an analyst, you should not favour one outcome over another.

In my opinion, CC (I will pretend to know him that well..) is one of the most underrated CEO’s in the semiconductor industry, primarily due to his lack of interest in personal marketing. Rating a CEO by public appearances is like judging a house by looking through the mailbox, but I still believe you can learn a lot.

While my Taiwanese friends will laugh out loud, I believe he is not trying to deceive anybody, but leave the audience with a crisp and honest view of the situation in the most successful semiconductor ever (yes, I include the green server company in that assessment)

He is very calm, controlled and comfortable in his skin; his sense of sharp, understated humour reveals that he does not have a fragile ego to protect. Like the company, he looks pretty modest.

While a company is more than its CEO, CC embodies all the qualities of TSMC, although I am certain he is a challenge to work for.

The most essential quality of TSMC is its unwavering customer focus, a trait the company has consistently maintained. Unlike US and European semiconductor companies, the Taiwanese leader never abuses the market to squeeze their customers. They believe that a long-term relationship will develop if you take care of your customers.

It should be the doctrine in every company, but I have worked in companies where investor profits and CEO pay/bonuses were prioritised way higher than customer satisfaction.

While TSMC has leading-edge competitors, they are struggling to attract customers, regardless of technology or price. They know that TSMC takes care of their customers over the long term.

This quality is essential to understand before attempting to comprehend TSMC. Everything they do is customer-driven, even though it may also serve other purposes.

TSMC is not investing in the US because of a white or orange administration. The company is investing in the US on behalf of its customers, which may have a greater affiliation with a particular administration.

Questions like: “Will the accelerated investment in the US hurt the investments in Europe and Japan?” are met with a sigh and explained by: “No - they are separate investments guided by individual customer demand”. The either-or mentality of quarter-by-quarter divisional squabbles over resources in US companies has never been attractive to TSMC's long-term plans.

While CC is very patient during investor calls, it is somewhat painful to observe analysts trying to talk him up or down rather than simply listening to what he has to say.

That is where the story of the Q2-25 TSMC investor call begins. While the guidance for next quarter is important, the longer-term implications are vital due to TSMC's dominant position in the industry and its decision not to abuse that position.

The TSMC Q2-25 result.

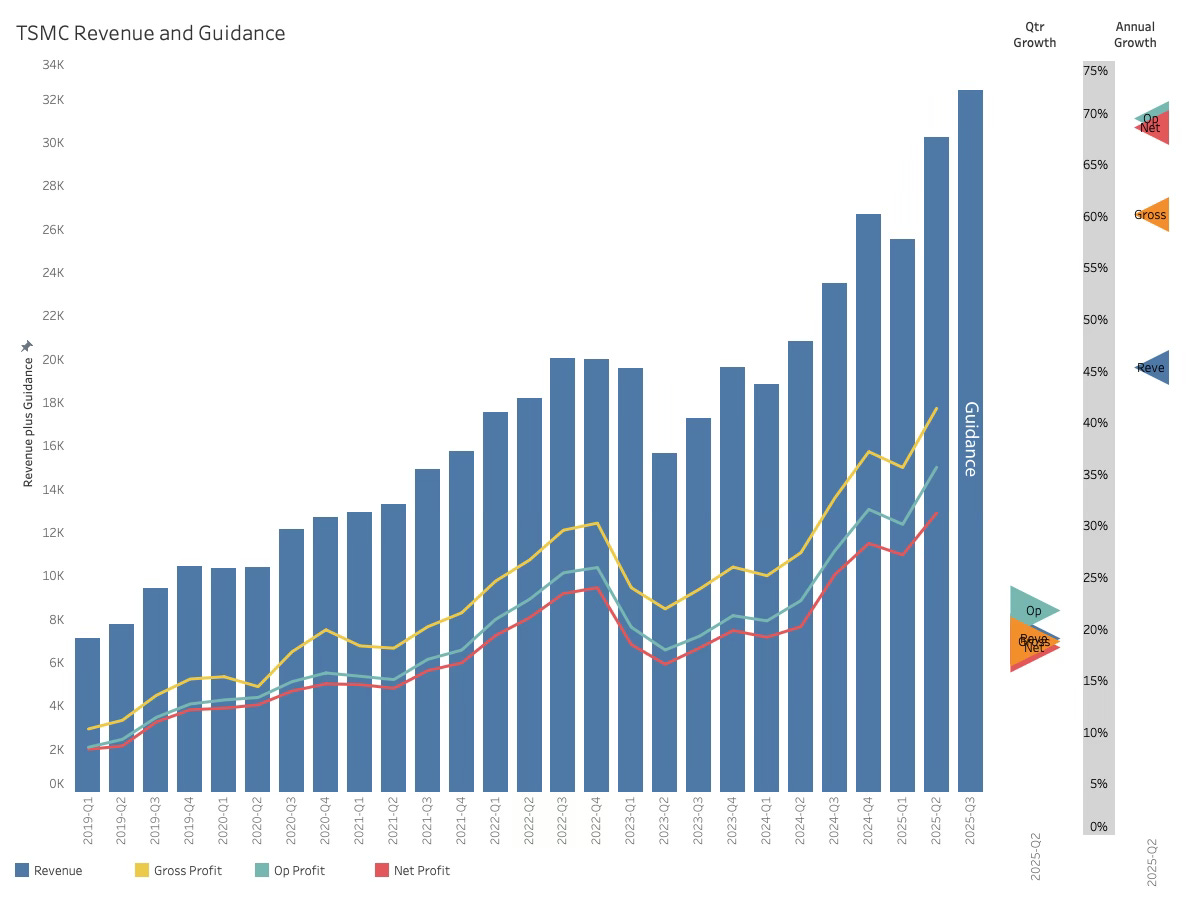

While the revenue result was spot on the guidance in US dollar terms, TSMC delivered aligned profitability growth, in line with last quarter's margins but way ahead of last year's. The revenue result was +18.5% quarter-over-quarter.

From a YoY perspective, revenue grew 45% while gross profit was up 60% and operating and net profit rose 69%.

The revenue and cost of goods sold were growing at a similar rate. This suggests that the TSMC supply chain had a good quarter, although the COGS growth of 28% did not match the annual revenue growth of 45%.

The wealth is now beginning to trickle through the supply chain.

Inventory grew by 10% QoQ, showing a business under control, while all the other financial ratios were unremarkable.

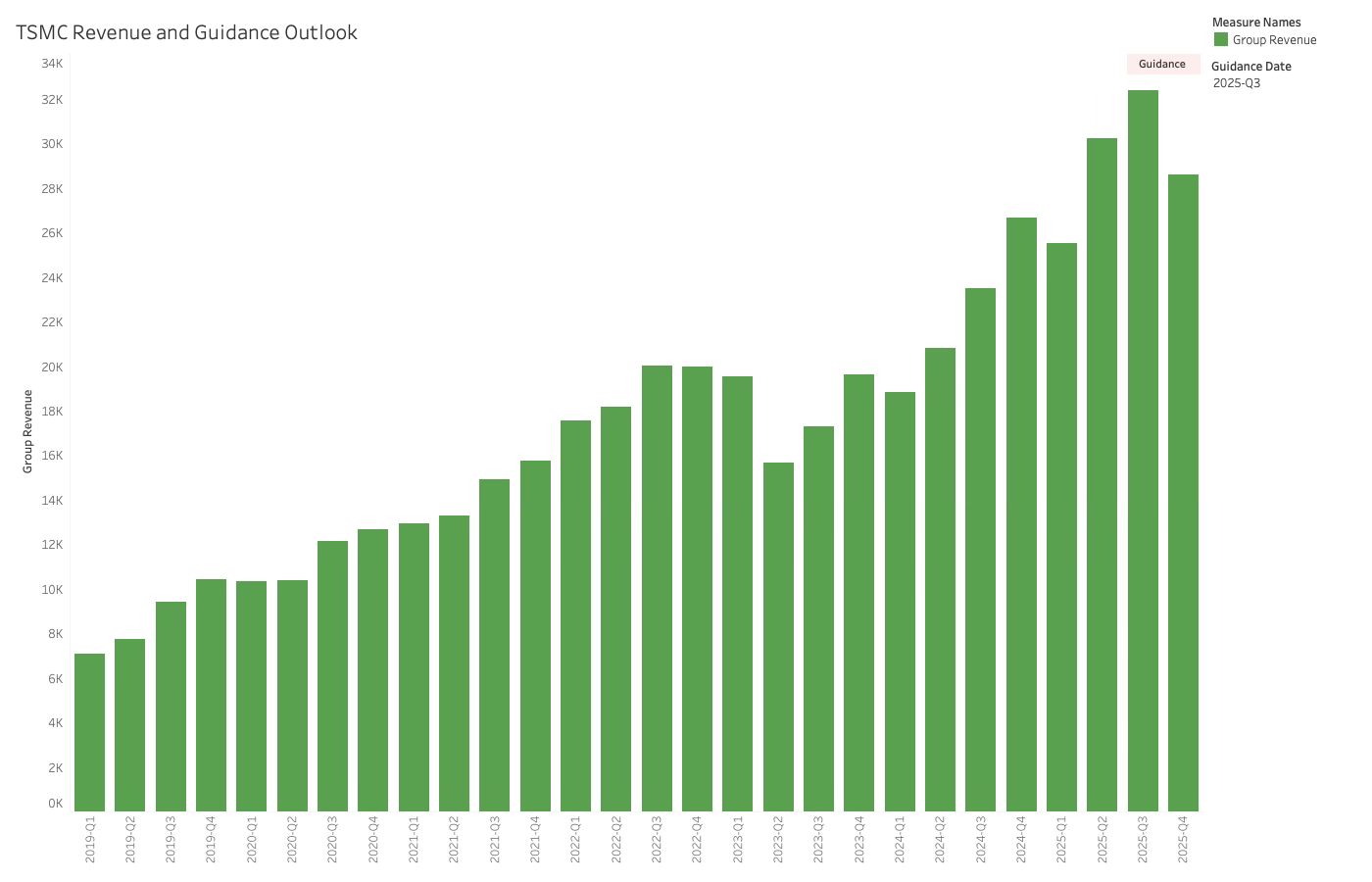

The guidance for Q3-25 was up 7.1% while the overall guidance for 2025 was set at 30% growth in US dollar terms. This sounds better than Q4-25 is down, but that is the reality of the statement.

Grilled about this by the analysts, CC Wei shrugged it off, saying it was the best judgment based on the current situation and the uncertainties regarding tariffs.

This answer was met with the “analyst” trying to make CC commit to a higher number by asking, “Could it be higher?”. CC did not bite but said, TSMC would always try to optimise the result and would work on all upsides that showed up.

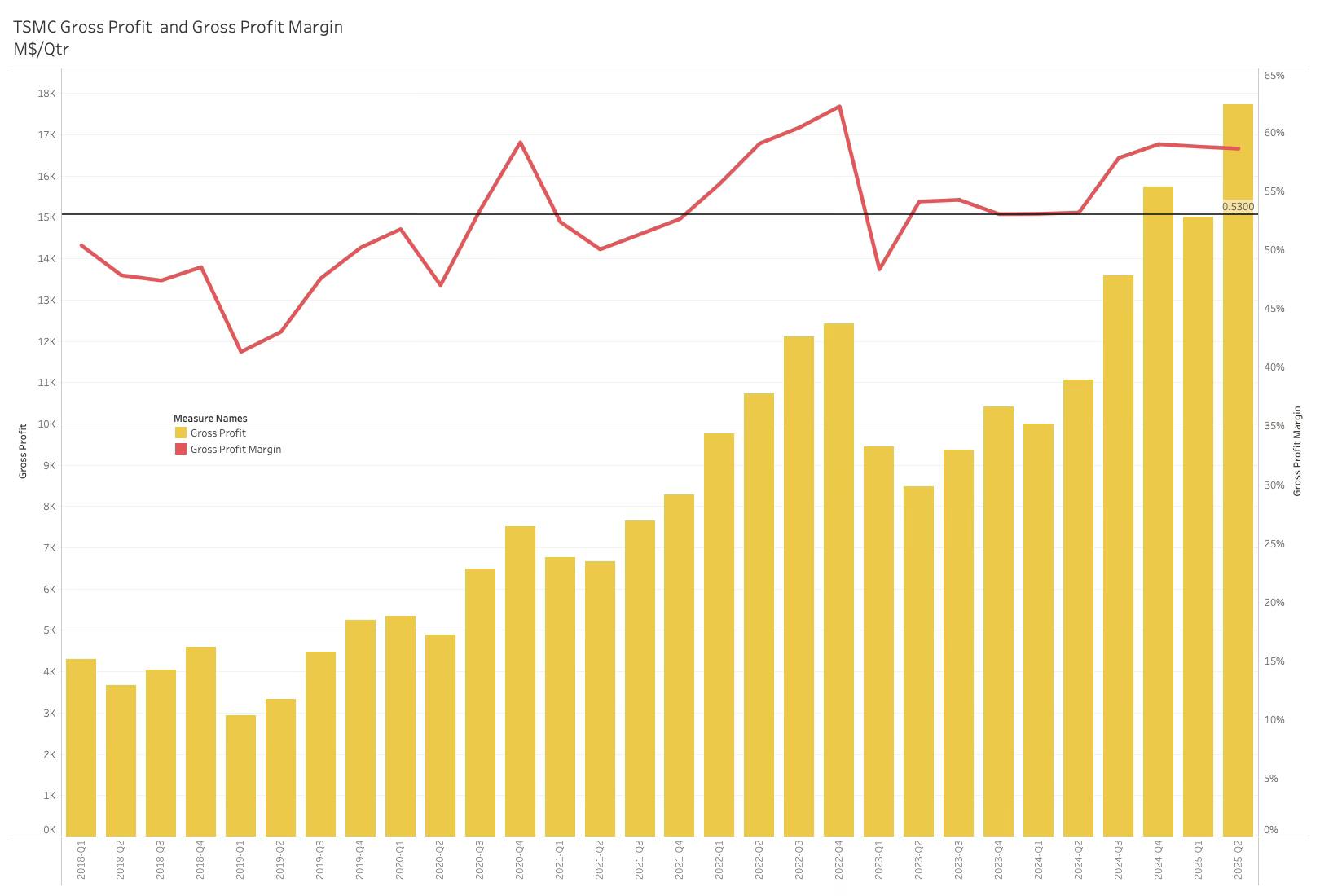

Much more interesting was the conversation about gross profit. Once again, the “analysts” tried to get CC to inflate the margin, and this time around, they had a better argument.

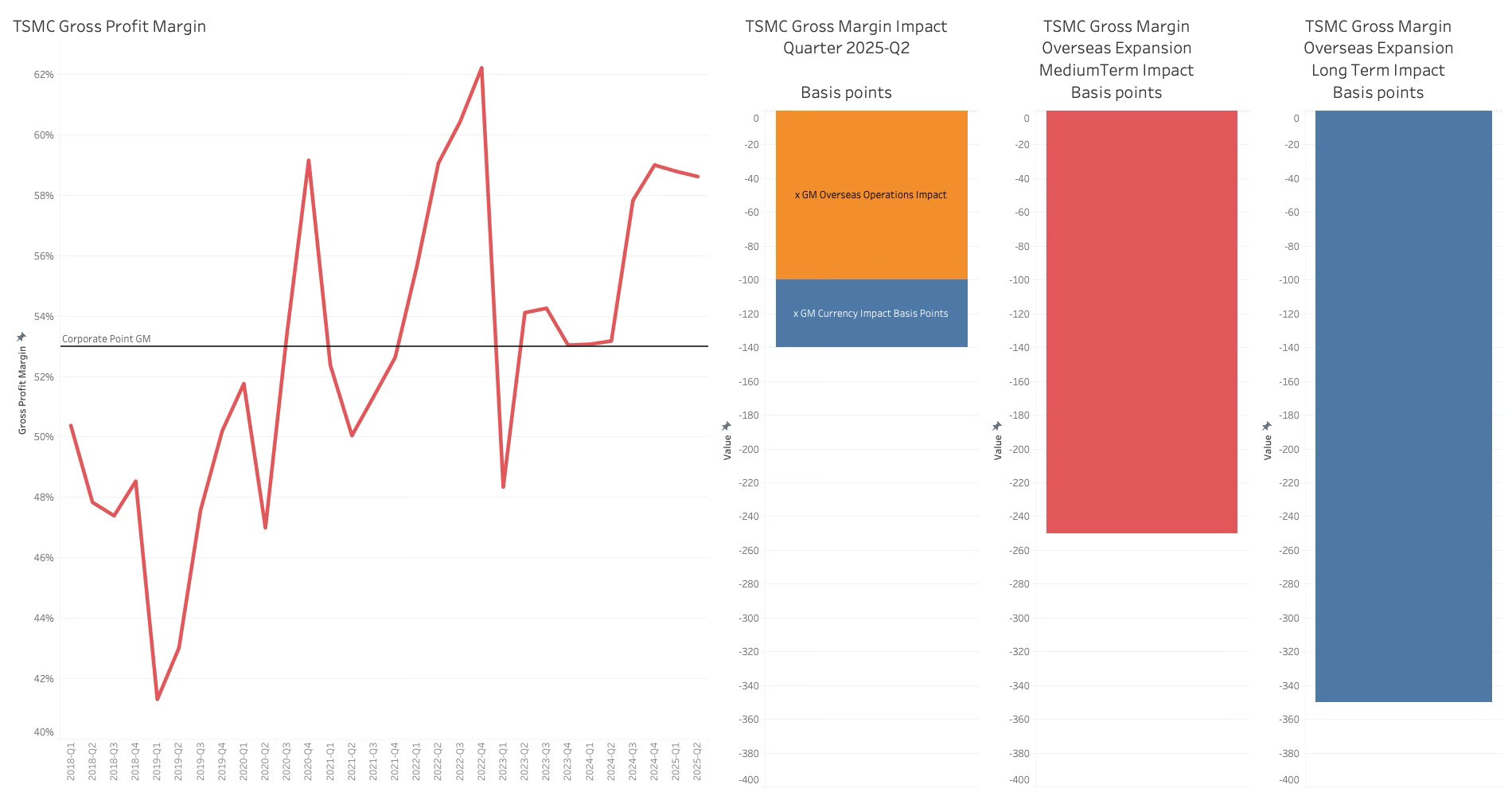

The Gross margin of TSMC has stayed above the long-term target of 53% and has generally been increasing since the last downcycle.

The discussion revealed that TSMC faced headwinds due to the depreciation of the New Taiwan Dollar (NT$) against the US dollar. As 75% of costs are NT$-based and nearly 100% of revenue is USD-linked, 1% decrease in NT$ per USD results in a 1% decrease in revenue and a 0.4% drop in gross margin.

The currency impact in Q2-25 was -40 basis points, while the larger impact came from a structural change.

Foreign operations, especially in the US, are more expensive and hurt gross margins. This drag was 100 basis points in Q2 and is expected to expand over time.

TSMC expects the drag to increase to 250 basis points within the next few quarters and grow to 350 basis points in the longer term.

As the US will eventually account for 30% of TSMC’s leading-edge capacity, likely translating into 17-18% of total capacity, it can be seen that the US fabs come with a cost that is higher than what TSMC has chosen to pass on to its customers.

This is why the 10 Fabs/packaging plants in the US, Japan and Europe are being offset by 15 facilities in Taiwan. It takes a couple of Taiwanese fabs to offset a foreign one.

There were also positive GM effects related to cost savings and better utilisation that will be covered later.

End markets

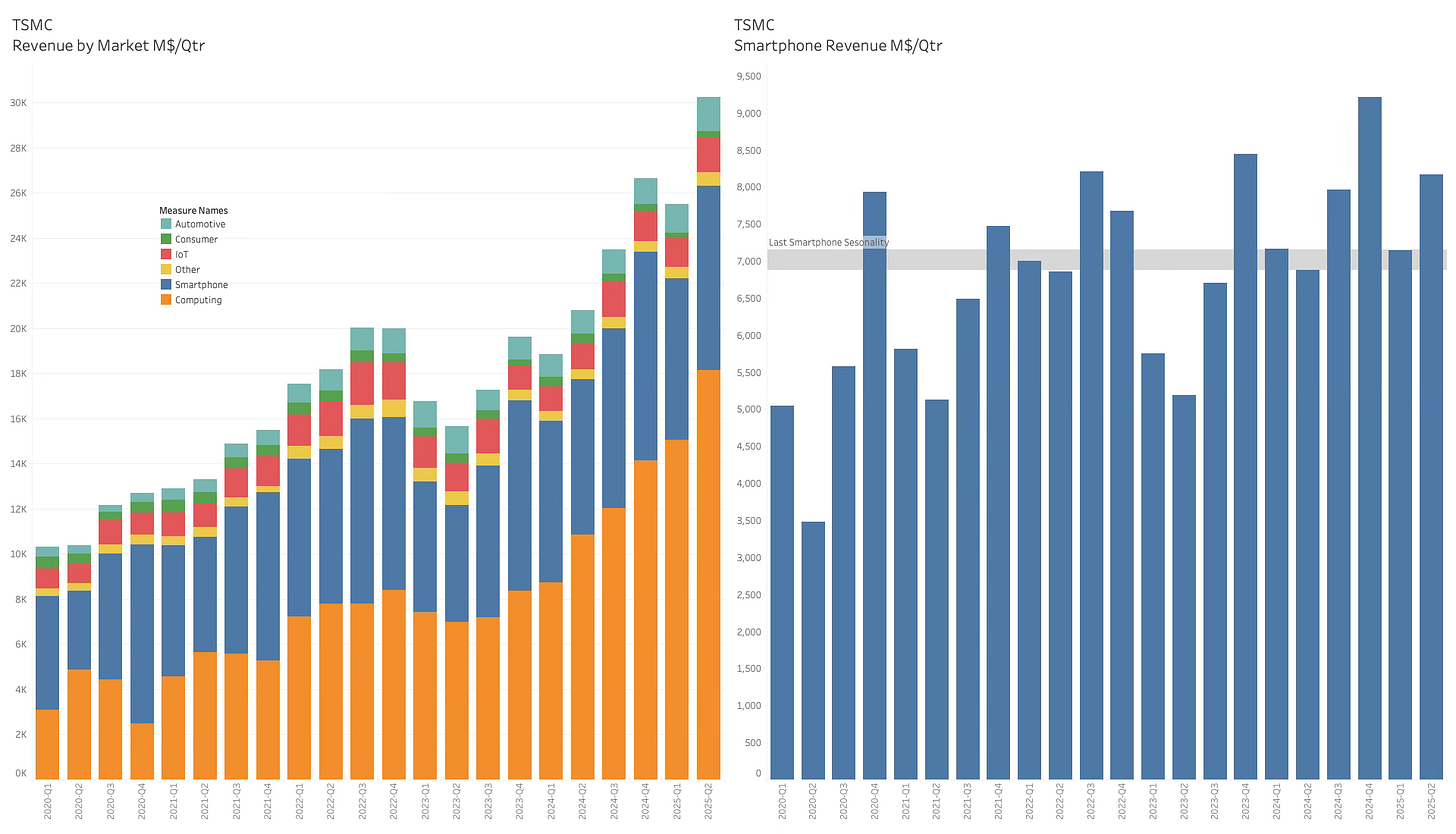

Not surprisingly, the revenue growth was driven by the high-performance compute market, as has been the case for the last couple of years.

More surprisingly was the smartphone end market, which came in significantly stronger than its seasonal trend from last year. While the impact of the Nvidia H20 embargo was not clarified, TSMC has not yet received any information about resuming H20 production after the embargo is reversed.

Q1 to Q2 is usually a down quarter in smartphone revenue, but the end market was up 14%.

In the longer term, TSMC expects a mild recovery in the non-AI markets, including the smartphone market.

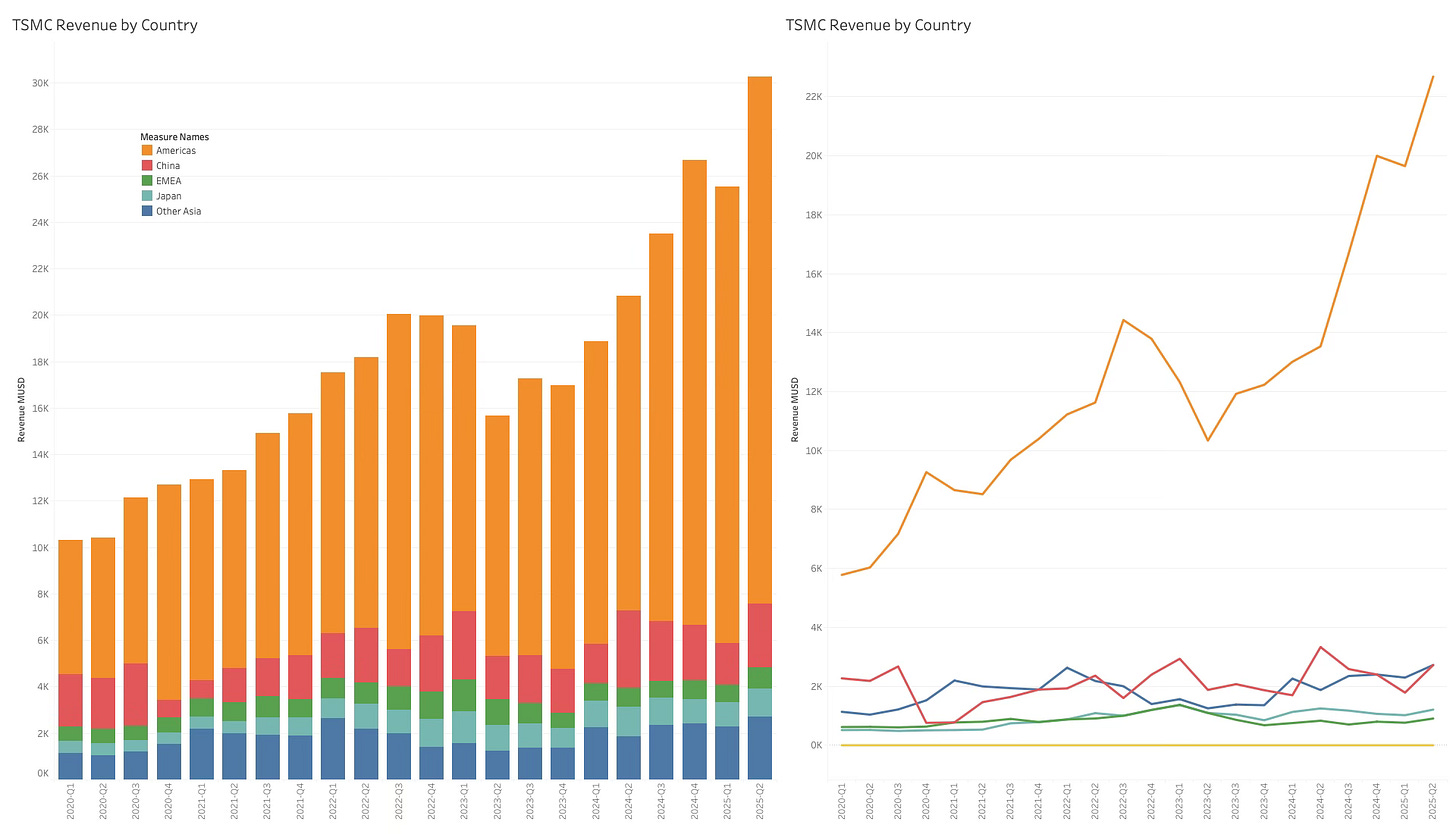

Apart from continuing the dominance of US clients, there was also an uptick in the Chinese market related to the increase in smartphone revenue shown earlier. Both can be tied to TSMC's comments about the impact of consumer incentives in China driving additional revenue.

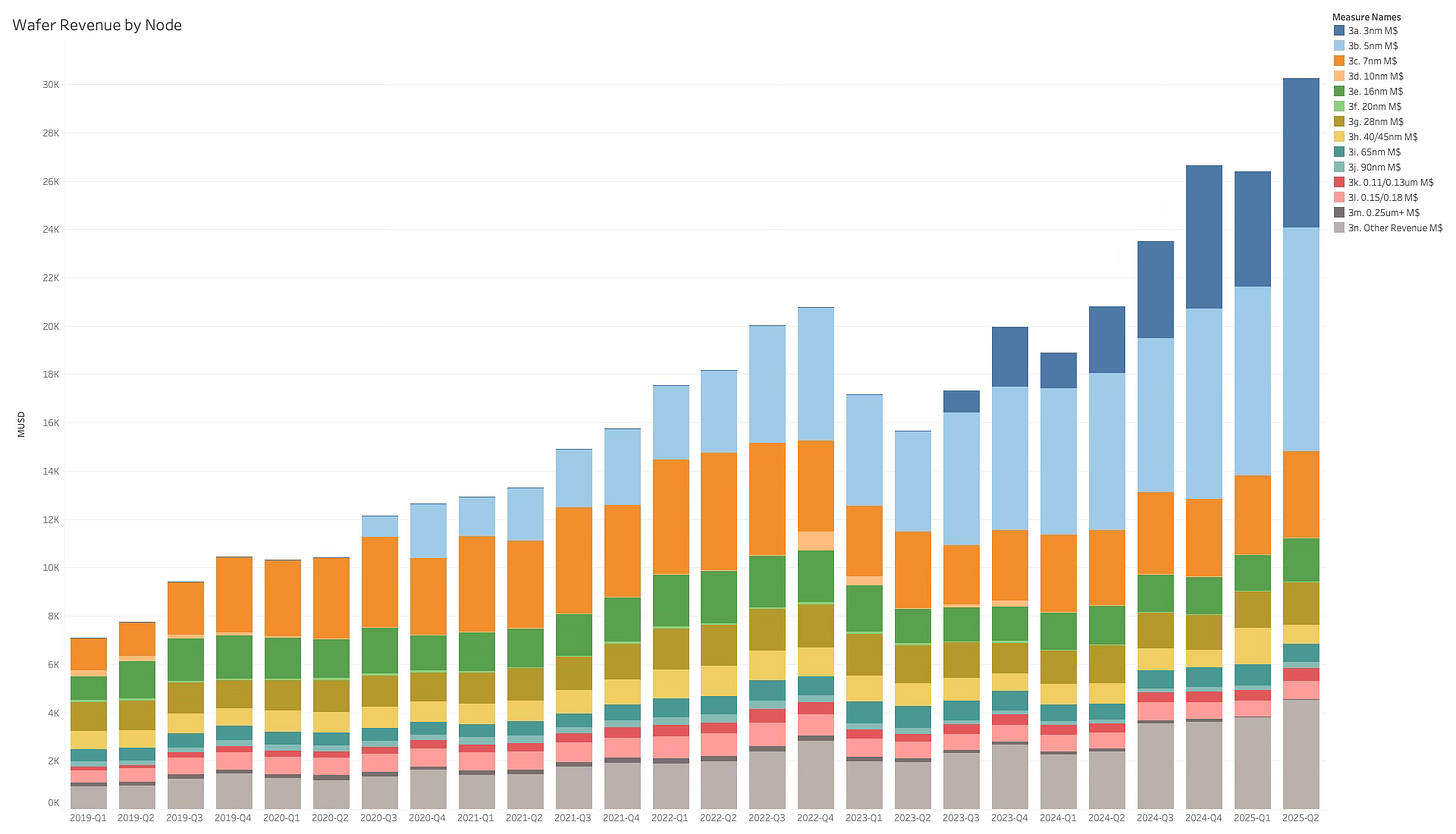

Revenue by technology

The 3nm revenue that has been exclusively sold to Apple has traditionally followed the revenue and cost of goods sold by Apple, which is Q4-centric. This explains the dive for 2nm in Q2-25, but not the strong recovery in Q2-25. There is now more pull from the GPU and networking companies that have mainly been using 5nm technology.

7nm and below now account for 63% of total revenue, and this percentage is expected to increase as TSMC has made it clear that they will not compete in the low-end logic market. Moving forward, it is only the leading edge logic and speciality nodes that will be focused on.

The high-value wafers in 7nm and below mean that TSMC derives a significant proportion of its revenue from a fraction of its wafer production.

The comparison to units is shown below.