TSMC's business update and launch of a new Strategy

What looks like a modest market expansion strategy is all but modest.

As usual, when TSMC reports, the Semiconductor industry gets a spray of insights that help understand what goes on in other areas of the industry. This time, TSMC gave more insight into their new Foundry 2.0 strategy, which will be covered later in this post.

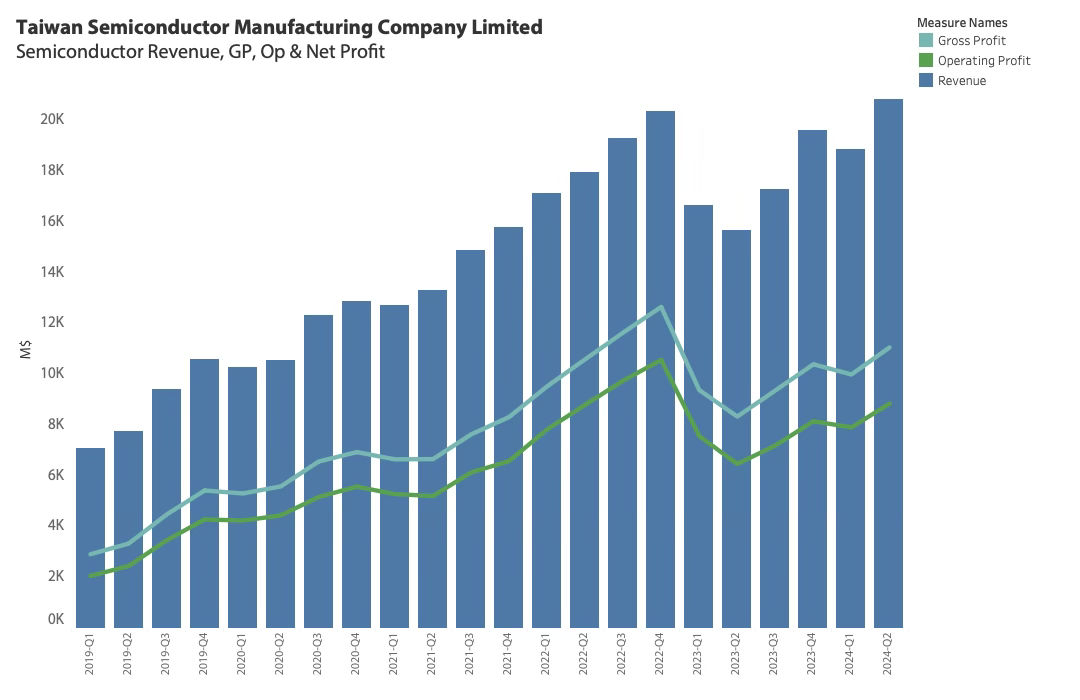

The Q2-2024 result was a new revenue record indicating that the Semiconductor industry is out of the downcycle and ready to aim for new highs.

However, TSMC's gross and operating profits have not returned to the same levels as last time, when revenue was over $20B/qtr. This is a new situation that needs to be uncovered.

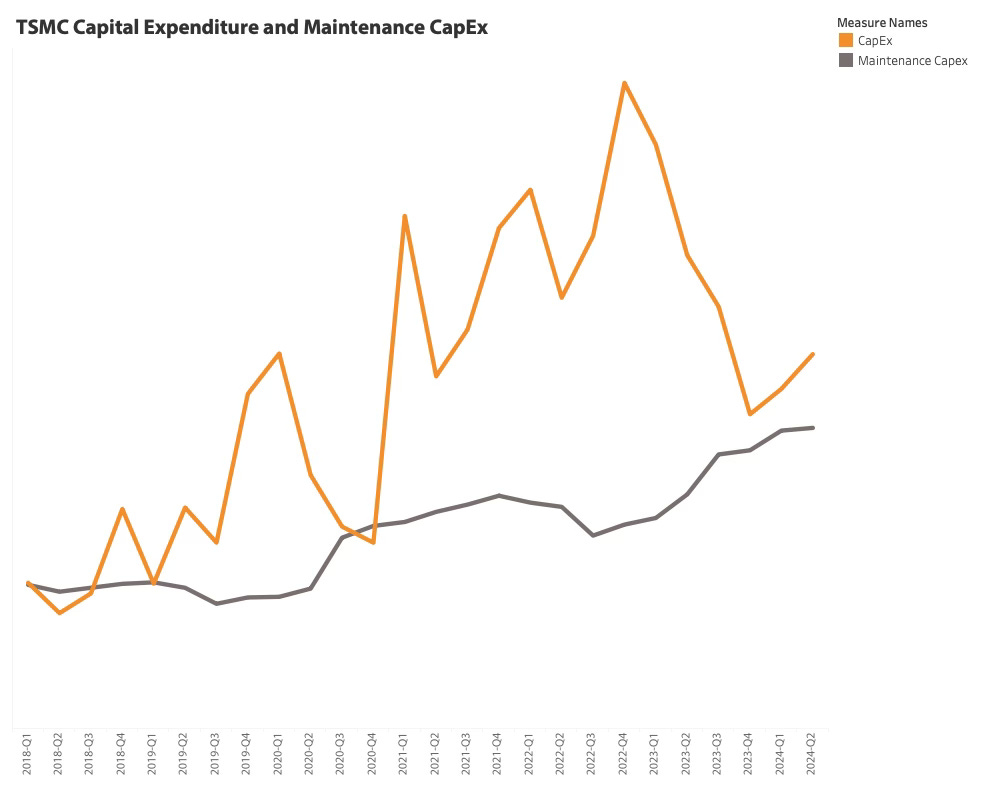

Semiconductor manufacturing companies need to spend significant capital every quarter to maintain and service their equipment. Spending at the maintenance capex level ensures that manufacturing capacity does not decline.

From the end of 2020 until the end of 2023, TSMC made a significant capex investment above maintenance. The company then dropped capex to just above maintenance. This capacity is now flowing online, which has lowered TSMC's utilisation ratio. The TSMC of Q2-24 has a lot more capacity than at the last peak.

TSMC's management did report increasing manufacturing utilisation, which means there is still spare capacity, although it might not be the capacity that TSMC needs.

Other gross margin levers were revealed in the investor call.

While the increasing manufacturing activity combined with the payment of Subsidies and selective price increases lifted the gross margin, there were also headwinds.

Inflation is increasing the cost of materials. As Taiwan's largest electricity consumer, TSMC depends on grid expansion to fuel future growth. The investment in new and cleaner electricity is increasing electricity prices.

Also, the higher operating costs of the future manufacturing facilities in Arizona and Kumamoto would negatively impact gross margins.

Lastly, the company mentioned the conversion from 5 nm to 2 nm. It was earlier indicated that this was only Apple, but now it looks like TSMC is under great pressure from more of its HPC customers to migrate to 2nm.

Migrating customers takes time and effort, and it also takes time before manufacturing is sufficiently stable to generate good yields and become economically viable.