The Upturn or Another Ski Jumping Hill?

The semiconductor companies with a hybrid manufacturing model are guiding up.

I have written extensively about the Semiconductor cycles, and especially this one that smells very different. However, it is a standing joke in the semiconductor industry that all cycles are different and all cycles are the same.

All Semiconductor cycles are different, and all semiconductor cycles are the same.

When we're in it, everything looks different from what it did the last time. This is probably because we have grown accustomed to fat backlogs, bonus checks, and customers covering our dinners.

Indeed, a few of them looked different: The financial crisis and COVID-19 shook the industry, but in hindsight, they both bore a striking resemblance to prior cycles, and we were able to return to work.

The semiconductor associations and large consultancies continue to sell their elaborate Excel spreadsheets, which show the market as up and to the right. At the same time, they tell their clients to ignore that propellerhead from the high north. He was probably dropped on his head as a baby.

To me they say, “Claus, relax - it will be fine.” And maybe it will.

While everybody enjoys being right once in a while, I subscribe to the analyst religion. It is okay to hope for the market to grow, but as an analyst, you cannot love one outcome more than another.

My numbers still whisper “structural change” to me, but I will be the first to declare the cycle "Normal” when I see it.

My update based on Q4-24 data: Ripples and Tsunamis in the Semiconductor Supply Chain still showed the market down for most companies, despite the top-line number showing an industry in a solid upturn.

The problem is that a normal upcycle, like the tide, lifts all boats, and this is not the case right now. Most companies outside the AI revolution and the majority of the supply chain are in decline or flat, at a point in time when they should be growing.

Most of the pain is felt in the Valley of Death, also known as the Hybrid Semiconductor Market, which comprises companies that combine internal manufacturing with foundry-supplied dies.

My Q1-25 analysis of the hybrids reveals a green sprout of hope in the Valley of Death. It is time to investigate what is really going on in the Hybrid semiconductor market.

The Q1-25 result of the Hybrids

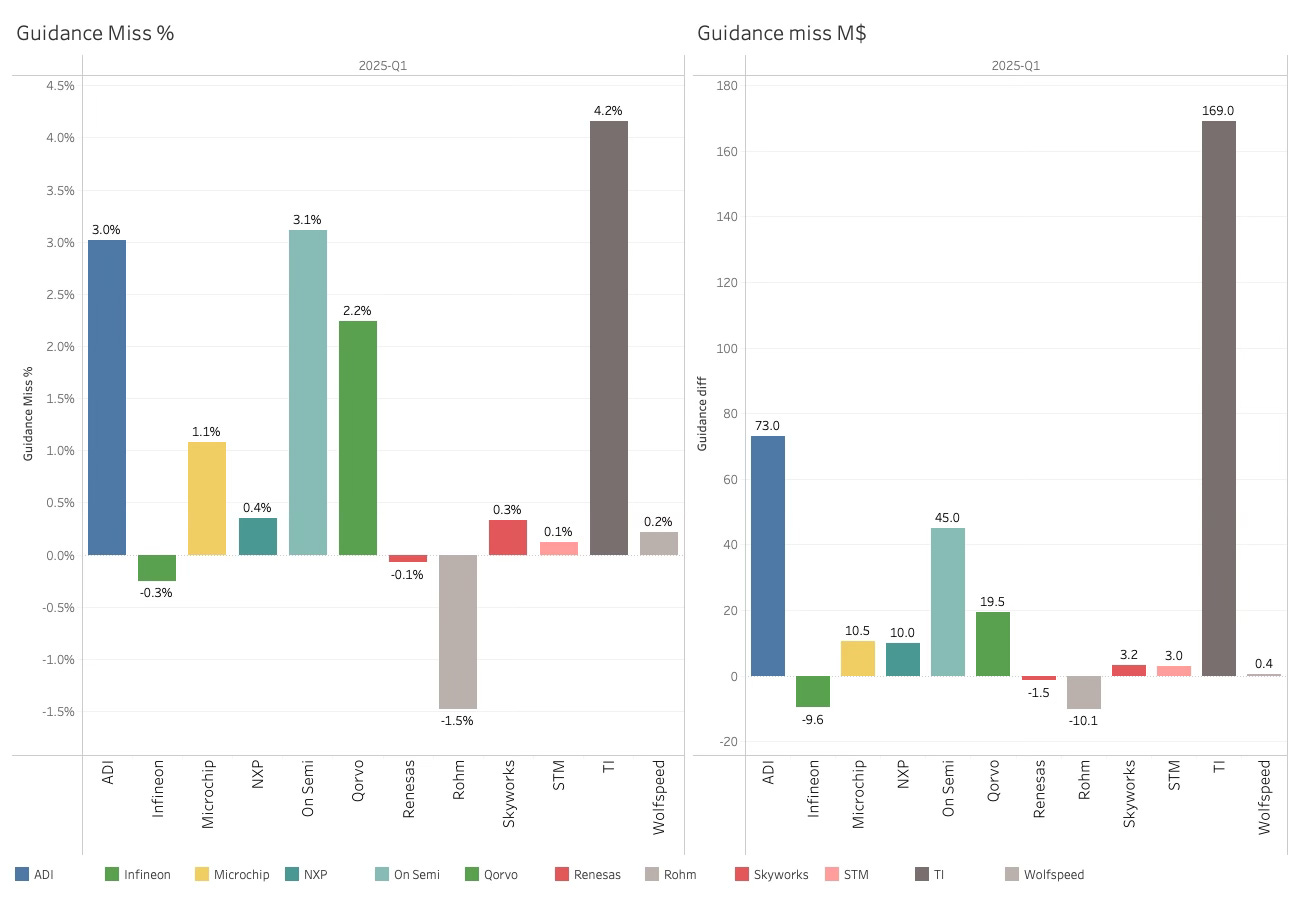

Semiconductor companies usually beat their guidance by a nickel on average. If you haven’t worked in a Semiconductor company, you would think that was a coincidence. However, Wall Street expects companies to deliver or beat their guidance; otherwise, they will be in the doghouse for a long time.

Unfortunately, this makes CEO’s play safe. They will move from: “Are you crazy, we need to sell everything” to “Are you crazy, we need to sell nothing” in a split second once the quarter is made.

In a normal up quarter, you have the full quarter on the books and can typically match the guidance down to the third decimal. As the hybrids currently have a weak backlog, the task was more difficult, but 10 out of 12 exceeded the number.

I am not saying they are playing it safe - I will leave that to others to say and nod.

The bottom line is that the Hybrids delivered a quarter that was significantly better than expected, with an average of 1.4% above guidance.

The TI number was firm, but mostly down to a benefit not included in the original guidance. Without this benefit, the beat would have been in the range of +0.3%

All in all, the quarter was as predicted, and all the stock analysts can tick their boxes and return to their models for next quarter.

The Q2-25 Guidance

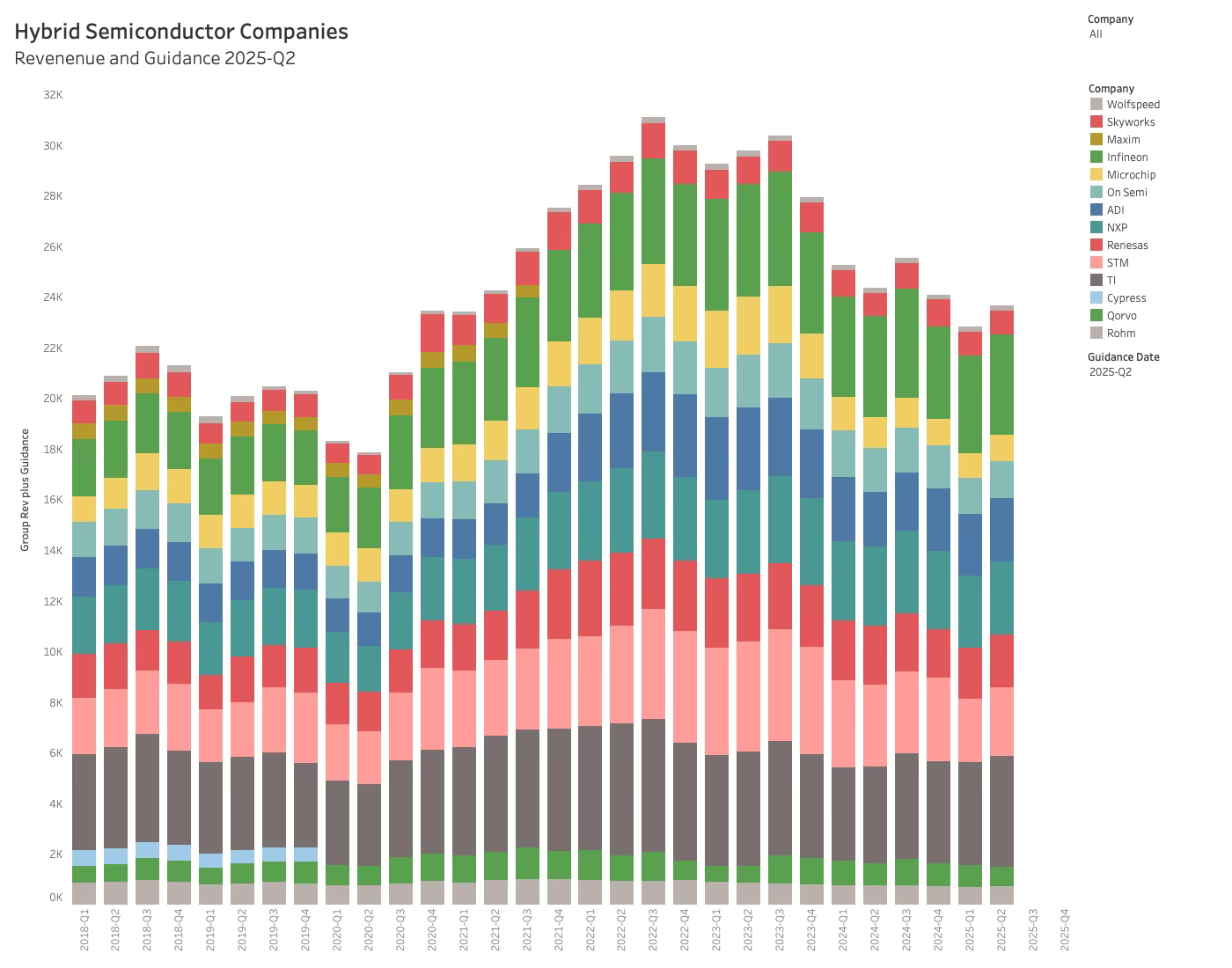

Q1-25 is the worst result in 18 quarters, and we are now 20 quarters away from the last dip. If this is the 2025 dip, the Hybrid cycle has been one year longer than usual. Some associate this with Covid, and there is likely some truth to that, but that ripple should have rung out now.

The last peak-to-peak was exactly 16 quarters, or the standard semiconductor cycle, so something is quite different in this down cycle.

The rumour has it that Wolfspeed is going to file for Chapter 11, which, if you follow their financials as I do, is an excellent idea. The last time I recall a semiconductor company filing for Chapter 11 was more than a decade ago, not during an economic upturn. This shows that we are living in interesting times, rather than a rerun of the last cycle.

The new guidance for Q2-25 hints at an upturn, or it could be another ski jumping hill teasing the hybrid companies.

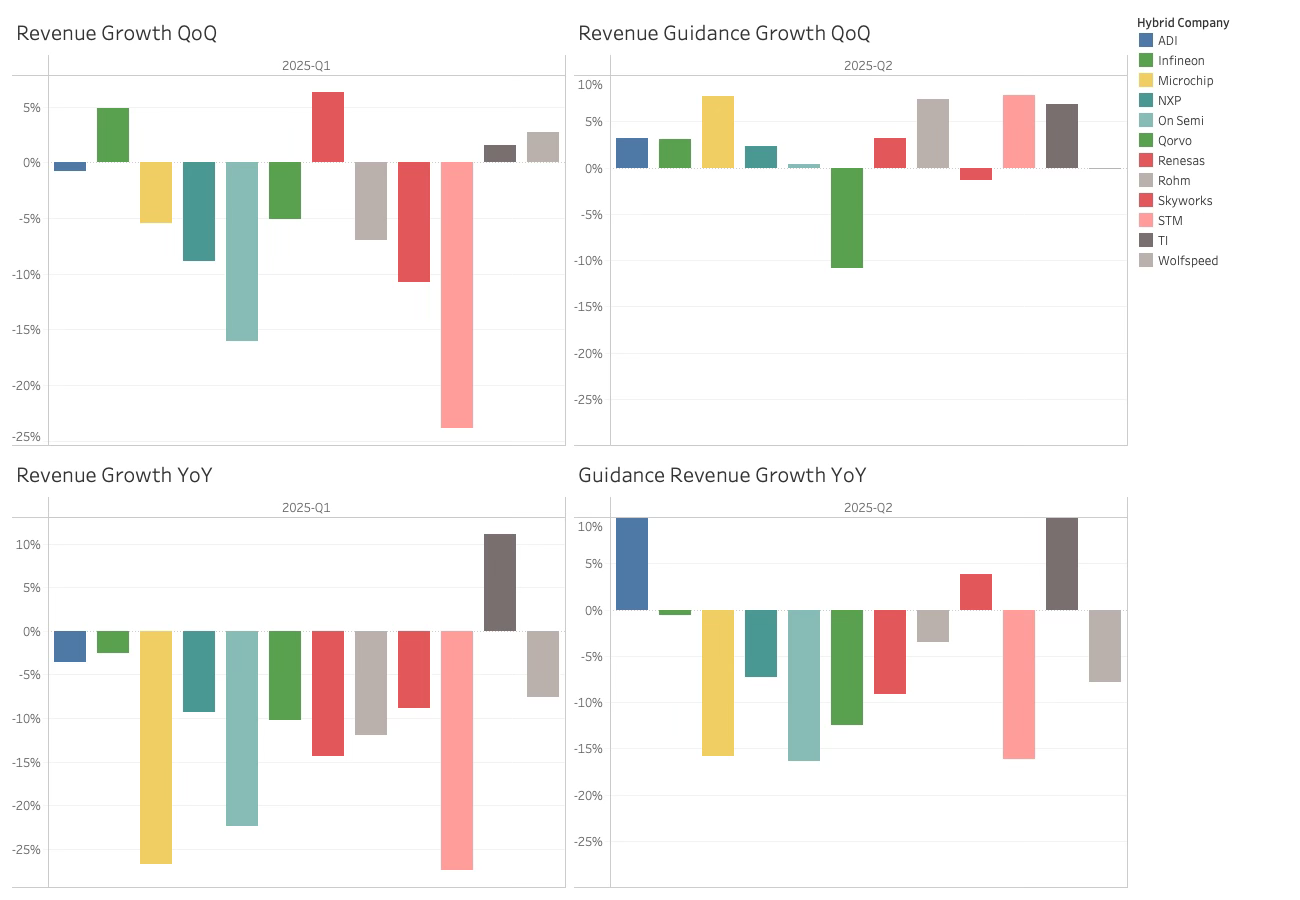

The overall quarterly result growth and the guidance growth can be seen below.

On average, guidance is up 3.6% over the last quarter and down 2.9% compared to the same quarter the previous year. While this could be the upturn, we are still in the flatlands. The consensus is broad, though, with 9 out of 12 companies guiding up.

Only TI and ADI are expected to return to annual YoY growth in Q2-25.

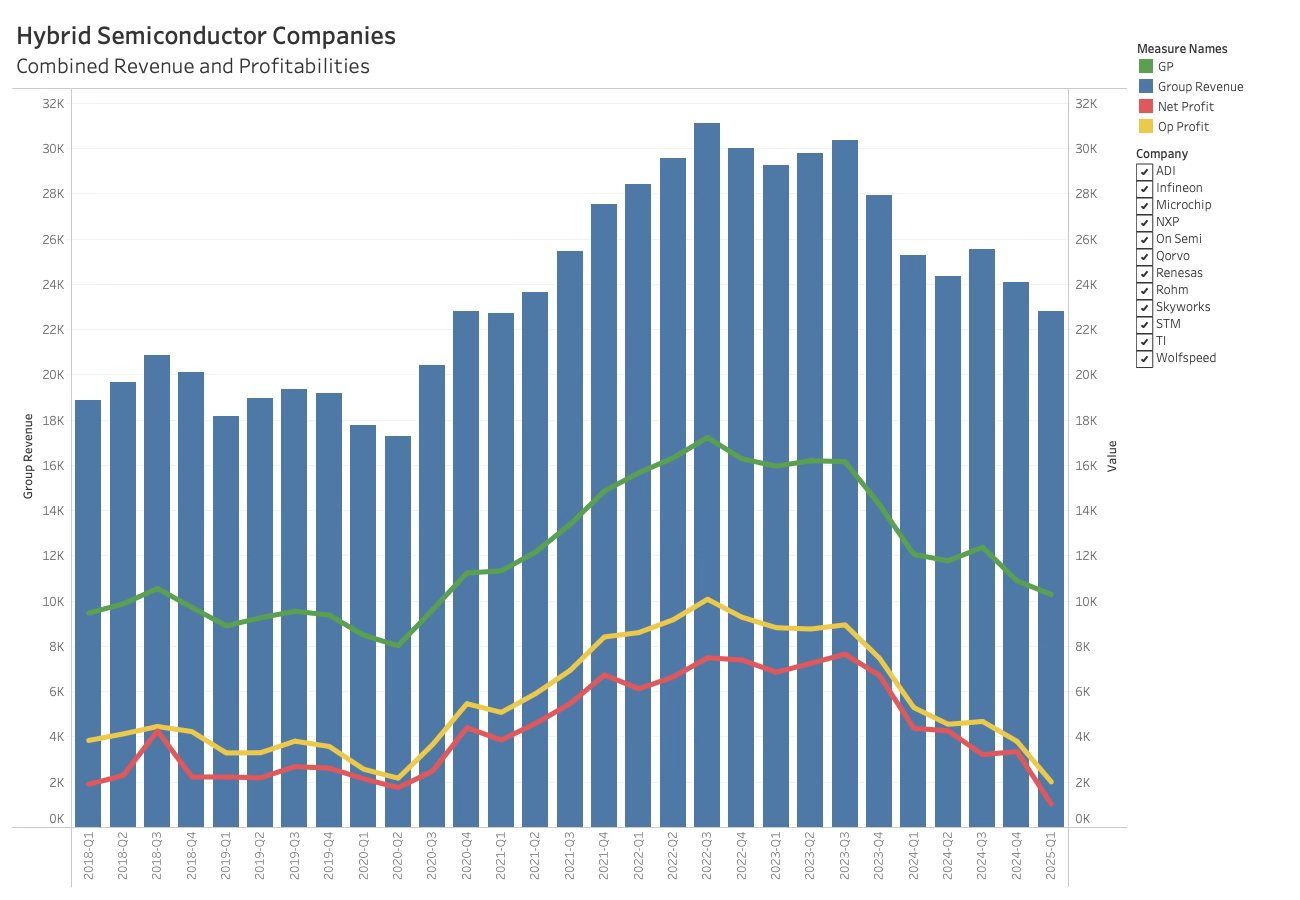

The profitability chart shows that Q1 2025 was another very challenging quarter for the hybrid companies, and many are taking corrective actions as a result.

The sentiment

Despite the overall positive guidance, the optimism was muted, reflecting the uncertain political and macroeconomic situation. The Infinieon call was the most informative, as it usually is. Germans almost love facts as much as I do.

“The foundations for a cyclical upturn are laid - in principle. We are cautiously optimistic about a modest recovery in the 2nd half of 2025, but mumble mumble tariffs, macro, mumble down F25 over F24.”

I know my German neighbours are usually cautious, but this is adding a belt and a parachute to the lederhosen suspenders. We are given no real colour on the next two quarters outside guidance. When I am finished mocking the great people of Infineon, this is a perfectly fair way of describing the current market situation: a feeble upturn threatened by tariffs, which I view as one of the structural changes to the semiconductor industry.

By market, the automotive industry was generally considered the strongest, with STM experiencing a weaker environment due to the European market, and Renesas facing similar challenges in the Japanese market. On Semi saw no growth outside China.

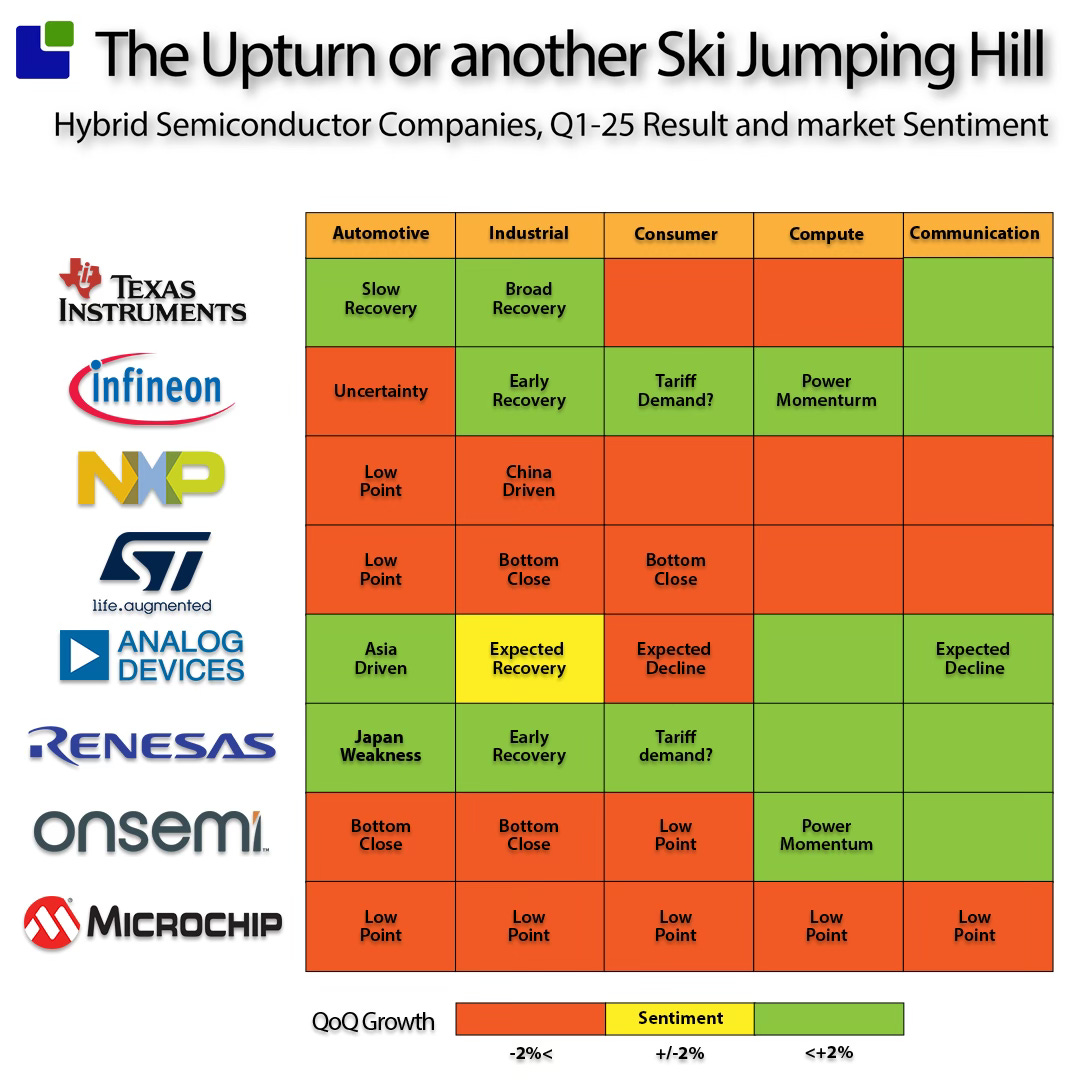

The overall Q1-25 result from a market perspective is presented below, along with the Q2-25 sentiment, which is also shown below.

Overall, the sentiment aligns with the general guidance for Q2-25, a cautious declaration of the bottom in most markets, with considerable reasonable tariff and macroeconomic padding.

It is time for a deeper analysis of the business of hybrid semiconductor companies to find more evidence of a structural change or a more normal recovery.

Hybrid Capacity Analysis

One of the structural changes I observe in the market is the shift from investments being driven by economic and financial logic to political logic. Some hybrid companies have secured funding for capacity that they might not have otherwise constructed if they had only considered the market situation and outlook.

A good starting point for a capacity overview is to analyse the combined inventory of the Hybrid Semiconductor companies.