The Chips Act's second act

ASMLs Q4-24 result and what it reveals about the Semiconductor Industry

With a postion as the leading company for a vital tool for not only the Semiconductor but more specifically for the AI revolution (no I am not going to mention DeepSeek), the ASML investor call is a key source of information when trying to understand what goes on in the industry.

While there are many good writers covering the details of the investor call and the high level result, I get my fun from diving deep into the data to find out what is really going on in the industry.

While the result is important to cover, it is the details behind the result that matters more to me. That said, lets briefly cover the result before diving deeper (no - not a reference to DeepSeek).

The Q4-24 result

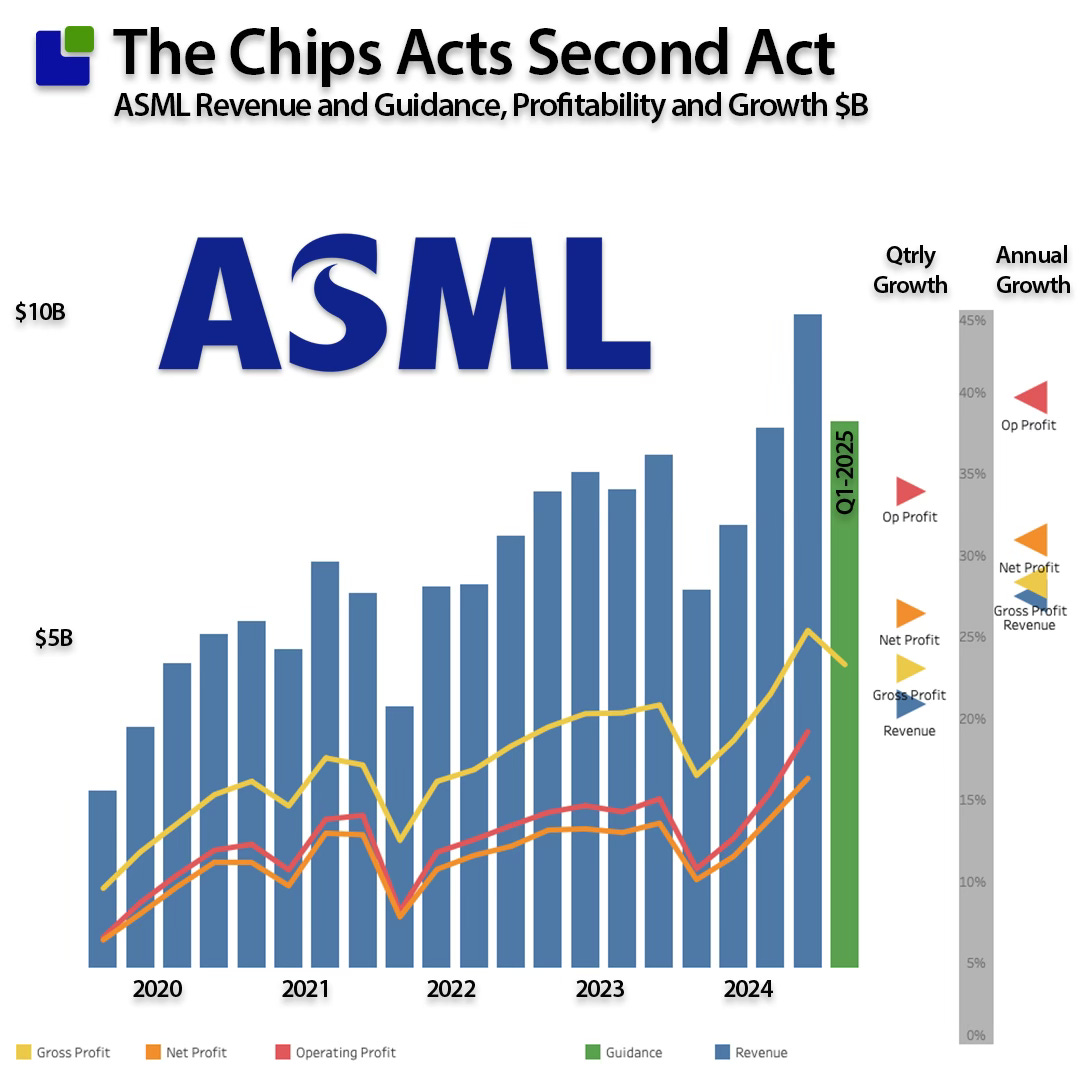

Regarding expectations and beating guidance, Q4-24 was an excellent quarter for ASML. Like the last few quarters, the guidance was again beaten, with 3%.

Revenue was up 21% sequentially in ASML's traditionally strong quarter due to customers' capital spending cycles and year-end budgets. YoY growth was a solid 27%.

While revenue growth was solid, profit growth was stellar. Operating profit growth increased by 34% sequentially and close to 40% year over year.

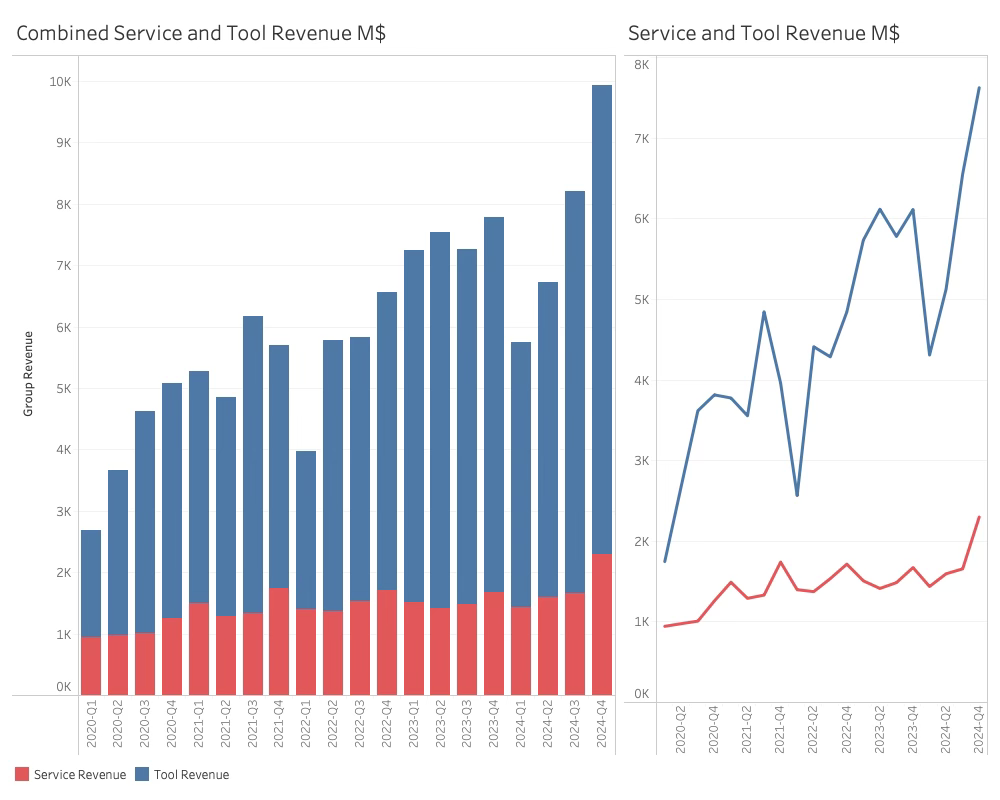

The reason behind the strong profit growth is ASML's service business, also known as the installed base business. It experienced a very strong growth of 60% in 2024, which was attributed to both the service and upgrade sides of the business.

ASML installed base now counts over 1000 systems and the customers are not only requiring maintenance and support but are also investing in upgrades to enhance their systems.

The chart shows that both the systems and service businesses are growing, but the service growth in Q4 is exceptional. While ASML did not offer any future guidance on the service business, there is good reason to believe that it will grow healthy as ASML's customers increasingly buy more complex systems and will need continuous upgrades.

ASML's full-year 2024 performance slightly exceeded expectations against guidance. The company had anticipated that its business would be similar to 2023, described as a transition year.

ASML Guidance

ASML's guidance for the first quarter of 2025 includes net sales between €7.5 and €8 billion and installed base sales of €2.1 billion. This represents a 16% decline over Q424.

The gross margin for Q1 2025 is expected to be between 52 and 53%.

For the full year of 2025, ASML anticipates: Net sales between €30 and €35 billion Gross margin between 51 and 53%

ASML also expects the business to generate between 44 and 60 billion in revenue by 2030, with a gross margin between 56 and 60%.

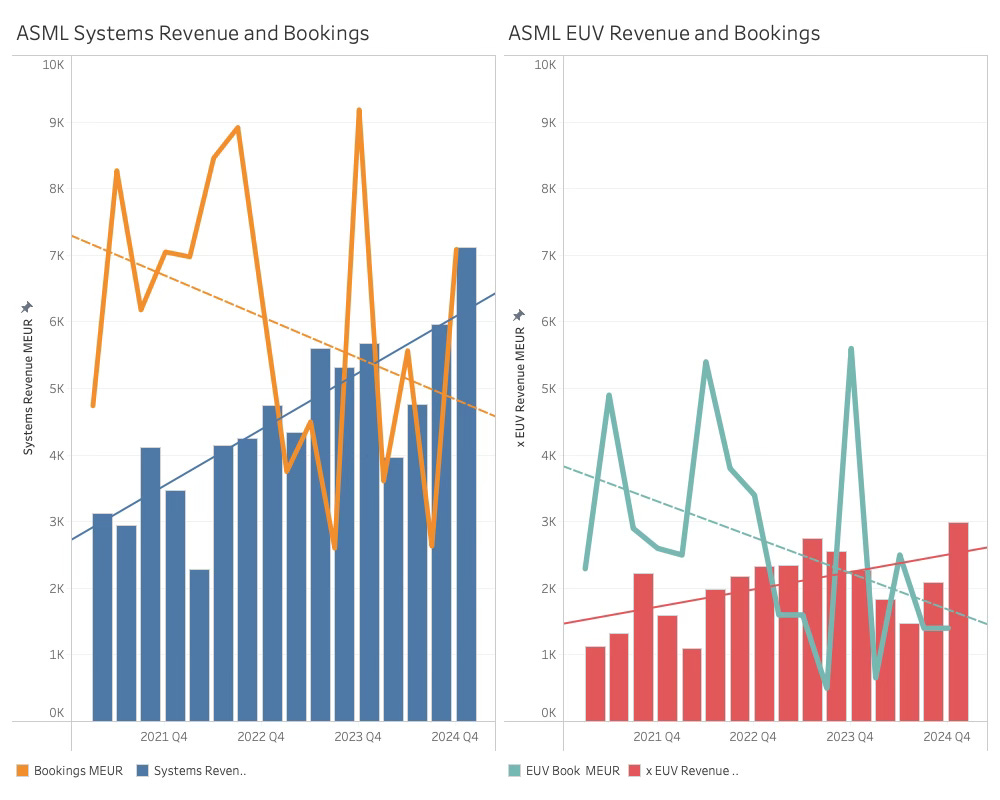

The Bookings situation

Moving forward, AMSL will not provide booking information as the management believes their conversation with customers and communication on the investor calls offer better information than the booking data.

I never get confused by numbers; the step can only be seen as ASML lowering transparency. While I don’t subscribe to conspiracy theories, something always annoys management when they decide to limit public data.

The argument is that the bookings data is lumpy and can confuse investors into seing problems where none are.

Or maybe see problems that are. Plotting revenue versus bookings including trendlines shows the uncomfortable fact that ASML is trying to hide. The bookings trend is down for both EUV systems and the overall systems business when seen over the last 4 years.

ASML might be right that their cotations with customers provide a better view but words are wordsords, and orders are orders. And in my time in sales, I have seen more words about orders than actual orders.

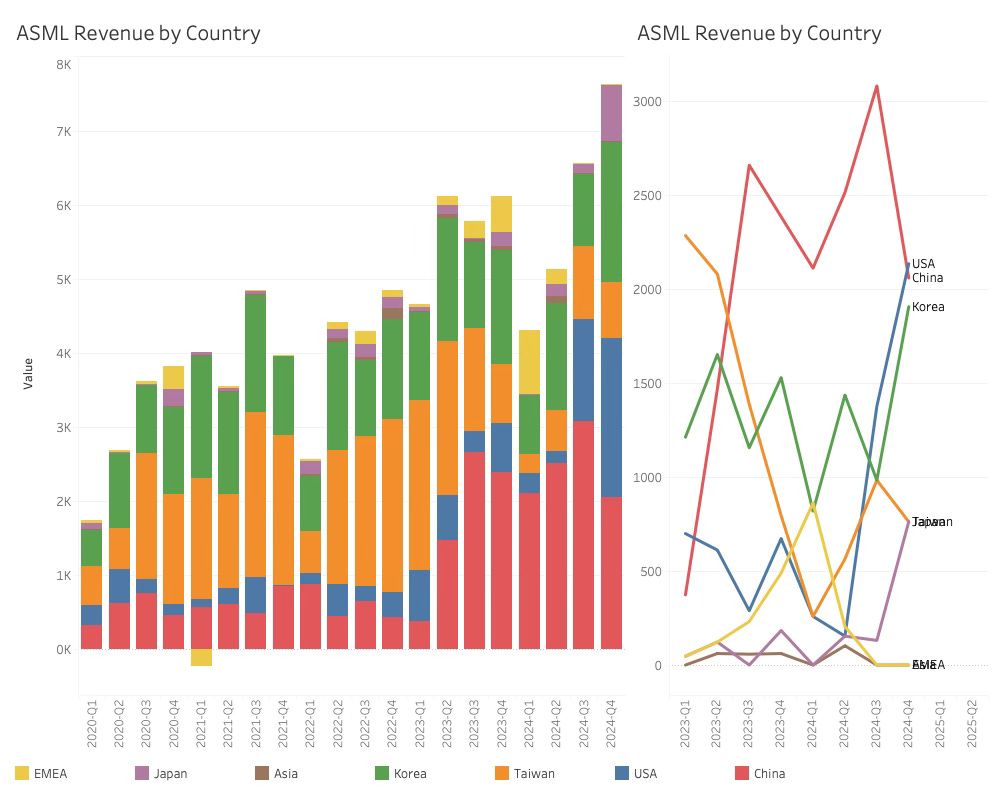

Revenue by country

While ASML revenue by country never fails to generate insights into the semiconductor industry, it was awaited with great interest, given the new US administration's propensity to use embargos and tariffs as invitations to conversation.

Fortunately for ASML, the data was favourable, given the current climate. First and foremost, the US is now ASML's most important market, ahead of China. The last time this happened, I wore a school uniform and was taught Latin.

The main (high-class) problem for ASML is the high level of revenue it receives from China. In 2024, China's revenue contribution to ASML was notably substantial, accounting for 41% of system sales. This is a significant increase from the 29% reported in 2023.

Chinese revenue is now trending towards the 20% level, as predicted by ASML. From 47% last quarter, the revenue share to China has declined to 27%.

What is also notable is the rapid rise of South Korean business, which was led by tools to SK Hynix. While incredibly successful with diverting capacity towards High Bandwidth manufacturing, SK Hynix has not been able to shake off the fears from the last intense downcycle and has not been willing to invest significantly before now. This is also part of a long-term plan to exit the memory roller coaster (The newfound ambition of SK Hynix).

Japan and Taiwan are tied behind the three leading ships to destinations which is also unusual. While ASML has offered little customer information, the two candiates in Japan is TSMC and Rapidus.

I need a deeper dive to show more about ASML customers and the current situation.

The Industry CapEx

Before people attack and tell me that I cannot compare foundries, IDMs and hybrid semiconductor companies, my answer will, as always, be: I just did!

It is perfectly fine to compare pears to apples (It is called fruit, by the way) as long as you have a specific investigation to undertake. Not all comparisons are fair, but that is rarely the aim of my analysis. I am trying to uncover insights.

One area where is makes sense is when looking at the combined CapEx of the semiconductor industry, as seen below:

Keep reading with a 7-day free trial

Subscribe to Semiconductor Business Intelligence to keep reading this post and get 7 days of free access to the full post archives.