The Untangling of Intel's Value Triad.

After the revelation of a new strategy, is Intel more valuable intact?

With the Q4-24 result, it is time to write the next chapter in the most epic story in the semiconductor industry: The rise and _______ of Intel Corporation (fill in your preferred prediction on the blank line).

As a corporate dropout, I have the freedom to follow the data wherever it leads—without worrying about whose fancy title or fragile ego it might bruise.

I have been accused (maybe rightfully so) of being tough on Intel, but I believe this is justified. I will keep analysing and commenting on what I learn from the numbers and the communication.

In this post, I will focus more on the Strategic changes dripping from the watertight script and the larger picture. You can never accuse Intel of not having a plan, but maybe the frequency with which it is changed is shifting. Once again, there is a shift.

Many have already covered Intel's financial results, so I will only do that briefly. If you miss some of my regular insights, don't hesitate to contact me, and I will see what I can get you.

Intels Q4-24 result

While I have been surprised by most of Intel's recent results, this one was the most boring in a couple of years, and that is good news. Revenue was 14.26B, up 7.3% QoQ and 7.4% YoY, and it beat guidance by 5.6%.

Gross Profit grew by 9.6% or more than revenue - a good sign. The revenue guidance was -14%, slightly better than the last seasonal drop of 17%.

The gross margin guidance was soft—a decline from 39% to 36% Gross margin in Q1.

The blame was on product mix, increased competition and start-up costs for 18A.

Although Intel is still in intensive care, all the other financial vitals were unsurprising. The machine that goes ping still goes ping.

Unsurprising is the best we can hope for after a quarter where every tech billionaire and their AI groupies have tried to come up with good ways of butchering Intel so they can get to the juicy cuts.

While shareholder value sometimes can be unlocked by divestiture, It is not recommended to do it in an oligarchy style by somebody with another agenda.

So I will dissect Intel, analyst style to find out if there could be a method to the madness and in the process I will explore the newest version of the Intel Strategy. Unlike last quarter, there is only one new strategy this quarter.

The Value Triad

Intel's ambition rests on a triadic foundation: x86, its product portfolio, and Intel Foundry Services. However, this strategy faces formidable competition from best-in-class rivals in each domain. The question will be whether Intel can or will successfully unlock value in these areas.

The best-in-class companies in each of the areas of the triad are incredibly valuable. Just unlocking a fraction of this value will represent an opportunity for Intel to boost its low market cap.

x86: The Crown Jewels

Intel's x86 instruction set architecture (ISA) has been the bedrock of the personal computer era. For decades, it reigned supreme, powering the vast majority of desktops and laptops.

The x86 architecture, with its complex instruction set (CISC) design, offered performance advantages in its early days. However, the rise of mobile computing and the increasing demands of data centres have presented new challenges. The simpler, more power-efficient RISC architectures, like ARM, have gained significant traction, particularly in mobile devices and increasingly in servers.

While x86 maintains a strong foothold in the PC market, its dominance is being eroded elsewhere, most notably in the server market. The rise of ARM-based servers, driven by hyperscale cloud providers seeking performance and efficiency gains, poses a significant threat. Furthermore, competition from other x86 licensees, like AMD, has intensified, putting pressure on Intel's market share and margins.

Intel historically held near-total control of the x86 ISA. Still, the cross-license agreement with AMD and, more recently, the licensing of x86 technology to Chinese companies has created a more fragmented market.

The newly formed "x86 alliance," if it can be called that, is less a formal pact and more a shared reliance on the x86 instruction set. Companies like AMD, while fierce competitors of Intel, still contribute to the x86 ecosystem by developing compatible processors. This shared architecture benefits software developers, who can target a large installed base of x86 machines.

The server market is undoubtedly a key battleground for the x86 ecosystem, but the x86 alliance isn't solely targeted at servers. It's more accurate to say that the server market represents a critical front in the broader x86 struggle for relevance. While x86 maintains a strong presence in enterprise servers, the rise of ARM-based processors in hyperscale data centres has presented a significant challenge. So, while the server market is undoubtedly essential, the x86 ecosystem also vies for dominance in other segments, such as PCs, edge computing, and embedded systems. The server market is just one, albeit crucial, piece of the larger x86 puzzle. The real target is maintaining the overall relevance and market share of the x86 ISA against the growing ARM ecosystem.

At the end of Pat Gelsingers' tenure, Intel suddenly started using the phrase “our x86 franchise” more strategically. This coincided with Michelle Johnston’s rise and is undoubtedly a result of the Client group gaining even more power.

So far, there has not been a wider attempt to monetise the x86 architecture. It looks more like the battle cry of the Client division, which can have implications for other areas of the triad. It does not look like it is easy or even possible to separate the x86 from Semiconductor Products (CCG plus minions).

This does not mean that the alliance is irrellevant. Intels top 3 customers accounted for 45% of the overall revenue in 2024 which has stayed consistent over the last decade. No other meaningfull semiconductor company has been able to achieve this.

While the original relationship was based on PC alone, the business has stayed consistent as revenue moved more towards server. Having your top 3 customers comitted to your IP is important - even if only in handshake form.

The Semiconductor Products

During the Investor call, it became obvious that a new market strategy was emerging. Maybe it is not so much a change in what markets to address, as a signal that priorities are going to change.

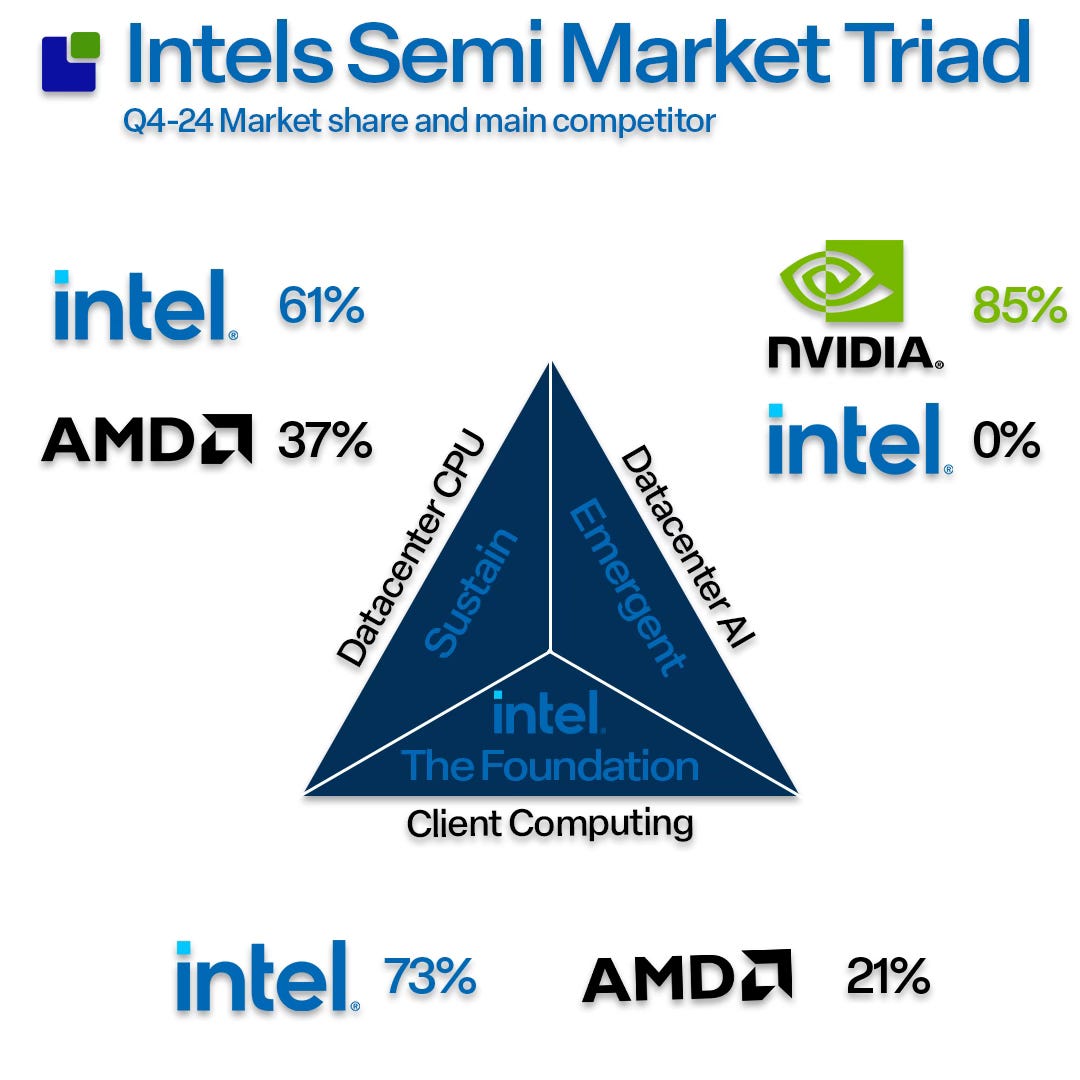

The company is now broadly recognising three market segments. Client and Datacenter processing split into traditional CPU and AI workload.

While this was also the major focus areas before the “Q4-24 Version 1.0” strategy it represents a much clearer market strategy than the normal Intel version “Why can’t we focus on everything? strategy.

Gone are the pretence that the rifraf divisions count anymore (they never did and they never will). It is now all about the x86 franchise in both the Client and the Datacenter markets. And the Data Center group is the junior partner.

The illusion of the Data Center group of becoming slightly independent of the Client Coputing Division by aquiring Habana Labs and their Gaudi processor is gone.

A lot of conversations with my customers as well in regards to what they see is needed to be competitive and to deliver the right product. And so, when I looked at that, obviously, we have our Gaudi product, we're learning a lot from that.

But one of the things that we've learned from Gaudi is it's not enough to just deliver the silicon. We need to be able to deliver a complete rack scale solution, and that's what we're going to be able to do with falcon excuse me, with Jaguar Shores. Falcon Shores will help us in that process of working on the system, networking well in regards to what they see is needed to be competitive and to deliver the right product.

And so, when I looked at that, obviously, we have our Gaudi product, we're learning a lot from that. But one of the things that we've learned from Gaudi is it's not enough to just deliver the silicon. We need to be able to deliver a complete rack scale solution, and that's what we're going to be able to do with falcon excuse me, with Jaguar Shores. Falcon Shores will help us in that process of working on the system, networking

At dawn of the conference call, Gaudi 3, was blindfolded and led to the Intel yard together with Falcon Shores….

Basically Intel have killed all of their current solutions for the AI Data center market making the segment truly emergent.

Before drawing conclusions about the new strategy it is worth looking at the two other established target markets in more detail.

The Foundation

The bedrock of Intels history, business and selfunderstanding has always been as first the only supplier of CPU and later as the main supplier of CPUs to the PC.

x86 was the first CPU that got know outside the industry, so famous it even had its own jingle and logo. After the AMD cross licence deal, Intel was not alone on the markets anymore but the first AMD processors were not really up to the Intel standard. It was more token competition while AMD were struggling to make money on the new business area.

But eventually AMD started to get things right and under Lisa Su, things have accelerated.

Over the last half decade, AMD has gone from 7% marketshare to 21% in Q4-24. The competition is real but Intel is still the top dog with 73% marketshare.

While the PC consumption is more stable than believed to be, the inventory situation plays a significant role in Intels business. This can be seen in inventory position of the top intel customers show together with the revenue of CCG and DCG:

The long Intel decline coincides with a high inventory level at key customers that has slowly been depleted. It also looks like history is repeating itself with the recent inventory increase. However, this time around, it is due to the increasing costs of the new AI servers.