Wafer Workshops are Waiting for the Wave

Where is the Silicon Foundation of the Artificial Semiconductor Upcycle?

This is not your grandmother’s semiconductor cycle. I have already covered what I call the Artificial Semiconductor Upcycle in several blog posts. This upcycle consists mainly of price and profit increases, and not so much of volume increases.

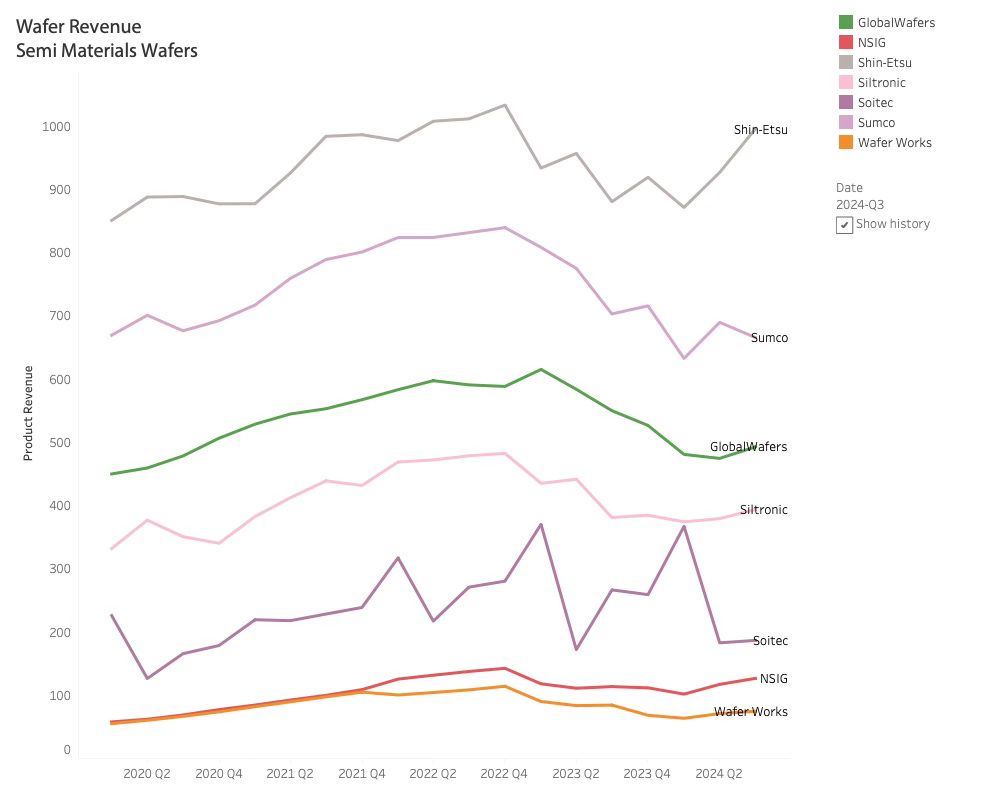

My analysis has now taken me to the Silicon Foundation of the industry: The wafer manufacturers. The people in the Wafer companies sit in front of Bloomberg TV, wondering what is happening. They are watching Nvidia grow over 300% since the WSTS called the upturn 6 quarters ago, and TSMC has grown 50% since then. Despite a slight increase in Q3-24, the Wafer manufacturers have not gained any benefits from the AI boom. Is the cycle delayed, or is it related to lower prices? It is time to take a look at the Wafer Manufacturers.

The Q3 result of the Wafer Manufacturers

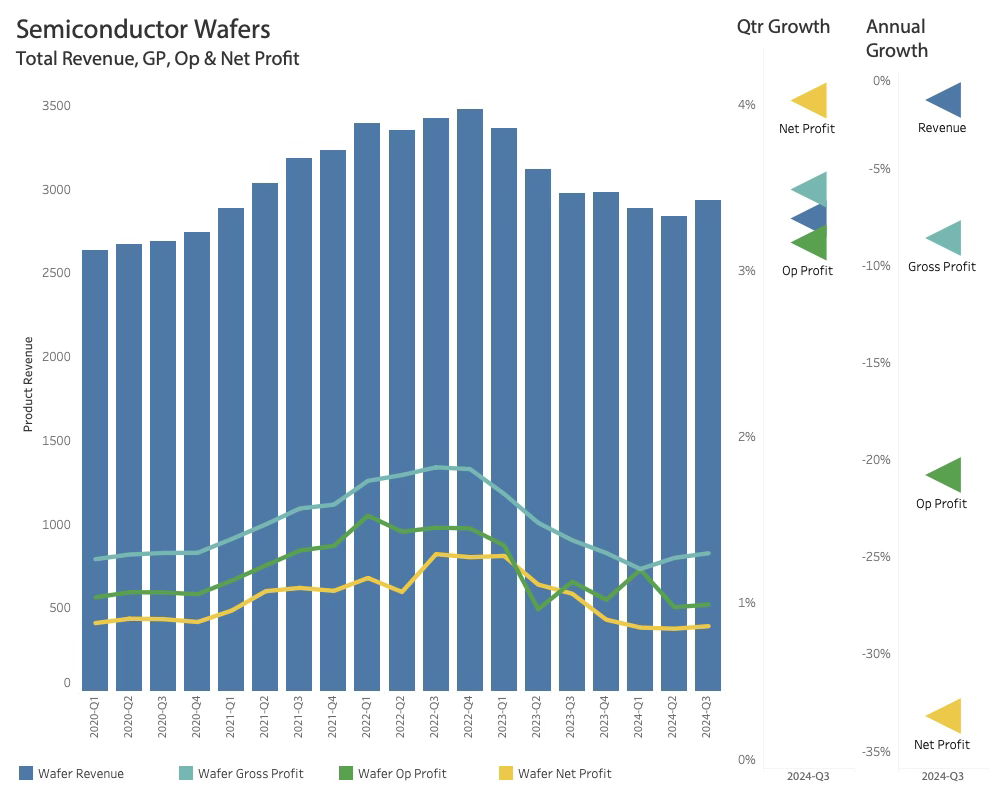

Even though the combined wafer revenue was up over 3%, the wafer manufacturers are still struggling to come out of the bottom of the down cycle. Revenue is slightly down from a year ago and down close to 19% from the last upcycle peak.

Wafer manufacturers expect to remain under pressure in the near term due to ongoing inventory corrections, increased costs, and uncertainty surrounding demand recovery. Rising electricity costs, declining silicon carbide volumes, and variations in the product mix were factors driving the higher costs. Shin-Etsu was extraordinarily affected by a hurricane disruption in its Texas facility.

Despite the apologetic and cautious messages from the Wafer manufacturers, the gross profit is on an upward slope, and both the operating and net profits increased in the quarter. The three profits are still distances away from the last peak, showing that the sector is still deep in the downcycle mud.

While the market for 300mm wafers is cited as strong, particularly those used in cutting-edge technologies like 7nm and 5nm logic and AI, the 200mm wafer market is facing a slump. The 200mm wafer market is reliant on the automotive, consumer, and industrial sectors, is feeling the pinch. While a recovery is expected, it's likely to be slow and dependent on broader economic improvement.

While the Wafer companies cite intense pricing competition, the growing overall margins sugest that the bottom has been reached.

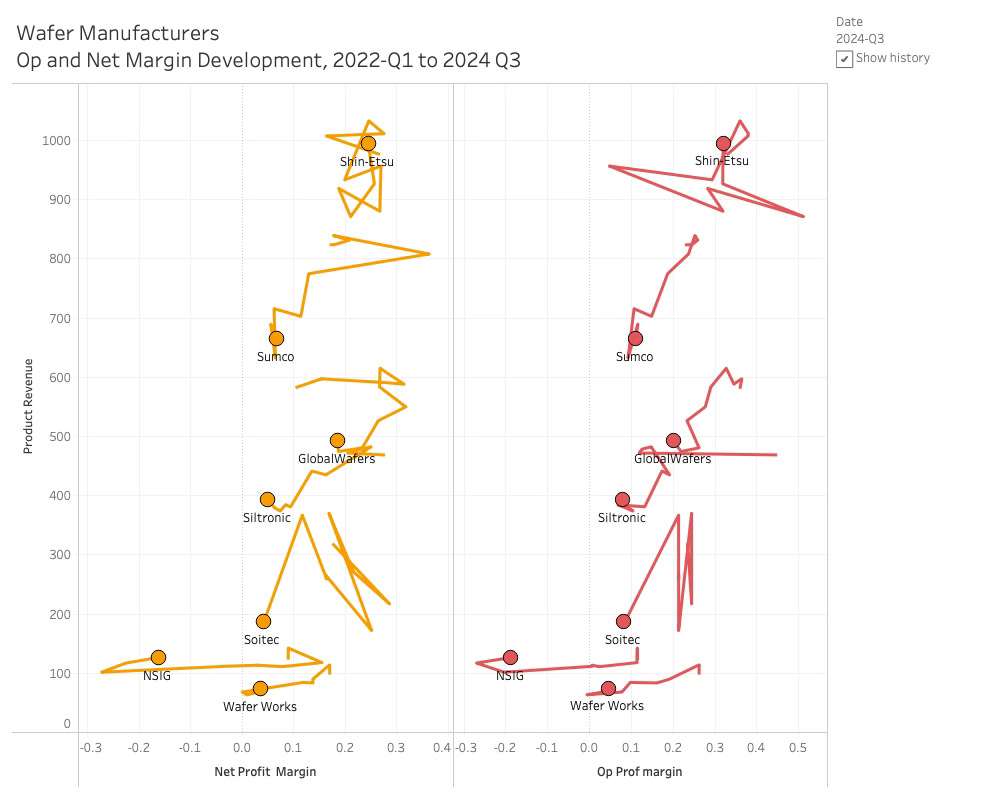

A deeper dive into the margin development reveals the source of the price pressure.

Not surprisingly, NSIG of China has lead the pricecompetitio and basically been selling at a loss for the last year hunting marketshare. The other wafer manufactureres have had to follow the dragon and have mostly followed the prices down although not to the same extrem level. Shin-Etsu has floated a bit around but is basically back to where it began in the beginning of 2022.

It is worth noting that NSIG have increased margins over the last two quarters suggesting the worst is over.

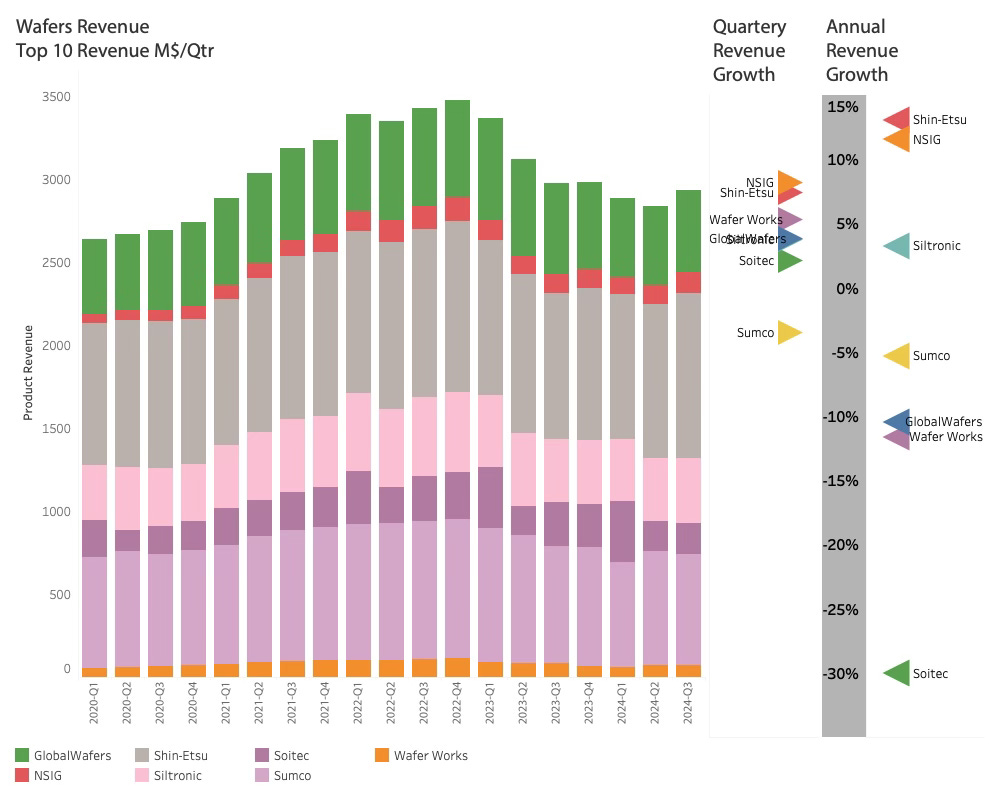

This price battle is going on in a virtually flat market so there has to be winners and losers.

While NSIG of China managed to wrestle 15% growth out of competing in price, Shin-Etsu did the same, suggesting that the Japanses company has managed to migrate its business to the high value segment and refrain from competing in the mud. Slitronic managed to get a little annual growth but the rest had a bad year.

In the recent quarter, most companies grew and while they are catious about the near term growht outlook, they are in general expecting the AI boom to eventually trickle down to them.

There is a lot of concern about the Chinese competition, but as can be seen, NSIG is not really making a dent in the market, other than being annoying to the rest.

Apart from NSIG, there are undoubtedly Chinese wafer manufactuers living in the shadow that want to support the local manufacturing base but to me it looks like they are more annoying than making an impact.

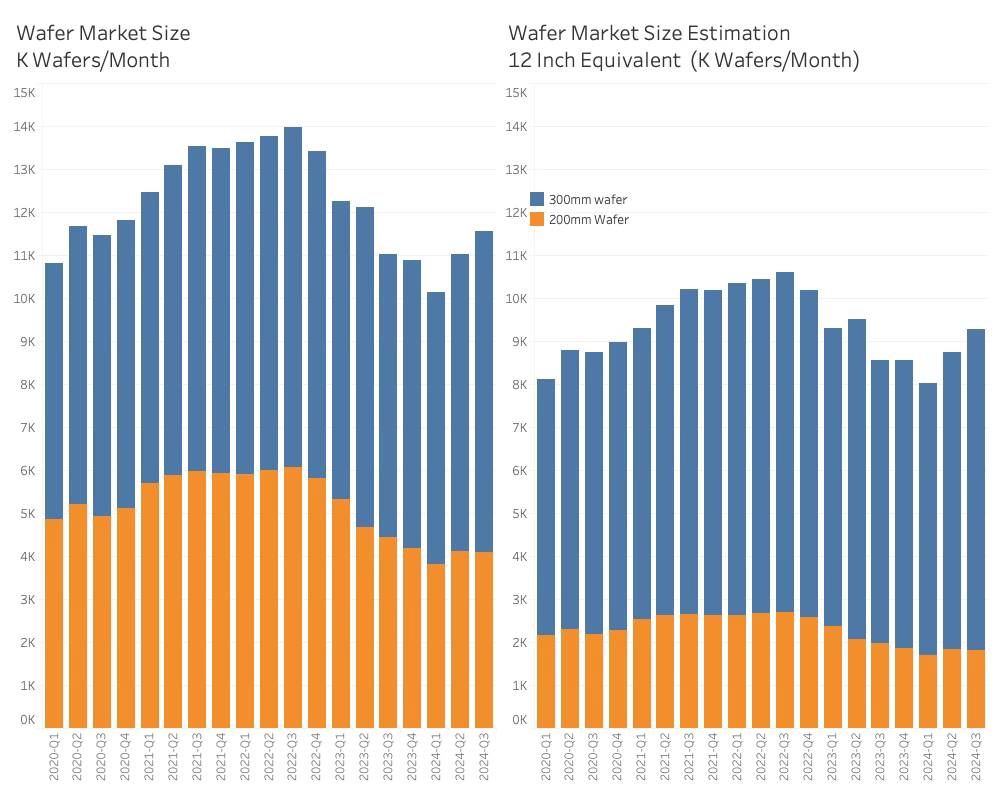

The total market from a wafer units perspecitve can be seen below.

The left graph shows the actual wafers shipped in K Wafers/month, while the right shows the 12 inch equivalent K Wafers/month shipped and is a proxy for the silicon area shipped.

Here it can also be seen that the 300mm shipments are increasing but has been offset by a decline in 200mm shipments. The last couple of quarters have shown growth in shipments despite revneue being flattish so the upturn is starting to show - although the trickle down value is nothing compared to the output of TSMC and Nvidia.

Sumco estimates that the Chinese production is about 1M wafers per month, which is in the range of 10% of the market, half coming from a principal. This matches NSIG’s numbers well and suggest that the Chinese shadow production is around 5%.

While 10% is significant, the real impact is manageble and as the Chinese products are described as subpar, they should not pose a significant treath to the western manufactueres yet.

The AI wave is starting to show. Area shipments are up about 13% YoY but revenue is down 2% in the same period. More area is shipped at less cost. The wafer manufacturers have not been invited to the AI celebration and are still waiting for the good times to appear.

The demand side of the equation

To understand the demand side of the equation, it is important to understand how much of a Semiconductor manufacturing compays purchasing spend is handed to the wafer manufacturers.