While Intel’s management is busy securing their jobs through investor relations with the US government, the culling of the headcount is coming to an end, and a new chapter (or culling) can begin.

The latest headcount reporting, conducted after the earnings call in July, showed that a significant amount of “Our Greatest Strength” had not left the company.

It is safe to assume that most employees now know whether they have survived this round, but the information has not yet been reflected in the reporting.

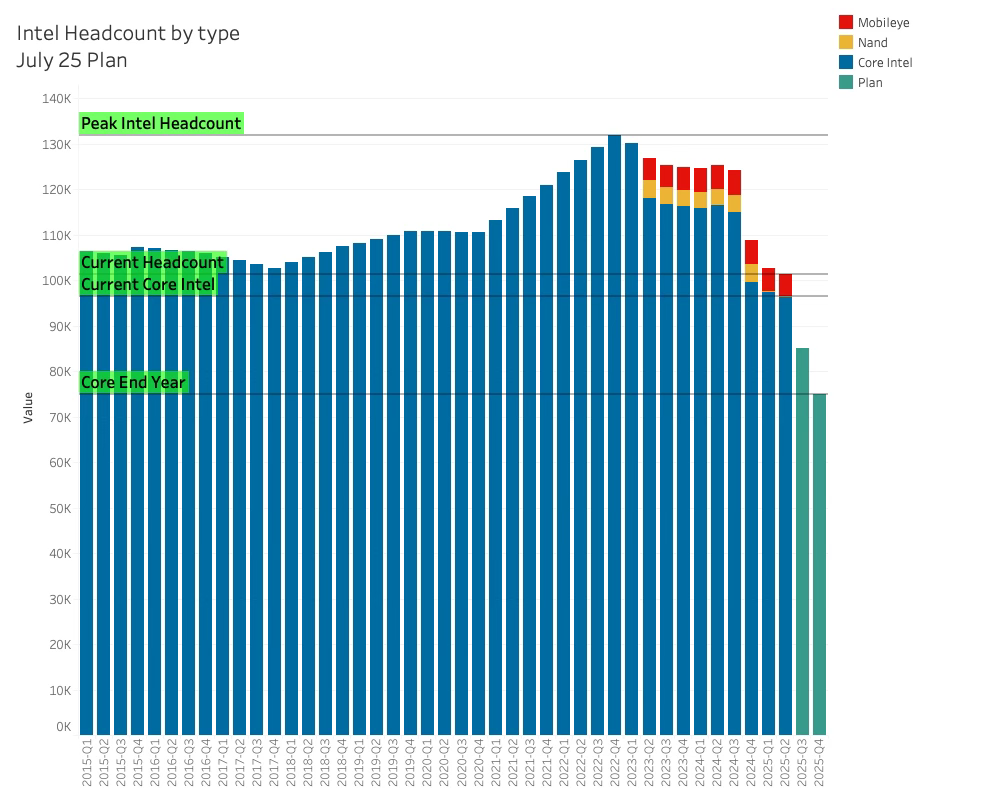

The last count was 101,400, including Mobileye, and the end-of-year target is 75,000, likely excluding Mobileye.

US semiconductor employment has declined by approximately 25,000 people since the peak, mirroring the decline at Intel. The latest numbers from July 1st suggest an attrition rate of 2,200 jobs a month, mainly due to Intel. This is about to decrease further.

Despite touting its American heritage, Intel has around half its employees outside the US, but this is likely to change as companies shift from serving their stakeholders to serving the nation.

Companies (a dusty document in a lawyer's filing cabinet in Delaware) have to become patriotic.

Over the last couple of weeks, the job openings data from Intel suggests that the culling is over and a new chapter can begin. Over the past five weeks, the number of job openings has increased by 53%, and Intel has surpassed Broadcom again.

This plot also confirms that Nvidia is and will continue to be too far ahead, as Lip Bu Tan has clearly stated.

Despite the significant growth in job openings, Intel is still some distance away from equilibrium.

The current level of job openings cannot replace the voluntary attrition rate at Intel, which needs to be offset by just over 1,100 open jobs when the company reaches its target of 75,000 by the end of 2025.

As can be seen, the turn is obvious, and the additional jobs posted will begin to reveal the new strategy - both the official bits and the real ones.

While the layoffs have likely affected the US operations the most, the US is also the primary focus of hiring. Sixty per cent of the new jobs posted are in the US. What is also visible is that Europe is history for Intel. While the decisions to kill the projects in Germany and Poland are known, it is now clear that Ireland is also a thing of the past.

Europe accounts for over 15% of Intel's headcount, while the current job openings have dropped to a fraction of a per cent.

Israel still holds on with a share slightly lower than the corporate average, but will likely be a victim in the next round. The backend manufacturing is consolidating around Malaysia and Vietnam, while India is a focus area with the 2nd largest job openings.

The job openings in Taiwan show that it will stay on the Intel map, as will TSMC, as a key supplier.