The Outline of an Upturn.

It is just words, but words matter! TI reports the Q2-25 result.

It is fair to say that I got slightly surprised by the analysts on the TI Q2-25 investor call. It brought me right back to when my girls were young and accused me, saying, “But you promised!”

It should be well known by now that I carefully listen to corporate candy floss and then largely ignore it in favour of facts. This brings me in all sorts of trouble as facts often get in the way of the elected narrative, and that narrative is a solid cyclical upturn.

In several articles, I have uncovered my analysis of why this semiconductor cycle is different and why I don’t get excited every time the upturn is called. The reality is that I work hard on not caring about being right or wrong, but like everybody else, I have an ego to deal with. Rather than feeding it, I am trying to use my ego as a warning signal. When I feel good about being right, it is a big flashing warning sign that I am about to miss something, and I need to look closer.

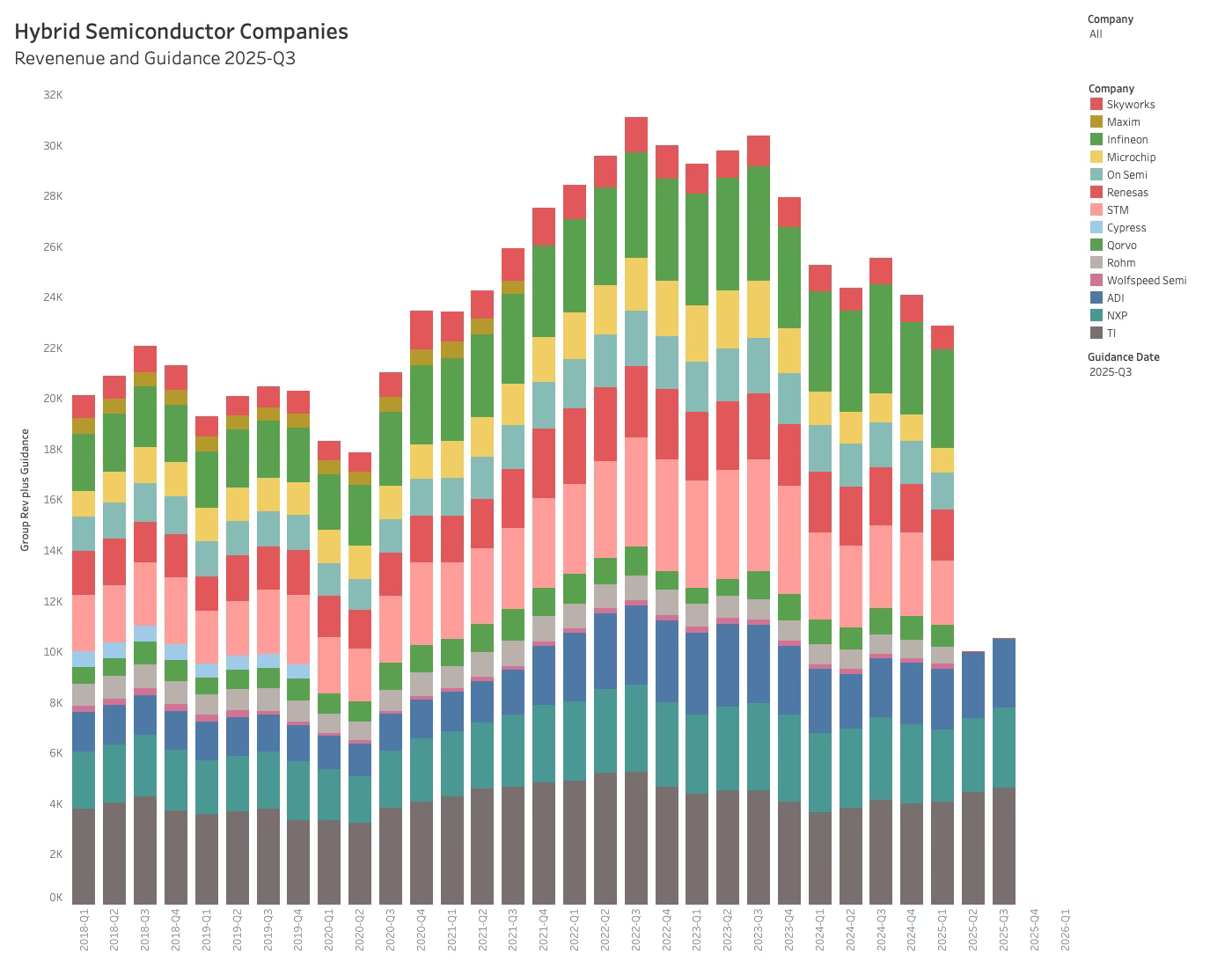

When I discuss a different semiconductor cycle, I am not disputing that hybrid companies will eventually be in an upcycle. Still, it might not be as strong as it was the last time around.

In the last quarter, the guidance from the hybrid companies suggested that the bottom had been reached, and it was time for the good old upturn (a year+ delayed)

While I did not see TI management take a victory lap in the TI Q1 investor call, the analyst heard something different and had a hard time not showing their disappointment. At one point in time, the TI leadership team started to become annoyed with having to defend their “tone” in the last call and recent investor communications as question after question home in on this.

First, I had a good laugh at the analysts making recommendations based on the “tone” of the investor call before returning to my preferred mode of uncovering facts. What is evident is that the analysts are expecting a normal upcycle, whereas TI is currently unable to support the scenario that the sell-side analysts have sold.

Even though I found the charade (a technical term for this kind of investor call) wasteful and that the TI leadership team had nothing to defend, I also found the confidence level to be relatively low.

TI is still observing two forces at play: The tariff impact on the global and the recovery phase of the Semiconductor supply chain. As TI constantly refers to customer inventory levels, the company reveals that it has a more static view of the semiconductor cycle. The opposing view could be that revenue has been declining because customer projects are reaching the end of their life cycle.

Like all other Semiconductor companies, TI relies on its Sales force project funnel, which shows that all projects are green and still alive. That is entirely unrelated to the practice of giving the sales force “funnel” targets to meet and sometimes even paying salespeople on their funnel “data”.

I have managed salespeople and funnels, and it is like selling rubber bands by the yard. If management wants more funnel, they get more funnel. If you get bashed for terminating a project, you simply keep it “alive” and live a happy life while your management sells the growing project base to unknowing analysts.

Also, suppose you assume it is in the customer’s best interest to tell the truth. In that case, you should talk to a few of them about the predatory behaviour of Semiconductor companies in scarcity situations.

Customers tell TI what they believe will benefit them the most, and that is rarely the truth.

The bottom line is that TI does not have reliable information about any structural changes in the industry if it relies on customer inventory.

This is the case for all hybrid companies and most other semiconductor companies. While they have a lot of information, they rarely have a solid grasp of what is happening in their markets, as they must rely on second and third-hand information.

You should think that the shipment data was solid, but having worked in the machine room, I know that nobody has an interest in giving accurate information, not even TI employees. Shipment data determines bonuses, promotions, demotions, hiring, and firing decisions within the company, and people are often more loyal to their colleagues than to the company itself.

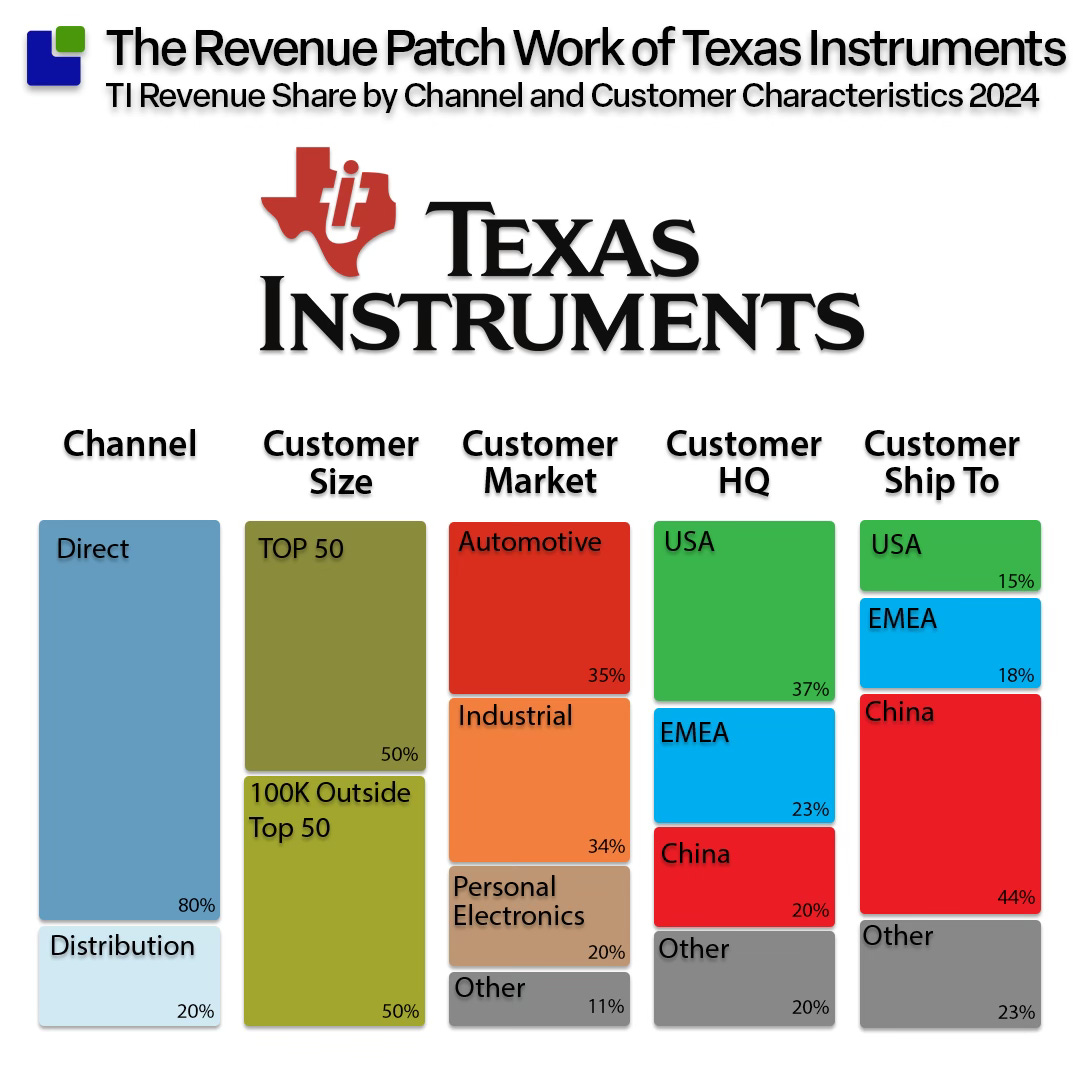

But hey, you shouldn't trust me; you should trust TI’s information. This is what the TI revenue patchwork looks like:

As a rule, each piece of business has a specific price that can change significantly depending on the name of the principal customer, and with that: distributor’s margins, Subcontractor Pricing, and people’s bonuses.

Additionally, each piece of business is presented through multiple channels, subcontractors, and countries, and must be priced for various locations on numerous occasions.

When semiconductor CEO’s are on stage, they talk confidently about their markets, customers and outlook. When they are off stage, they chastise the entire organisation for having poor sales data.

I am not saying the CEO does not have a grip; I am telling you that it is more slippery than they would like you to know.

We are now at the point where my readers are thinking, 'Let's get to the meat and potatoes of the TI investor call'

The Q2-25 Result of Texas Instruments

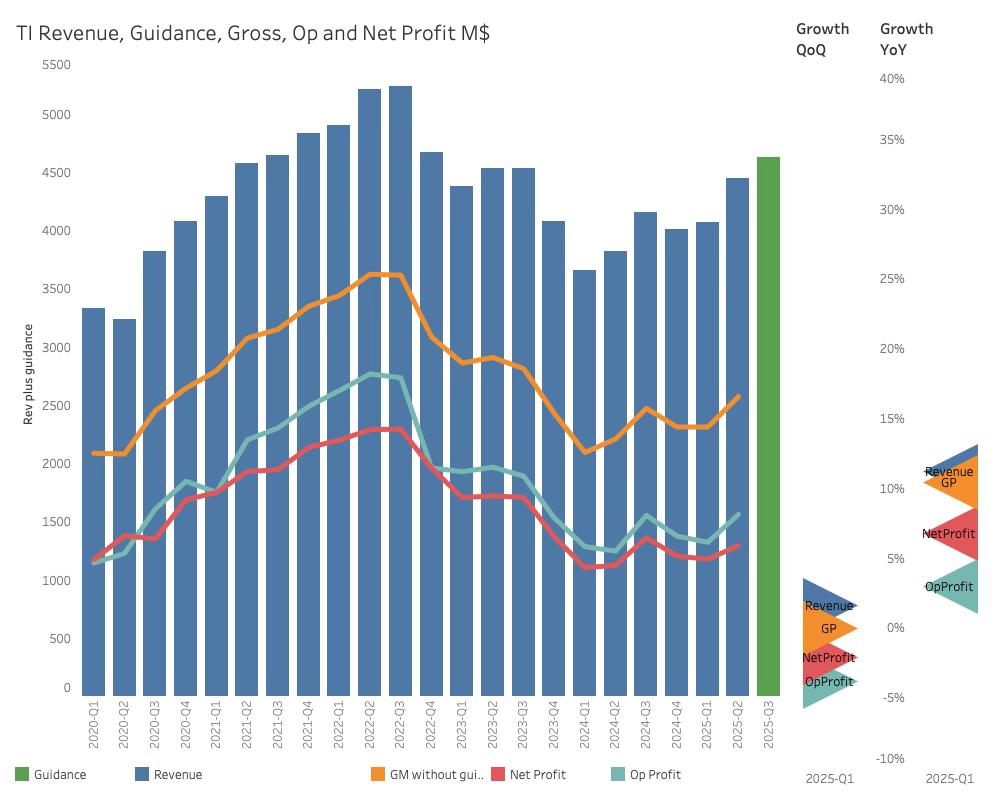

You have heard me say this before and will probably hear it again: The revenue result of TI was as expected. The Q2 revenue of 4.448 B$ was 2.2% above guidance.

This sounds counterintuitive, given I just highlighted the semiconductor companies’ lack of insight into their own business. However, Semiconductor companies are very good at hitting the number and spend a lot of resources ensuring this happens. The long manufacturing cycle also creates a substantial backlog, which helps in "hitting the number”.

Despite this, the TI revenue number showed a healthy 9.3% growth, but that was last quarter’s news, as guidance is well known to have been met. The new guidance of 4% growth did not please the analysts.

While I would agree that the 4% growth was low if you were hoping for an expected upturn, I have not yet seen the signs of a solid upturn. It does, however, confirm that the bottom has been formed.

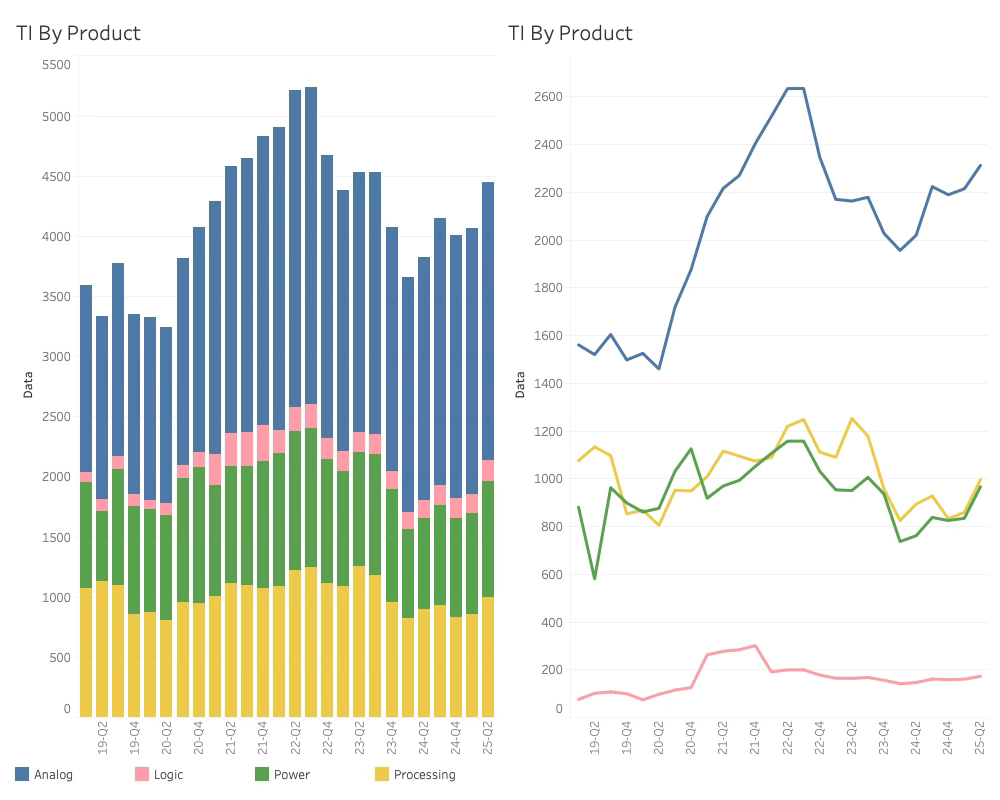

TI has fared much better than the hybrid companies on average. While the hybrid collectively is guiding up this quarter, the downturn has lasted for 10 quarters, whereas TI has been on an upward path for 5 quarters.

This is very similar to the revenue situation of Analog Devices, demonstrating that the analogue products are doing better than the other products. This is something that I will explore later in this post.

The three companies that have reported Q3 results have an average revenue growth of 7.4% in the quarter. Seen in that light, the TI result was good. The current guidance for Q3 is 5.1% for the three companies, making Tis guidance of 4% weak but in line with its peer group.

While there was a lot of back and forth on the call, TI reiterated that they believed this was a strong recovery with some noise coming from the tariff activities of the White House. At the same time, they also stated that they do not have any information about what customers plan to order in the long tail, so perhaps that is the correct statement—a belief. Time will tell.

An analysis of TI’s margins reveals that, while revenue has been on an upward trend, the margins remain near the bottom. This is not signalling a solid demand-driven upcycle yet. The bargaining power is still firmly on the customer side, even though the revenue is increasing.

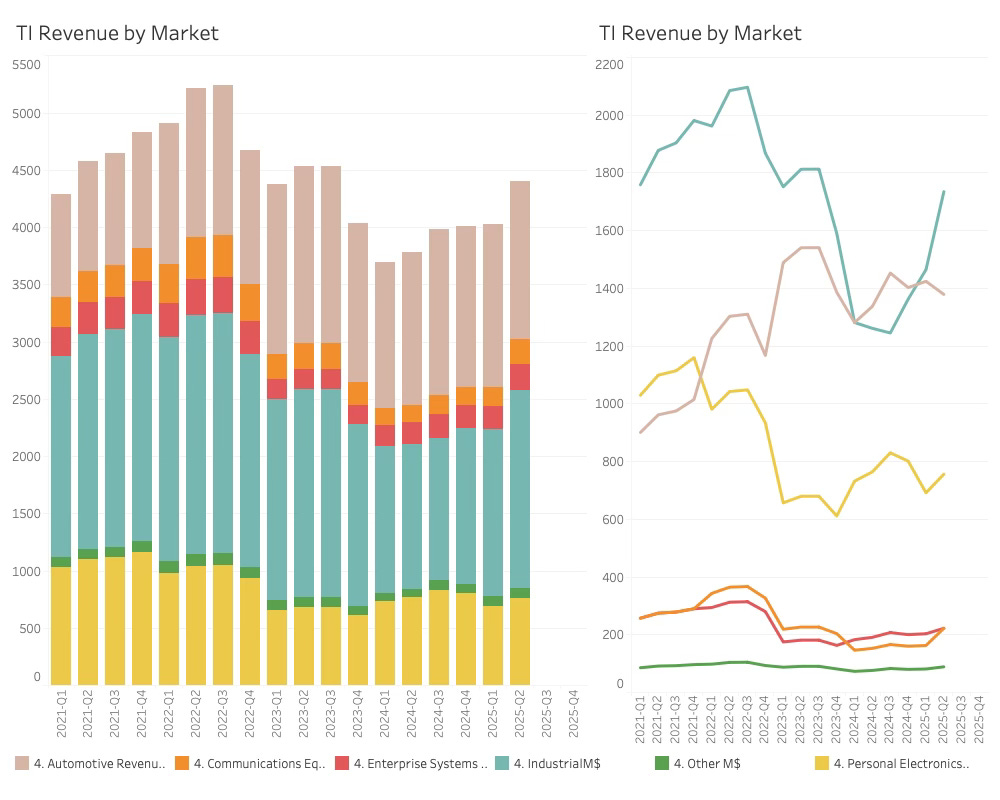

What TI revealed in terms of revenue by market was that industrial and personal were driving the quarter with automotive declining sequentially.

Industrial is now having momentum, and in all likelihood, this is driven by shipments to China. The revenue to China grew 19% in the quarter and was up 33% annually. This could be a revelation of a potential loss of automotive market share in China, not just by TI but by all Western companies.

It is worth noting that TSMC also saw an uptick in its China business, which it attributed to government incentives.

Compared to the beginning of the decade, TI has become more of an analogue company while the other product groups have receded. This is very similar to the situation of TI’s main analogue competitor. Analog Devices has also fared better in this downturn than the other hybrid companies.

The analog story is a lot better in the downturn than the micro & power development of the hybrid companies, and it seems like the Chinese companies have not yet cracked analog.

Capacity situation

While the revenue of TI is ticking up, so is the inventory. The story is that TI is “investing” in inventory, as the customers have very low inventories themselves. From the patchwork revenue model, it can be seen that it is not plausible that TI have any tangible grip on the customer’s inventory - at least not from a data perspective; instead, it has anecdotal evidence from its sales force and partners.

This is always a welcome addition when aligned with the corporate story. But who decides “low”? What TI deems “low”, the customers can judge as appropriate.