The Server Company Formerly known as "Chip"

Nvidia's Q1-2025 Result and Its Impact on the Semiconductor Industry

Once again, Nvidia delivered the goods, and the market responded with a “Nah.” Although not at a record high, the stock remained at the elevated AI hype level, and all is good.

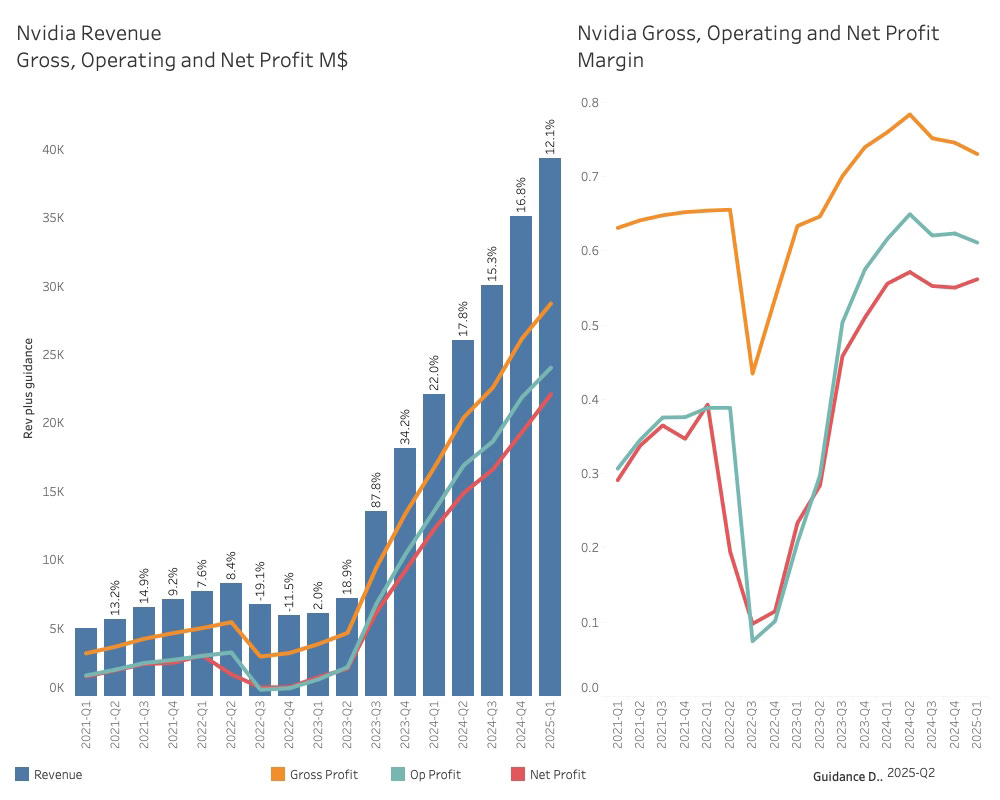

The quarterly result was up 12.1%, slightly slower than the growth rates of previous quarters but still very respectable.

The gross margin was slightly down again as Blackwell was being introduced. The gross margin is expected to decline slightly to the low seventies before settling at 75% at the end of the year. The net profit margin increased slightly, so everything is under control at a very comfortable level.

While other companies would kill to beat their soft guidance with 4.8%, Nvidia is now expected to deliver at this level. The new guidance is 43B$ for the second quarter of 2025, representing 9.4% growth.

While the Blackwell introduction likely has been frantic, the top and bottom lines show a company in control. Now, let's examine the middle.

Nvidia has both product and market segments that now more represent the historical configuration of the company than the future. Divisions also function as tools to manage the business and allocate resources. a resource allocation model, and a We will soon see a reorganisation that better represents Nvidia of today.

In Q1, the Data Center and Compute continued to propel the business even higher, while the Graphics segment and the smaller divisions collectively failed.

Jensen and Collette are faithfully running through highlights of all the divisions, although it is more or less a waste of time. Nvidia is the Datacenter group with a couple of appendages.

The same is true when analysing the Nvidia revenue from a high-level product perspective.

In the beginning of the AI boom, both networking featured more prominently from a revenue perspective than now. While I am not disputing the importance of networking and software for Nvidia's success, some insights can be extracted from the decline in revenue.

As most people following Nvidia understand, Nvidia supplies server manufacturers with GPUs for their design and sells their server brand. The Compute section of the business represents a mix of server and GPU, while the software and networking components represent sales to the other server manufacturers.

I will explore this more in the advanced part of the analysis, but for now, it is sufficient to observe that Nvidia’s GPU sales to other server brands are likely declining. A higher share of Nvidia revenue is now derived from the Nvidia Server Brand.

The contentious subject of billing by country was elegantly brushed away by Nvidia:

As a percentage of total Data Center revenue, data centre sales in China remained well below levels seen at the onset of export controls.

Without any regulation change, we believe that China shipments will remain roughly at the current percentage. The data centre solutions market in China remains very competitive.

Which sounds a lot better than the Chinese business growth in Q1-25.

While Nvidia stated that the Chinese business was very competitive, it does not look like this impacts its profits. The decline in Taiwanese revenue is also quite interesting. This does not represent Nvidia's ODMs (manufacturers), as this is recorded as cost, not revenue. This means that the other server manufacturers are not experiencing the same growth as Nvidia's server revenue, either by choice or allocation.

It is time to shift gears and better understand Nvidia's business.

Advanced analysis of Nvidia’s business.

In analysing Nvidia’s business, it is necessary to go deep into the financials of several areas of the supply chain. One area of particular importance is the server market. This is an incredibly complex market segment and far too broad a subject for a blog post on Nvidia.

My next post will examine the server market and give more details about Nvidia’s market position.