The Reshaping of the Server Market and Manufacturing

The Current Strength of the AI Revolution - Part Two.

This is the second part of the article, digging into the current strength of the AI revolution.

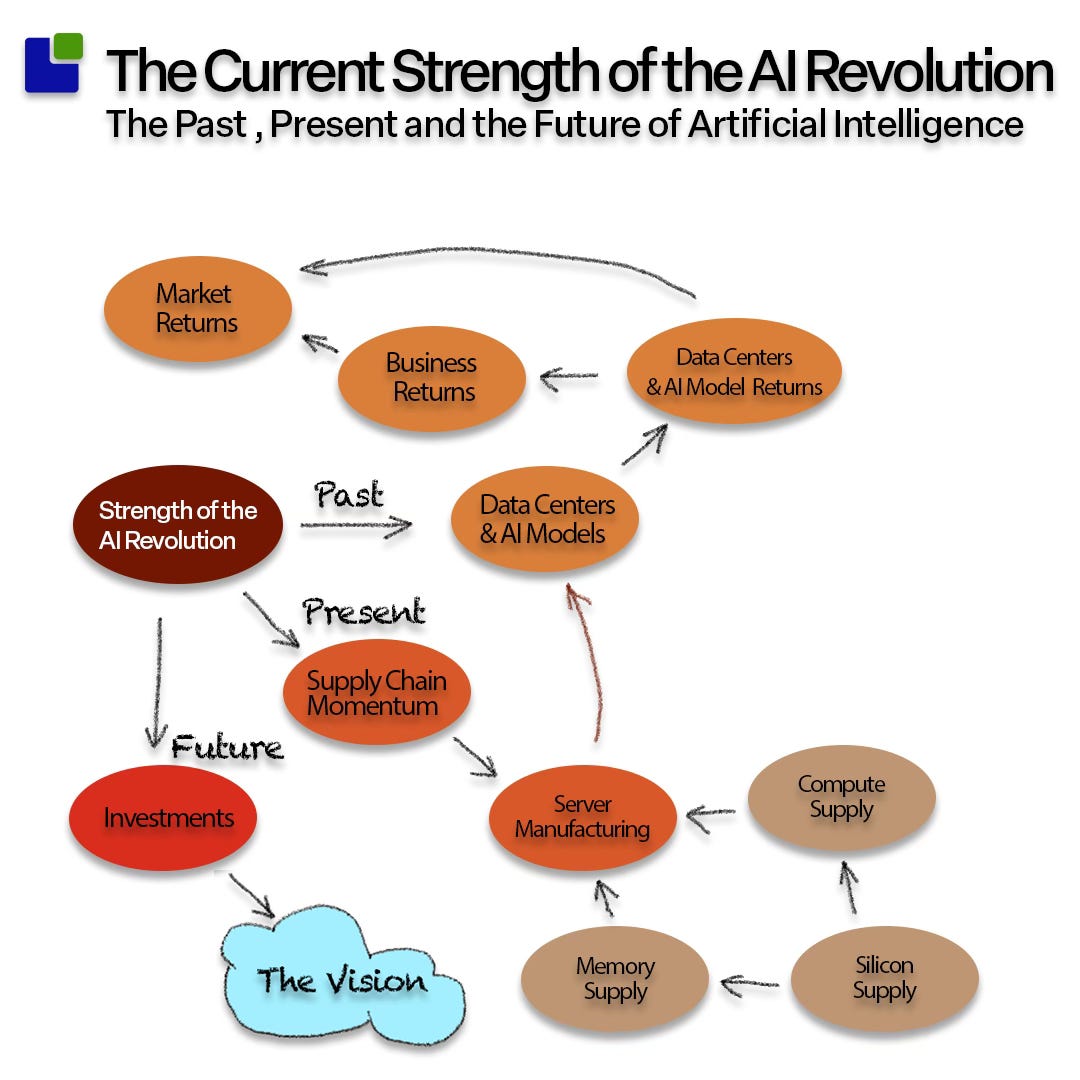

In the first part, I covered questions about the current returns that AI is generating in the Stock market, business returns, and the direct returns of data centre and AI model owners.

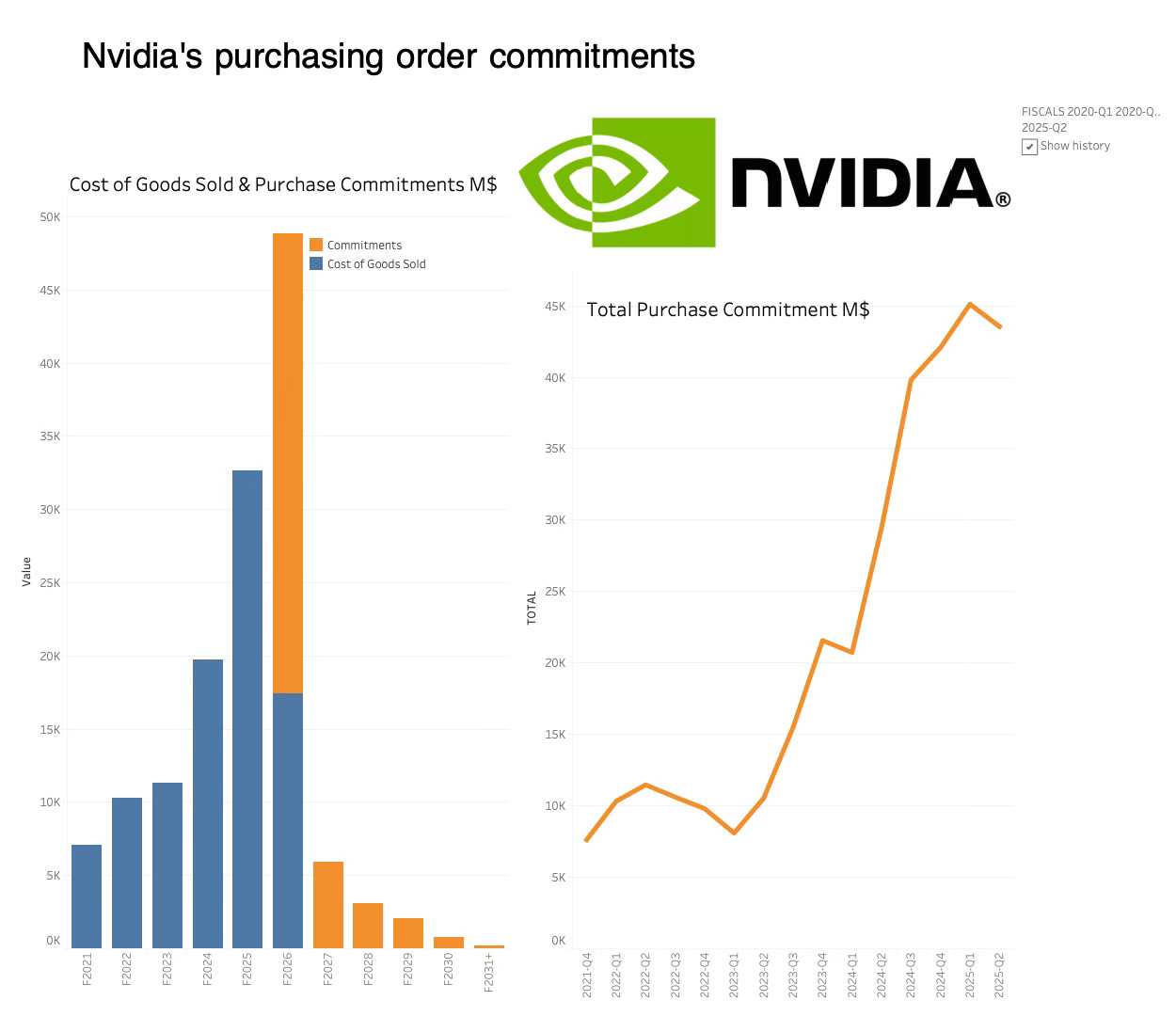

This second part of the article will focus on the current situation, specifically the momentum in the supply chain. While there is no guarantee that what is in the supply chain will also be bought, the AI supply chain has a significantly higher order coverage than an ordinary semiconductor business. Companies need to secure a supply of scarce, newly developed subcomponents, such as memory and GPUs, as evidenced by the purchasing order commitments made by Nvidia.

While the moat of Nvidia is a popular topic, its ability to manage and commit to its supply chain is vastly underestimated. This adds yards to Nvidia’s moat.

No other semiconductor company has the financial muscle to place a supply backlog of $40-45B. This value represents 165B$ worth of revenue or more than 3 quarters of the current revenue run rate.

In this light, it is plausible to assume that the supply chain represents the current strength of the AI revolution, which is still supply-limited.

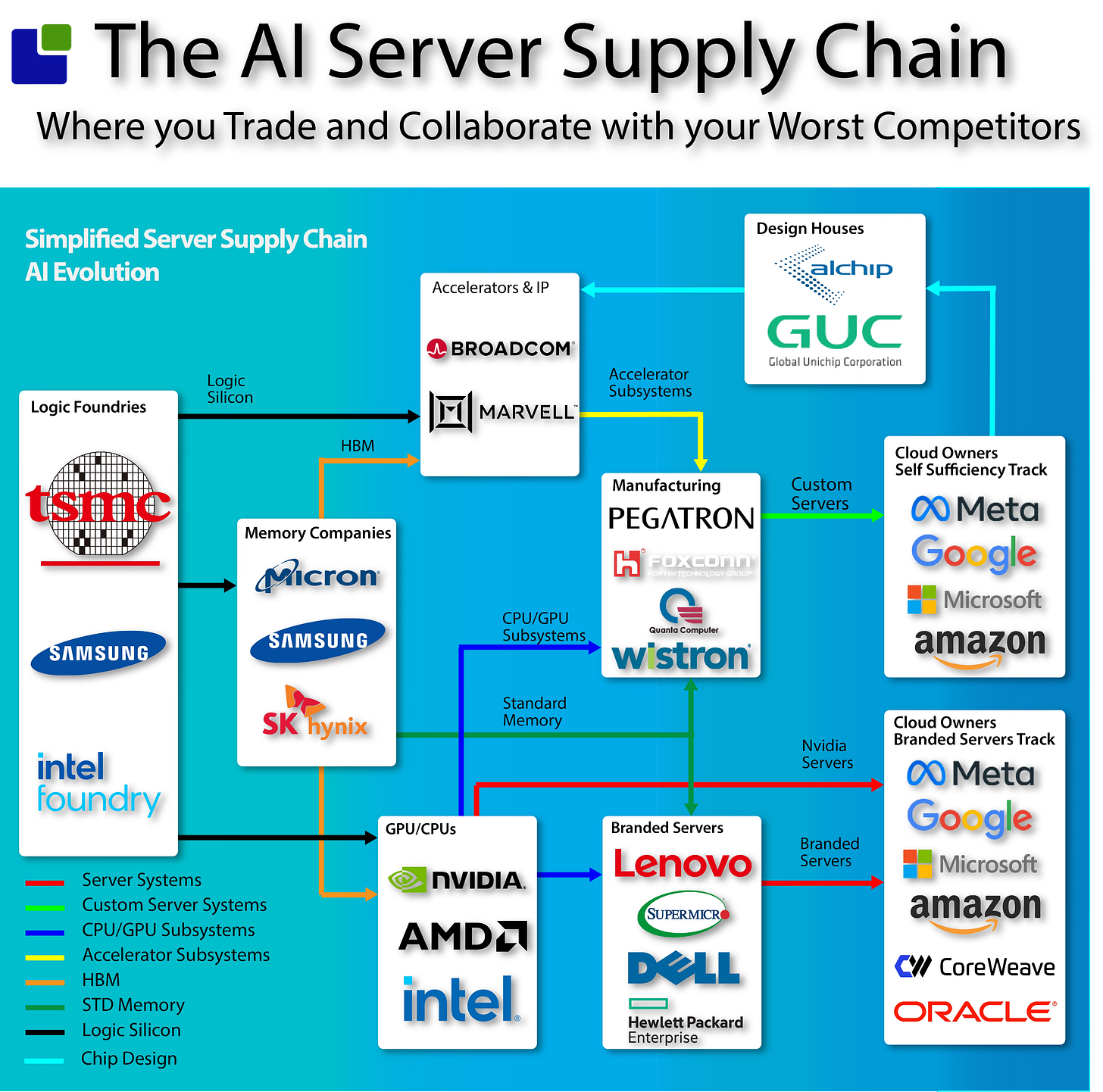

My reverse analysis has now reached the server manufacturers, and before moving on, it is time to view a snapshot of the simplified server manufacturing model as seen below:

The Companies selling branded servers to the Cloud companies are in direct competition with their single most important supplier, Nvidia. Apart from supplying GPU boards, including high-bandwidth memories, the AI giant also supplies the key memory components needed to create a branded server.

While it is no secret (except perhaps to WSTS) that Nvidia is no longer a semiconductor company selling integrated devices on the market, but a supplier of complete AI server systems and subsystems needed by other companies to build their own AI servers.

In the following analysis, I will define and categorise Nvidia products in different ways. Although I will treat the Nvidia business as a combination of Chip sales (GPU Subsystems and networking) and Server sales in my baseline analysis, I will categorise them separately.

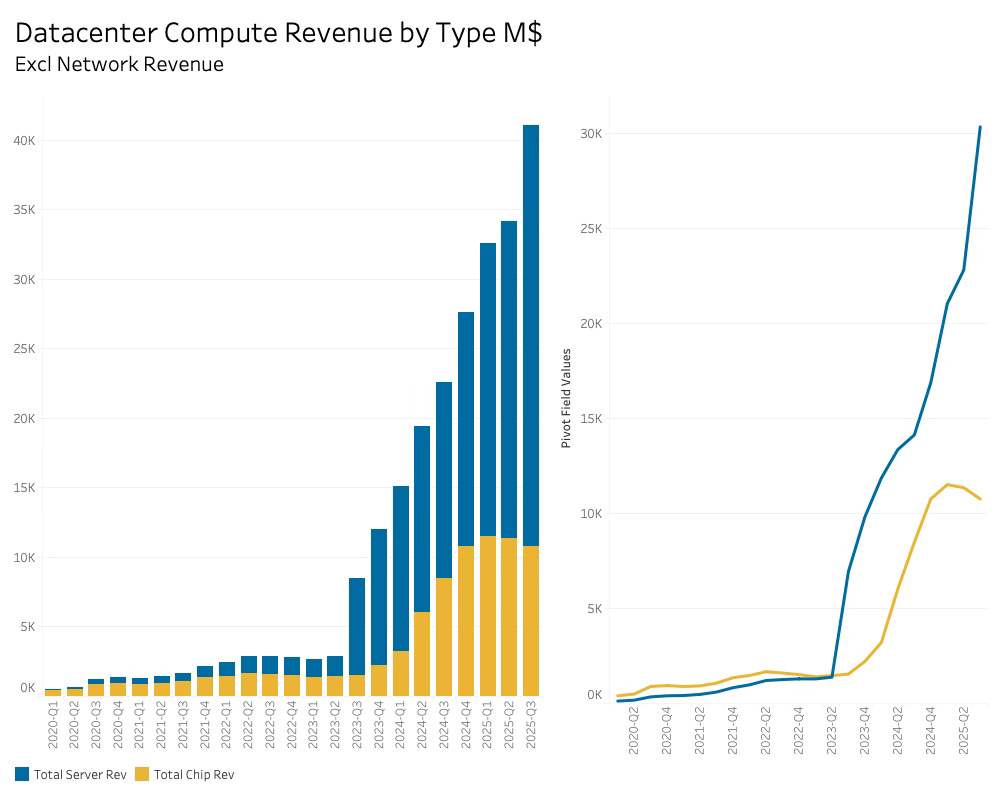

This definition gives the following Nvidia datacenter revenue:

While it is no surprise that Nvidia’s server revenue grows faster than that of its chip business (supplied to customers/competitors), the decline in chip sales seems counterintuitive.

The reason for this is the H20 sales to China that were banned during the “negotiation” period between Nvidia and the White House. The China sales would have added $2 billion in Q2-25 and $8 billion in Q3-25.

The Business of the Server Brands

Due to their historic close relationship, server brands are typically businesses that sell both PCs and servers. Irrespective of where they started, they are now all very focused on the AI side of the company, experiencing or expecting radical growth.

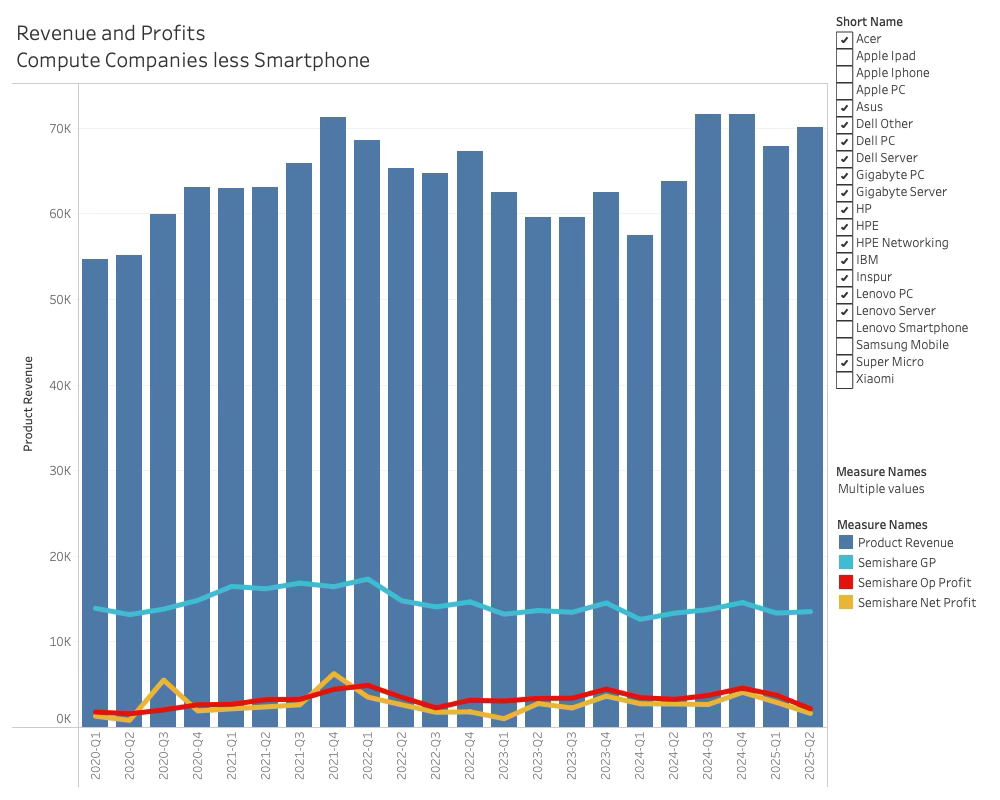

Overall, the financials of these companies have been very flat with profit cycles until recently. This matches the softness in the PC business and traditional servers, which has also impacted Intel’s revenue over the last half-decade

The overall business of these companies remains relatively flat over time. So far, there have been only a limited number of PCs and servers that we need. The margins reflect this, and the operating and net margins have been in decline recently.

Upon closer examination of the server companies, it is not surprising to see that the AI component of the business is having a significant impact.

The shift in business from PC to AI PC and from Server to AI server is evident and a lot more dominant than the headline numbers suggest.

What is slightly surprising is that the AI server numbers have been declining over the last couple of quarters, suggesting a potential slowdown in AI adoption.