Signs of Life Outside Artificial Intelligence?

A Review of the Semiconductor Foundry Market (Q3-24).

The pieces move at different speeds on the semiconductor manufacturing chessboard. While the AI revolution continues benefiting a few manufacturers, the rest are stuck in the industrial and automotive mud, now costing CEO positions. This week, Microchip pulled Steve Sanghi out of “retirement”, replacing industry veteran Ganesh Moorthy, who was found too light after 23 years in the company’s service. Also, the lacklustre EV performance has cost Wolfspeed CEO Gregg Lowe his position in what will likely end the company’s ambitious spending spree for borrowed money.

WSTS and SIA are trotting along, telling everybody about the industry upturn while the CEOs still have a corner office. Praying that the board members refrain from reading the increasingly irrelevant sales statistics that tell more about the AI boom than the general market.

From my recent investigation of the Hybrid Manufacturing market, it is clear that the upturn is still another quarter away. The collective guidance of the semiconductor companies was down by more than 5% for Q4-24 and more than 15% year over year (read more in The Semiconductor Workhorses). The inventory position was improving, but distribution inventory has reached a low point and is rising again.

You might not care about the state of the market, as it will eventually improve, but timing is everything for companies in the Semiconductor Supply chain.

Timing is everything in the Semiconductor Industry.

When the market turn is visible, everybody is out of the start block, and all necessary growth resources become scarce. You need more fab capacity, materials, and employees to fuel the upcycle, only to find out another company has acquired it. You might even need to apply for a job in the winning company as your position might not survive.

Being too early is equally bad. Making bets before the market is ready is dangerous, as the semiconductor business is long-term capital and is cost-heavy.

Even though TSMC’s dominance shadows the foundry market, it is an excellent area to search for additional insights into the state of the semiconductor market and its supply chain. There is much more to see than just TSMC.

The results of the Foundry Companies

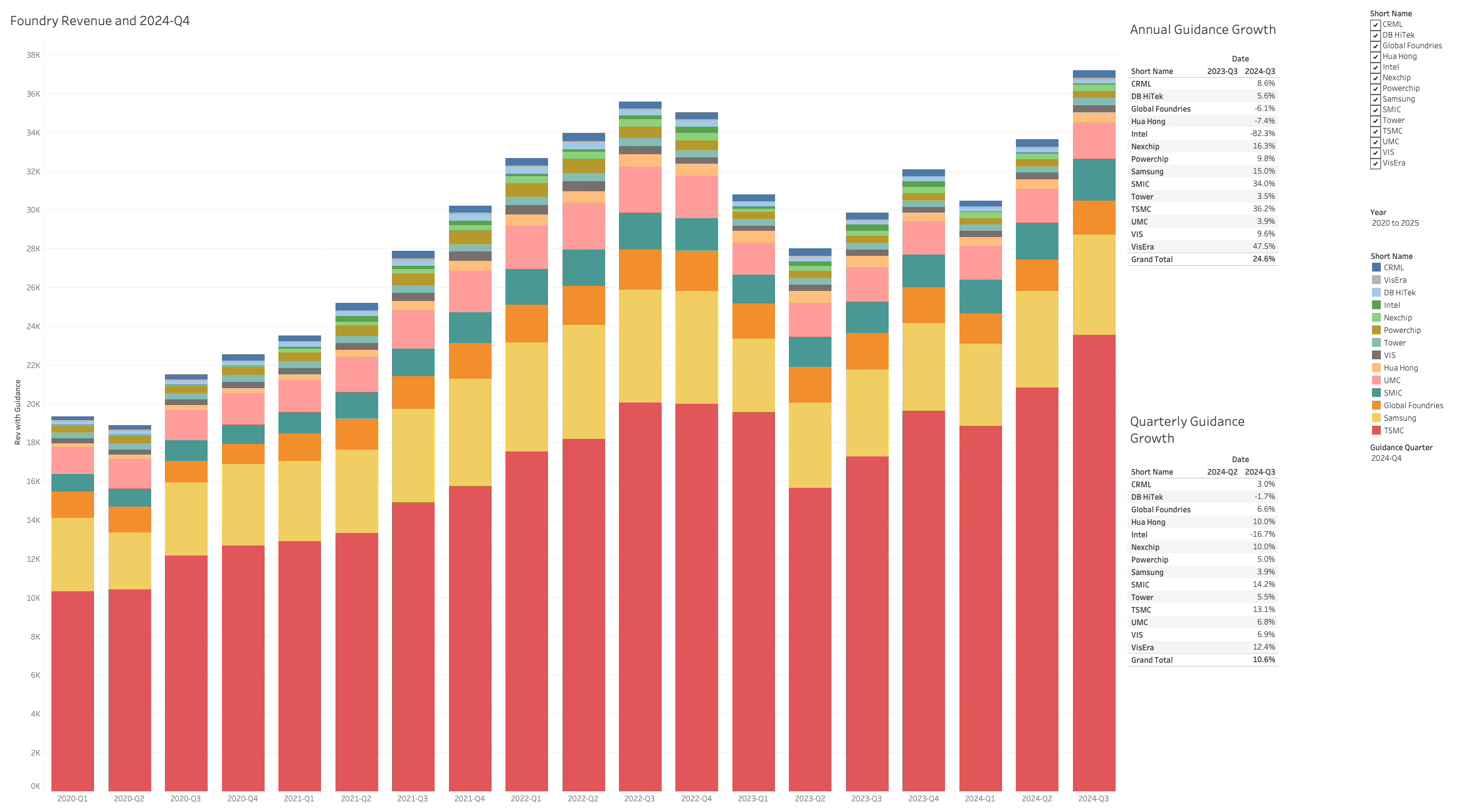

Overall, it was a good quarter for the foundries from a revenue perspective.

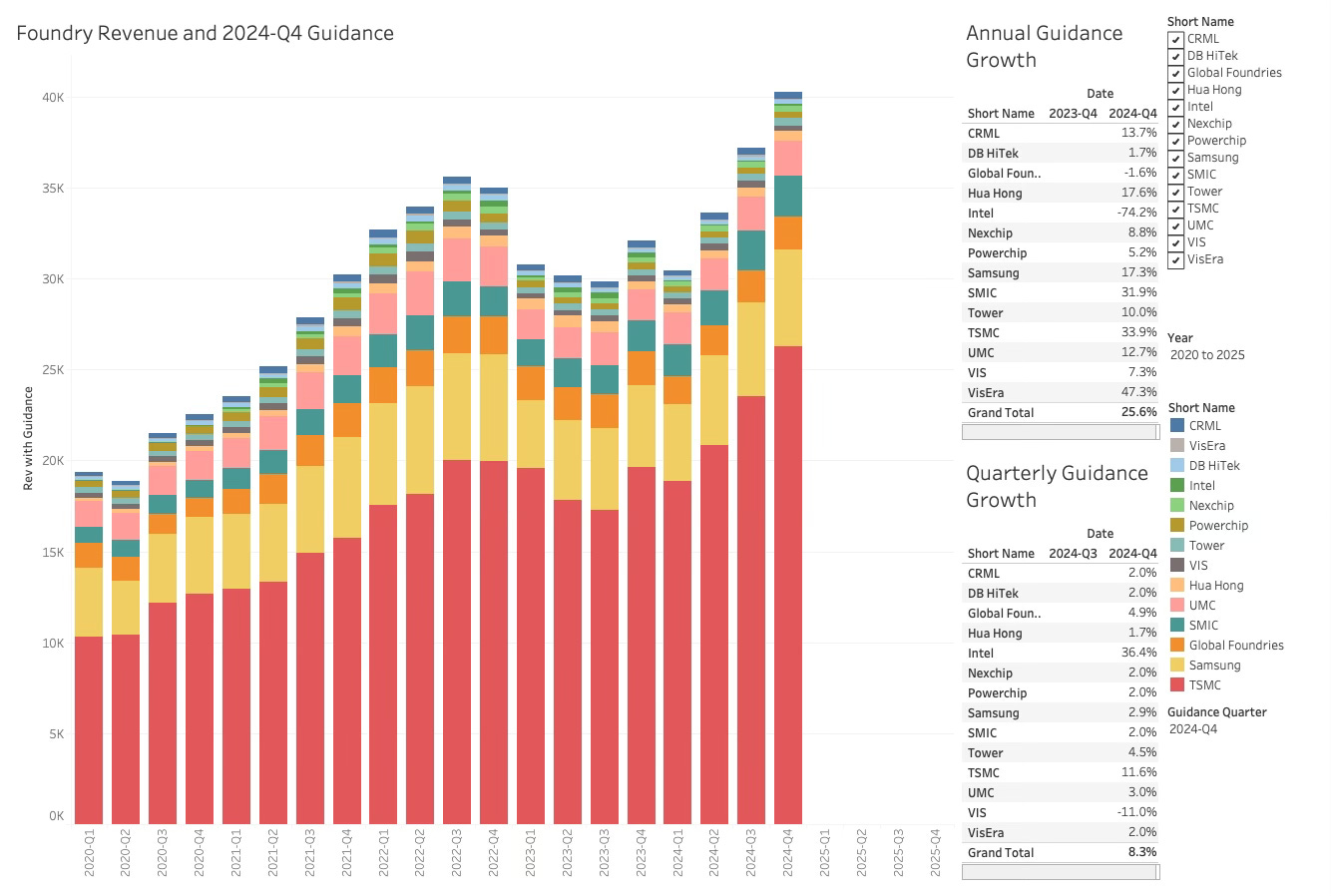

TSMC largely drove the 10.6% QoQ and 24.6% YoY growth, but the smaller foundries also mostly saw growth. Intel is not on the map (we only use their external foundry revenue), and Samsung is not on the same trajectory as TSMC.

Besides TSMC, global foundries and Tower also said they were benefitting from the AI boom.

TSMC and others observed a slow recovery in the non-AI semiconductor market, particularly for PCs and smartphones, attributing it to a weaker macroeconomic environment.

Overall the Foundries are navigating a market in slow recovery over most market categories but it is a delicate balance that is hard to predict and expedites from customers are up. Most foundries are seeing and increse in design wins across most markets.

Profitability

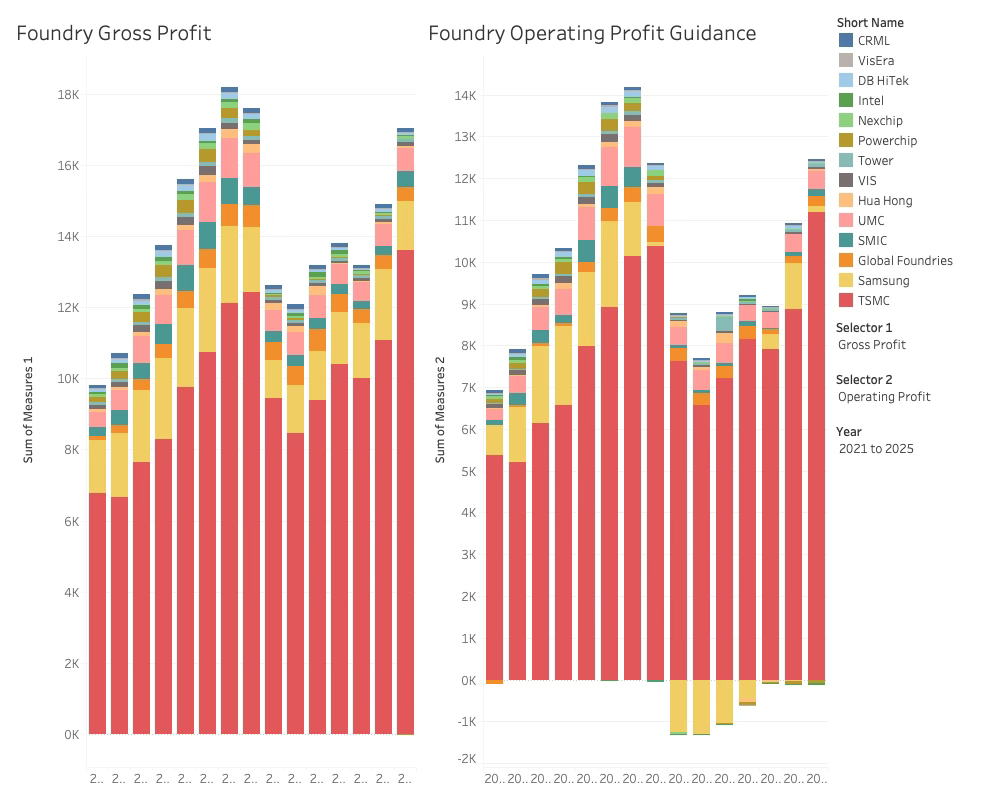

The gross and operating margins reveal that the foundries are not fully recovered except for TSMC. The Taiwanese leader is already much more profitable than the last cycle despite running at a lower capacity than the other foundries. At this point in time, TSMC captures 90% of the operating profits of the Top 14 foundries.

Citing inflationary pressures and rising costs, the foundries are trying to optimise pricing outside long-term agreements and migrate customers to more favourable technologies.

TSMC currently captures 90% of the Foundry's operating profits

Apart from pricing, the foundries are all working on improving operational efficiencies and tightly controlling costs to mitigate inflationary pressures. TSMC, which has a more robust position, continuously works with customers to ensure a fair value capture for both parties (another phrase for selected price increases).

Inventories

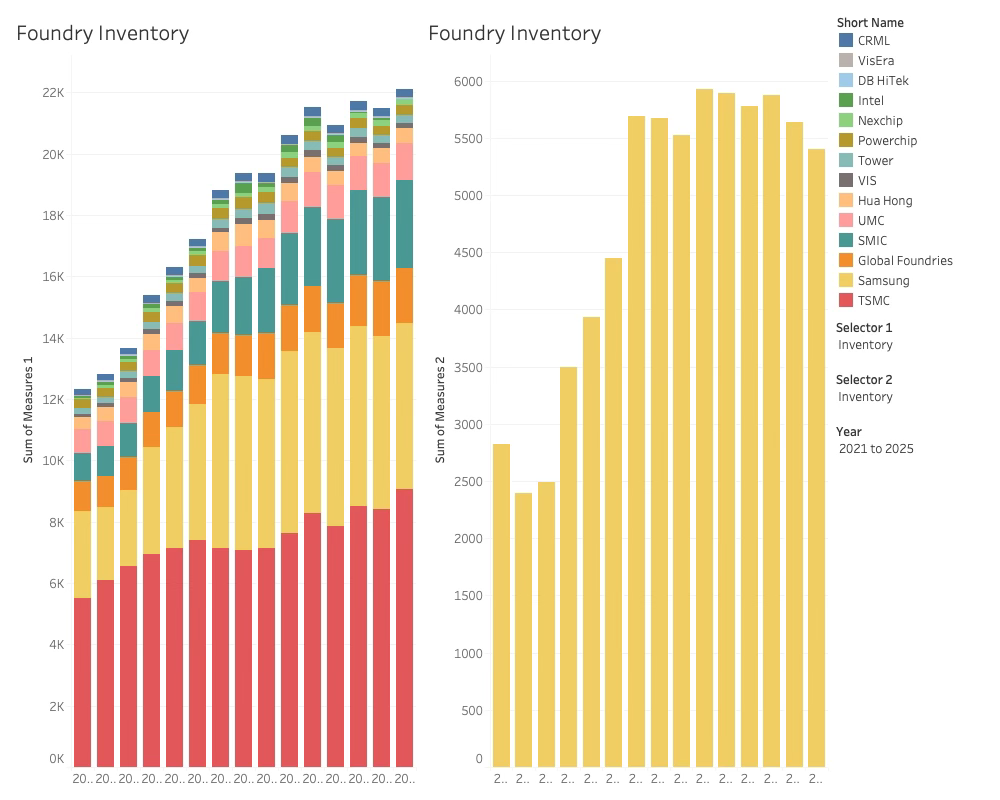

The inventories increased slightly after a flattish period, suggesting an equilibrium supply chain. We will take a deeper dive into the inventory situation in the advanced analysis.

Samsung that have struggled with high inventories saw another decline in Q3-24.

UMC indicated continued improvement in overall industry inventory levels, particularly in computing, consumer, and communication markets. However, customers are adopting a conservative approach to inventory restocking, leading to a preference for rush orders instead of long-term projections. Demand in the automotive and industrial sectors remains weak due to slower inventory digestion. While companies note an overall improvement in inventory levels, the pace of restocking remains cautious.

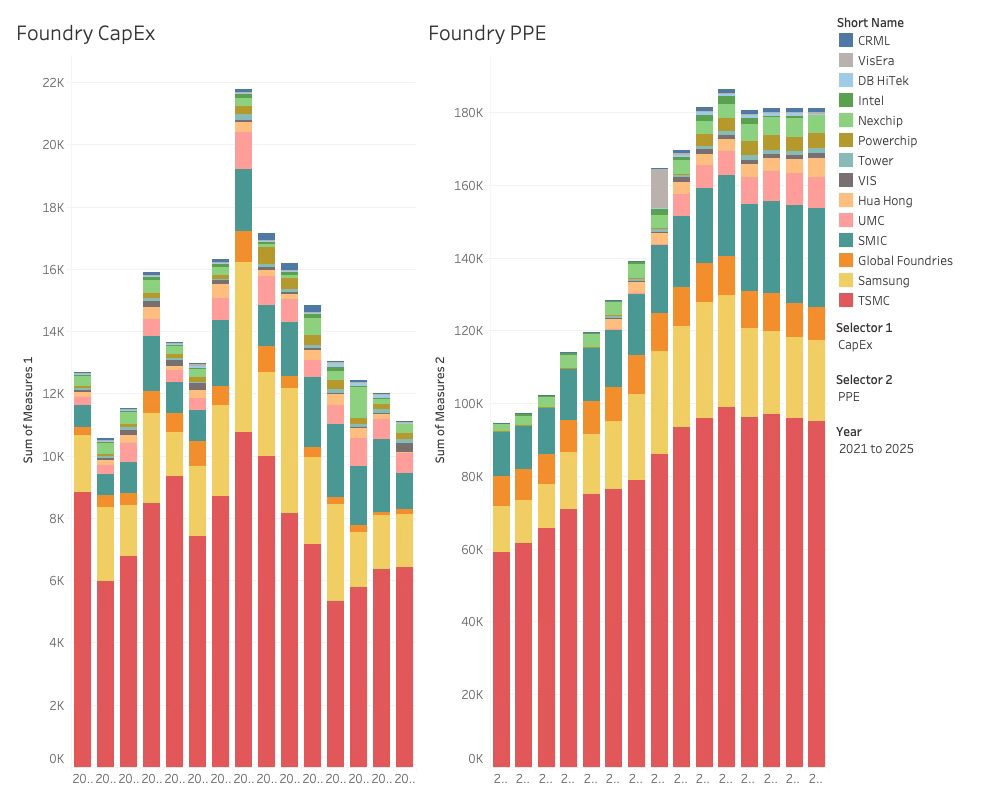

Investments and Capacity Levels

The CapEx continued to decline in Q3-24. Even though revenues were up, the foundries are not ready to start the upcycle spending spree. The current level of CapEx is barely sufficient to maintain the current value of the manufacturing assets, as seen by the flat Property, Plant and Equipment (PPE) level below. It has flatlined for 6 quarters now.

Although property, plant, and equipment are accurate metrics to gain insights into the capacity of a foundry, there is a time skew from an investment being made until you can reap the full benefit of the investment. The advanced analysis will uncover more details about the actual capacity and load levels.

Let us turn the focus to the outlook for next quarter.

The Q4-24 revenue guidance

In our analysis, we assign all of Samsung's non-memory revenue to the foundry business even though the LSI business accounts for 13% of the non-memory business. For the companies that do not give guidance, I use the average industry growth rate of 2%.

Using this method, the following Q4 guidance appears:

The guidance totals are expectedly dominated by TSMC that pulls both the annual and the quarterly numbers up. SMIC actually gave 2% guidance for Q4 but is close to the TSMC annual growth numbers.

This paints a pitucture of the different drivers in the market. TSMC lifted by the AI boom and SMIC by the China business while the rest are a mixed bag of mostly limited growth rates servicing the Automotive and Industrial markets.

While this is not surprising (the expert answer (experts are never surprised by anything)), it is not the same as being confirmed (the analyst approach) so the analysis moves forward irrespective. There will be insights to discover.