As the semiconductor industry has grown to become one of the leading actors on the geopolitical stage, it is no longer solely driven by financials.

The four-year boom-bust semiconductor cycle was created when massive investments in fabs were made during good times and came online during bad times.

While this mass psychosis was insane for an outsider, we all knew how to save our bonus checks, as they were either nonsensical or nonexistent. As Semiconductor employees, we had seen it before or knew somebody who had, so we knew the drill.

The cycle also included Semiconductor suppliers, particularly Semiconductor tool suppliers. As everybody built fabs simultaneously, they also needed to be tooled simultaneously, so the semiconductor cycle encompassed the entire supply chain.

This changed as the US “suddenly” realised that the massive and decades-long Chinese investments into a local semiconductor industry could become an issue of national security.

What started as a military project later became the US Chips Act, which encouraged Semiconductor companies to build fabs on US soil. This was coordinated with a barrage of embargoes aimed at limiting China's access to the most advanced tools and processes.

A big carrot and a big stick suddenly changed Semiconductor business models, and investment plans based on financials had to be changed to rely on subsidies and circumvent embargoes (The Immense Changes in the Semiconductor Industry)

The response was immediate and somewhat counter to the purpose of the US government’s actions: Western Semiconductor companies reduced their CapEx investments and acquisition of Semiconductor tools. At the same time, China went on a buying spree in Western tool shops (Tools for Dips and Chips)

While the outcome could be predicted, the US Government responded with even more draconian embargoes (Small yard, even higher fence) to move the needle.

A couple of years after the Chips Act was ratified and a couple of weeks after the last embargoes, it is time to assess the Semiconductor Tool market and seek insights that can predict its future direction.

Everything in the semiconductor industry starts with a tool.

The business climate of the Semiconductor Tool Companies

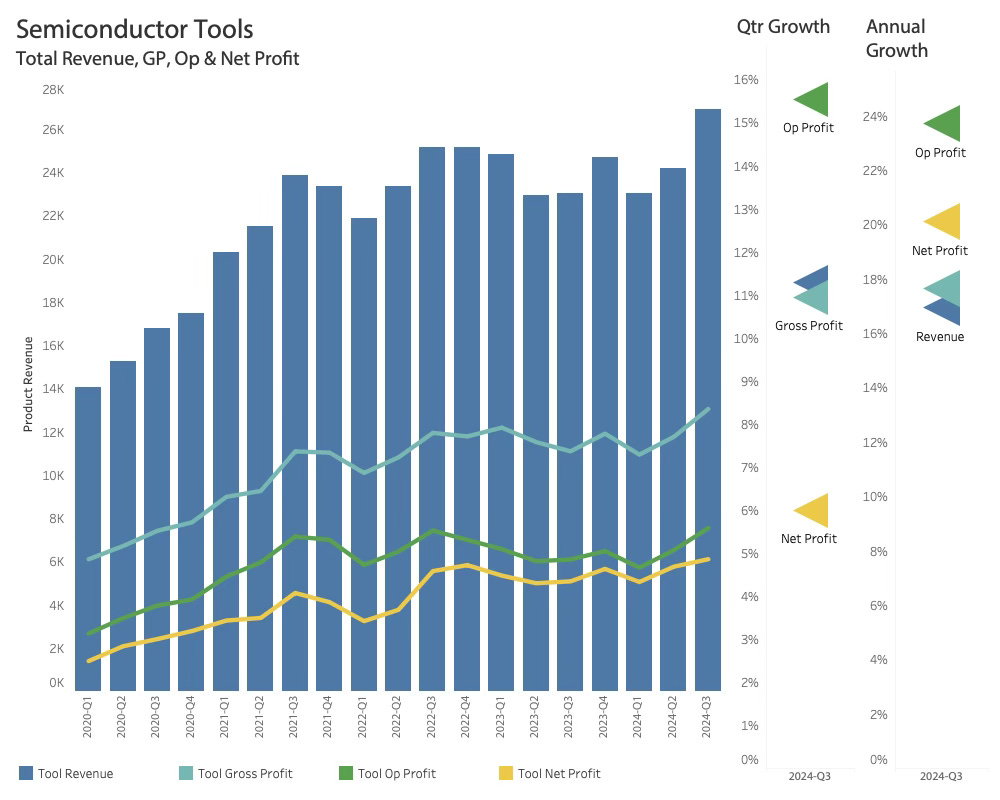

Since the Chips Act was ratified two years ago, the Semiconductor Tool Market has been flattish, with a combined revenue of around $23B$ a quarter. Although the tool companies have complex supply chains of highly specialised components and subsystems, they also work closely with their suppliers and have managed the slowdown without any significant impact on profitability margins. They have all stayed relatively stable.

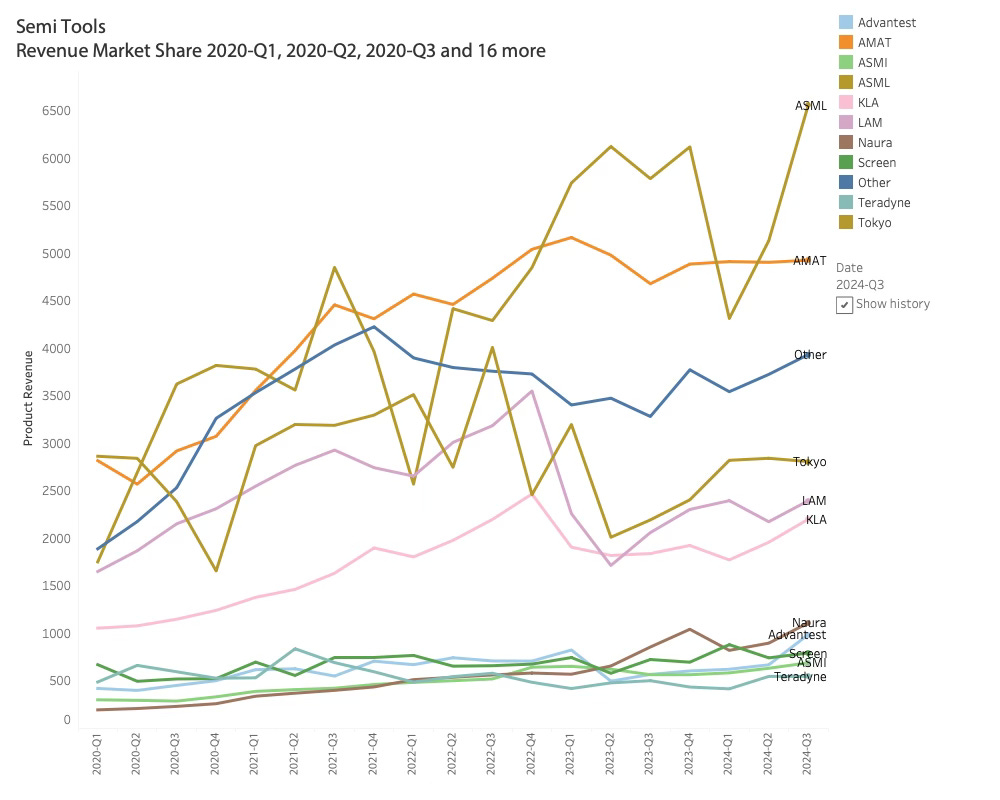

The leading companies are highly specialised and do not compete in the traditional sense. Their business is more about timing than pricing.

This patience impacts the inventory positions of tool companies and their suppliers. Despite flat revenue, inventories have increased by over 50% in the last two years, and most companies have increased their debt.

This has depressed the net profit slightly more than the operating profit margins.

It is also apparent that Q3-24 was a strong quarter, with over 11% quarterly growth and a continuation of last quarter’s increase.

This could signal a turning point for the tools market, but more analysis is needed to call the upturn.

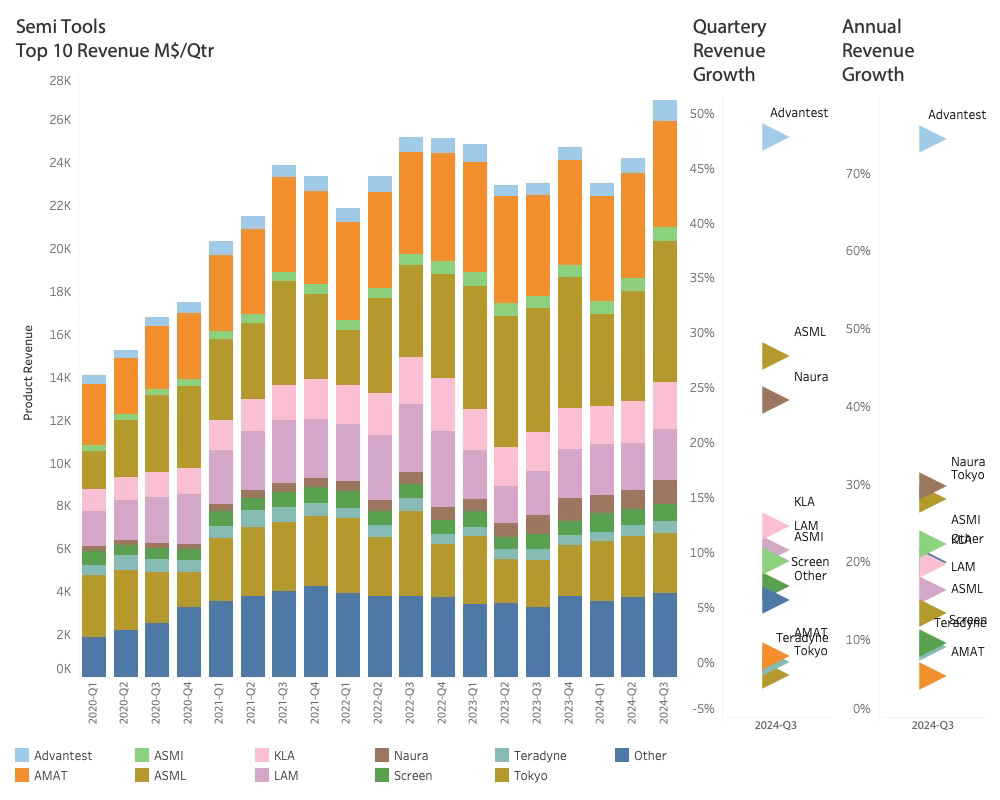

The companies' Q3 results show that ASML had an excellent quarter with a significant increase in system sales. While the new Hi-NA systems are performing well with customers and are expected to generate revenue this quarter, ASML was cautious about the future, citing a decline in China business and a slower recovery in PC and Mobile.

Also, Advantest did well with the large revenue increase driven by the additional need for AI/HPC testing and the higher testing requirement for HBM memories.

The investor presentations were generally positive, as most delivered positive revenue growth. However, all tool companies were cautious about the next period. There is still a lot of uncertainty in the market, which can impact tool customers' behaviour and timing. In general, there was no firm commitment to an upturn.

On a positive note, several of the top 10 customers have initiated a share repurchase program, indicating that the share price is lower than reasonable and share reduction is more favourable for shareholder returns than dividends.

The strong result propelled ASML back into leadership after briefly vacating the throne to Applied Materials.

While more stable, Applied Materials is not on an actual growth trajectory yet.

The company is still experiencing softness in equipment serving the traditional markets and in the leading edge, only one customer is succeeding. No doubt references to TMSC over Intel and Samsung.

Despite the recent gains in Q3, there is not much help to be received from the mixed and cautious messages from the Tool companies.

More information could be provided in the supply network.

The structural situation

Before anybody buys a Semiconductor tool, a semiconductor company must invest. While a Tool revenue dollar is intimately related to a Semiconductor CapEx dollar, there are many moving parts to consider. Despite this, comparing Semiconductor CapEx is a very effective way of understanding what is happening.

The first thing to observe is that the tool revenue did not respond to the decline in CapEx from the semiconductor companies but remained flat. This was due to an influx of Chinese demand for Western tools in response to the embargoes. While we catch the CapEx of the “public” Chinese companies, there is a lot of “private” CapEx (primarily government-funded) floating around that we cannot catch. More on the Chinese business later.